Announcement of the World Economic Outlook Report

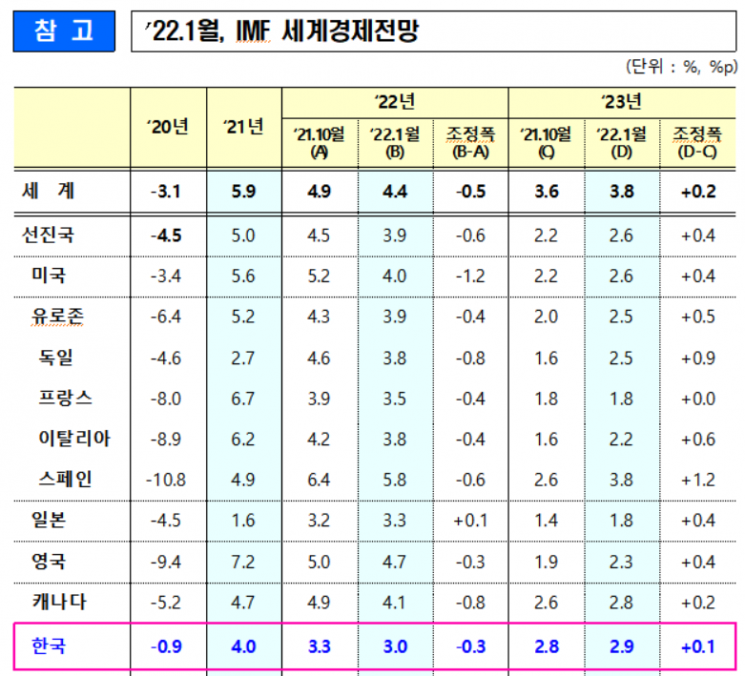

[Sejong=Asia Economy Reporter Son Sun-hee] The International Monetary Fund (IMF) has projected South Korea's economic growth rate for this year at 3.0%. This is a downward revision of 0.3 percentage points from the forecast of 3.3% released last October.

On the 25th (local time), the IMF released the 'World Economic Outlook' report, revealing growth rate forecasts for major advanced and emerging economies, including South Korea. The forecast for South Korea's economic growth rate next year is 2.9%, which is an upward revision of 0.1 percentage points from the previous forecast of 2.8%.

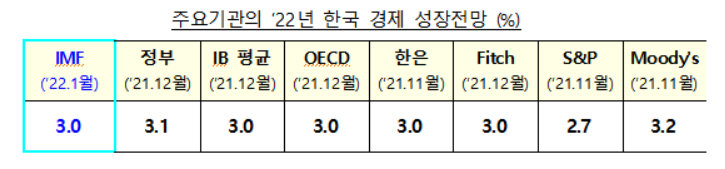

The IMF's forecast for South Korea's economic growth rate this year slightly underperforms the government's target of 3.1% set in December last year. It aligns with the forecasts from the OECD (3.0%), credit rating agency Fitch (3.0%), and the average forecast of major investment banks (3.0%) announced in December last year. It is higher than the 2.7% forecast by credit rating agency Standard & Poor's released in November last year, but lower than Moody's forecast of 3.2%.

However, the downward revision of South Korea's economic growth forecast (0.3 percentage points) is relatively smaller compared to the United States (-1.2 percentage points), China (-0.8 percentage points), and Germany (-0.8%). The Ministry of Economy and Finance evaluated that "although there are impacts from the spread of Omicron and downward revisions by major trading partners, factors such as the current account surplus, strong consumption, and the effects of the recently announced supplementary budget (supplementary budget proposal) are included."

Regarding the IMF's forecast being slightly below the government's forecast, it was interpreted that "the IMF's forecast timing is the most recent, reflecting a greater impact of Omicron."

In particular, excluding the base effect caused by the COVID-19 pandemic, the average growth rate from 2020 to 2022 for South Korea was 2.01%, which is the highest level compared to the Group of Seven (G7) countries.

The Ministry of Economy and Finance stated, "After the fastest crisis recovery this year, the South Korean economy will continue its growth trend through next year," and predicted that "all major G7 advanced countries are expected to recover to pre-COVID levels in 2022."

The IMF projected the global economic growth rate this year at 4.4%, a downward revision of 0.5 percentage points from the forecast of 4.9% in October last year. The main reasons cited for the expected slowdown in economic recovery include ▲ the spread of Omicron ▲ higher-than-expected inflation ▲ risks in China's real estate market and reduced consumption.

Although the global economic growth rate forecast for next year was revised upward by 0.2 percentage points to 3.8% from the previous forecast of 3.6%, it is expected to be insufficient to offset this year's downward revision.

For advanced economies, the growth rate was revised downward by 0.6 percentage points to 3.9%, due to factors such as renewed COVID-19 outbreaks, supply chain disruptions, inflationary pressures from rising energy prices, adjustments in U.S. fiscal policy, and early normalization of monetary policy. Emerging economies were also revised downward by 0.3 percentage points to 4.8%.

Furthermore, the IMF mentioned five additional potential downside risks to the economy. These include the spread of variant viruses due to vaccine disparities and the possibility of movement restrictions, as well as concerns about prolonged global supply chain disruptions. The IMF analyzed that last year's supply chain disruptions reduced global GDP by -0.5 to 1.0% and increased core inflation by 1%.

There is also concern that as the U.S. pursues monetary policy normalization, shocks could be inflicted on global financial markets, especially in emerging economies. Additionally, wage increases due to a tightened labor market could intensify inflationary pressures, and if China's real estate market contraction worsens, there is a possibility of further slowdown in China's economic growth.

In response, the IMF recommended, "To effectively respond to COVID-19, it is necessary to strengthen international cooperation for vaccine supply to low-income countries and support for COVID testing, treatment, and protective equipment." Regarding fiscal policy, it advised, "While there is a need to reduce expanded fiscal deficits, in the event of renewed COVID-19 outbreaks, support for vulnerable groups and businesses should be reinforced, and a sustainable medium-term fiscal management plan should be prepared."

As the U.S. accelerates tightening to normalize monetary policy, the IMF stated, "Monetary policy stances should be set according to each country's inflation pressures and employment recovery status, and market communication should be strengthened to reduce uncertainty."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.