Reducing Size Through Digital Transformation

Expanding Voluntary Retirement Targets Increasingly

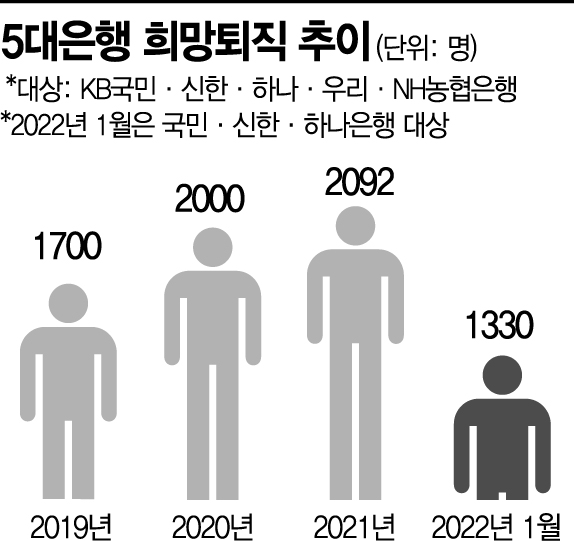

[Asia Economy Reporter Kiho Sung] It has been confirmed that a total of about 1,330 employees decided to leave banks through voluntary retirement programs conducted at the beginning of the new year. This number exceeds half of last year's 2,092 voluntary retirees from the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Bank).

According to the financial sector on the 21st, a total of about 1,330 bank employees have left or are preparing to leave the banks through voluntary retirement programs conducted by three banks: KB Kookmin Bank, Shinhan Bank, and Hana Bank.

First, at Kookmin Bank, a total of 674 employees will leave the bank. Kookmin Bank accepted voluntary retirement applications until the 6th and has finalized the number of retirees after screening.

Last year, about 800 employees retired through voluntary retirement at Kookmin Bank. The reason for the smaller number this year is believed to be because the eligible birth years for voluntary retirement were narrowed to 1966?1971, compared to 1965?1973 last year. However, this is still more than 200 employees compared to 462 in 2020. Kookmin Bank offers special retirement benefits to this year’s voluntary retirees, including 23 to 35 months’ salary, tuition support (3.5 million KRW per semester, up to 8 semesters), or reemployment support funds (up to 34 million KRW). Additionally, health checkups for the retiree and their spouse are supported, and reemployment opportunities (contract positions) are provided one year after retirement.

Shinhan Bank confirmed the retirement of about 250 employees through voluntary retirement applications accepted until the 11th. Shinhan Bank conducted voluntary retirement twice last year, in January and July, with about 350 employees leaving the company. In January 2020, about 250 employees left through a single voluntary retirement program.

The voluntary retirement candidates at Shinhan Bank this time were branch managers or higher and general employees born after 1963 with more than 15 years of service. Additionally, general employees below grade 4, RS (Retail Service) staff, indefinite contract workers, and management support contract workers born in 1966 with more than 15 years of service were also eligible. Shinhan Bank provides special retirement benefits of up to 36 months’ average monthly salary depending on the birth year.

At Hana Bank, about 400 employees have applied for voluntary retirement, and the final confirmation is currently under discussion. Hana Bank implements a ‘quasi-retirement special retirement’ for general employees with more than 15 years of service and aged 40 or older. Selected quasi-retirement special retirees receive up to 24 to 36 months’ average salary depending on rank and age. Additionally, a special retirement program for wage peak employees is conducted for general employees born in the second half of 1966 and 1967, whose wage peak period has arrived. They receive 25 to 31 months’ average salary. Last year, a total of 511 employees left the bank through quasi-retirement special retirement and wage peak special retirement.

The issue is that banks are considering voluntary retirement programs in the second half of the year, and the scale of voluntary retirement is increasing. Despite record-high profits every year, the digital transformation has become a key issue, leading banks to expand the scope of voluntary retirement and offer generous conditions to downsize. Therefore, there is a high possibility that additional voluntary retirement programs will be conducted this year.

A banking industry official said, "As branch closures continue due to digital transformation, an increase in voluntary retirement is inevitable for the time being," adding, "This trend is expected to continue every year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.