Recorded Double-Digit Growth Rate for 2 Consecutive Years

Impact on Property Tax and Health Insurance Premiums

This year, the nationwide official land price increased by 10.17%, marking a double-digit rise for the second consecutive year. The official price of standard detached houses nationwide rose by 7.34%, higher than last year's 6.80%. As the official prices, which are used for over 60 administrative purposes including taxation, have risen sharply, the tax burden on citizens has significantly increased.

On the 25th, the Ministry of Land, Infrastructure and Transport announced that after collecting opinions on the official price proposals for 540,000 standard land parcels and 240,000 standard detached houses (hereafter standard houses) as of January 1 this year, the official prices for standard land and standard houses were finalized.

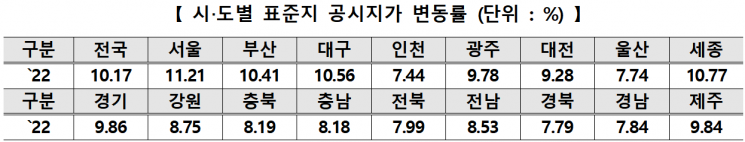

The nationwide official land price increase rate was 10.17%, a slight adjustment (0.01 percentage points increase) from the rate (10.16%) estimated by the Ministry of Land at the end of last year. This is 0.18 percentage points lower than last year's increase rate (10.35%).

However, considering that last year's increase rate was the highest in 14 years since 2007 (12.40%), this year's increase is still substantial. This is because real estate prices rose significantly nationwide last year, and due to the government's application of the official price realization rate (official price/market price) roadmap, the official prices rose more than the land price increase rate.

According to the real estate official price realization rate roadmap announced in 2020, the government plans to raise the realization rate to 90.0% by 2035, increasing it annually.

This year, the realization rate of the official land price is 71.4%, up 3.0 percentage points from last year's 68.4%. This is similar to the roadmap's target of 71.6% for next year.

By city and province, Seoul recorded the highest increase in official land price at 11.21%. It was followed by Sejong at 10.77%, Daegu 10.56%, Busan 10.41%, Gyeonggi 9.86%, Jeju 9.84%, Gwangju 9.78%, and Daejeon 9.28%.

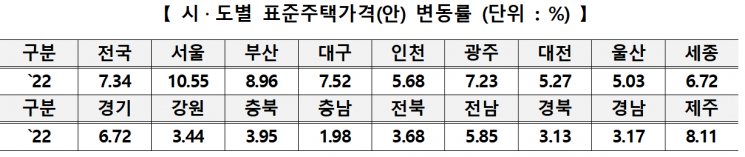

The nationwide official price increase rate for standard houses was finalized at 7.34%, 0.02 percentage points lower than the 7.36% announced at the end of last year. Compared to last year's increase rate of 6.80%, it rose by 0.54 percentage points.

By region, Seoul saw the highest increase at 10.55%, followed by Busan 8.96%, Jeju 8.11%, Daegu 7.52%, Gwangju 7.23%, Gyeonggi 6.72%, and Sejong 6.72%.

Standard houses serve as the basis for calculating the official prices of individual houses, and local governments use the official prices of standard houses to estimate the prices of individual houses.

As the official prices of standard land and standard houses have risen significantly, increasing the burden of property tax and health insurance premiums on citizens, the ruling party, the Democratic Party of Korea, and the government are discussing measures to ease the tax burden.

The government plans to proceed with the official price realization plan as scheduled but will prepare measures to ease the burden on citizens through tax and other systems and announce them in March.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)