This Year's Business Goals Announcement... Emphasizing Market Trust Recovery and Raising the Level of Han Stock Market

Son Byung-doo, Chairman of the Korea Exchange, is announcing this year's business strategy at the Korea Exchange Seoul headquarters in Yeongdeungpo-gu, Seoul on the 25th.

Son Byung-doo, Chairman of the Korea Exchange, is announcing this year's business strategy at the Korea Exchange Seoul headquarters in Yeongdeungpo-gu, Seoul on the 25th.

[Asia Economy Reporter Minwoo Lee] The Korea Exchange (KRX) has identified restoring market trust as a key priority for this year. It plans to devise measures to ensure that investors do not suffer losses from actions such as physical division of major subsidiaries or executives selling stock options.

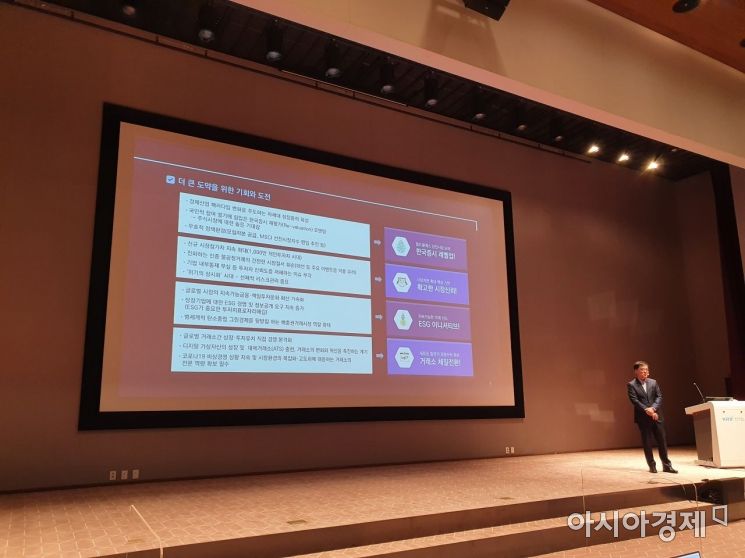

On the 25th, Sohn Byung-doo, Chairman of the Korea Exchange, held a press briefing at the KRX Seoul office in Yeouido, Yeongdeungpo-gu, Seoul, where he announced the "Core Strategy Toward an Innovation-Leading Capital Market," which includes these initiatives.

Through this, the KRX aims to establish improved listing management measures to strengthen shareholder rights protection. This is to prevent investors from being harmed, as seen in the case of LG Chem, whose stock price plummeted following the physical division and listing of its secondary battery subsidiary, LG Energy Solution. First, the KRX plans to consider adding qualitative assessments on whether sufficient communication with minority shareholders was conducted through briefings during the process of physically dividing and listing subsidiaries, and whether protection measures for existing shareholders were established.

Measures related to stock options will also be prepared, similar to the case of Kakao Pay, where the stock price sharply declined after executives exercised stock options and sold large amounts of shares immediately after listing. However, specific details were not disclosed. The KRX stated it will review measures considering investor protection aspects and the purpose of stock options.

The KRX has also set goals to raise the level of the domestic stock market. To sustain the record-high initial public offering (IPO) boom, it plans to continue improving listing systems. It will actively attract unicorn companies (unlisted companies valued at over 1 trillion won) to list on the domestic market and strengthen technical review capabilities to attract future promising industry companies to the KOSDAQ market. Additionally, it plans to promote the listing of Business Development Companies (BDC) and revitalize the Startup Market (KSM).

To prevent the "Korea Discount," where the domestic stock market is undervalued compared to overseas markets, the KRX will actively support policies for inclusion in the Morgan Stanley Capital International (MSCI) Developed Markets Index. It also announced plans to actively discover indices and related investment products related to next-generation promising industries.

Furthermore, the KRX previewed the introduction of KOSDAQ segments and the expansion of ESG (Environmental, Social, and Governance) information disclosure and related products. Chairman Sohn emphasized, "We will carefully analyze market conditions during project implementation, listen to the voices of various stakeholders, and find optimal solutions to achieve visible results with balance and speed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.