Amendment to National Pension Representative Lawsuit

Business Community Expresses Concerns to Ministry of Health and Welfare

Fund Trusteeship Committee Influenced by Civic and Labor Groups

Concerns Over Negative Impact on Corporate Management

[Asia Economy Reporters Choi Dae-yeol and Lee Ki-min] On the 20th, the business community strongly criticized the Ministry of Health and Welfare officials regarding the recently proposed amendments to the National Pension Service (NPS) representative lawsuit system. They repeatedly argued that if the government's existing amendment is finalized, there is a risk of excessive lawsuits against companies depending on public opinion or political and social conditions.

The government decided to gather opinions from various sectors, including the business community, and discuss the amendment again at the NPS Fund Management Committee scheduled for the end of next month. Although the government appears to have taken a step back in response to corporate opposition, it is uncertain whether the controversy will easily subside. This is because the likelihood of changing the current trend to strengthen the authority of the Stewardship Responsibility Committee (SRC), which is under the Fund Management Committee, is low. The business community recently requested the Ministry of Health and Welfare to fully suspend the proposed amendments but agreed to exchange opinions until the meeting next month.

Government Reaches Out Amid Strong Corporate Opposition

On the same day, the Korea Employers Federation, the Korea Chamber of Commerce and Industry, and other five major economic organizations, along with the vice-chairmen of the Korea Listed Companies Association, met with Yang Sung-il, the first vice minister of the Ministry of Health and Welfare, to convey recent corporate concerns regarding the NPS shareholder representative lawsuit. This meeting was arranged at the Ministry of Health and Welfare's request due to growing corporate opposition surrounding the recent amendment to the stewardship responsibility activity guidelines.

Lee Dong-geun, vice chairman of the Korea Employers Federation, told reporters immediately after the meeting, "No country has a case where a pension fund sues its own domestic companies because there is no practical benefit," adding, "All business representatives attending today strongly opposed it." Vice Minister Yang said, "We listened carefully to the issues raised by the business community and exchanged honest opinions."

Donggeun Lee, Executive Vice President of the Korea Employers Federation. / Photo by Hyunmin Kim kimhyun81@

Donggeun Lee, Executive Vice President of the Korea Employers Federation. / Photo by Hyunmin Kim kimhyun81@

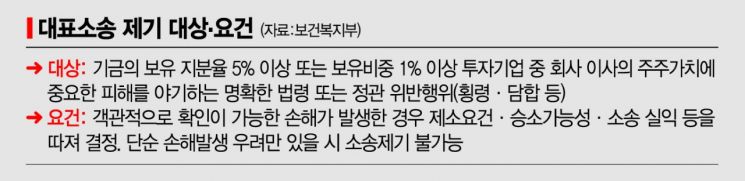

According to the government's amendment, the Stewardship Responsibility Committee (SRC) will have the authority to decide on representative lawsuits against directors of companies in which the pension holds shares. The Ministry of Health and Welfare cites the need to establish a timely and consistent decision-making system as the reason, but the business community criticizes that the SRC, which is only a review and deliberation body, making lawsuit decisions over the higher decision-making body, the Fund Management Committee, is a 'wrong delegation of authority.' They argue that lawsuit decisions should remain with the current Fund Management Headquarters of the National Pension Service, and if separate judgments are needed for exceptional cases, they should be entrusted to the Fund Management Committee, not the SRC.

Previously, in December last year, the Ministry of Health and Welfare submitted the amendment to the 'Stewardship Responsibility Activity Guidelines' to the 10th NPS Fund Management Committee meeting but no conclusion was reached. It is reported that the decision was postponed due to differing opinions on some agenda items. Currently, the principal decision-maker for representative lawsuits in the NPS is the Fund Management Headquarters, with the SRC judging only exceptional cases; the amendment aims to unify this authority under the SRC.

Concerns Over Business Deterioration Due to SRC’s Heavy Influence from Civic and Labor Groups

There are concerns that if the decision-making authority shifts from the professional fund management organization of the NPS Fund Management Committee to the SRC, which is heavily composed of members recommended by labor and civic groups, excessive intervention by these groups could disrupt corporate management. The SRC is composed of nine members, with three each recommended by labor organizations, employer organizations, and regional pension subscriber groups, and the chairmanship rotates. Vice Chairman Lee Dong-geun said, "The core of the guideline amendment is to change the decision-maker for representative lawsuits from the professional fund management organization within the NPS to a committee heavily skewed toward members recommended by labor and civic groups," adding, "There is no reason to change the decision-maker without even trying to implement the current guidelines."

Academics also express concerns that if decision-making authority is delegated to the SRC, responsibility will become unclear, and companies involved in excessive lawsuits may suffer from deteriorating business environments. Choi Jun-seon, emeritus professor at Sungkyunkwan University Law School, criticized, "The NPS pushing shareholder proposals or representative lawsuits beyond exercising voting rights is excessive management interference beyond healthy dialogue," adding, "If distorted stewardship responsibility theories continuously attempt to interfere with management rights and stimulate anti-business sentiment, it will ultimately lead to a loss of national competitiveness."

At the end of October 2020, civic group representatives including those from People's Solidarity for Participatory Democracy held a picket protest at the National Pension Fund Management Committee meeting. Photo by Jin-Hyung Kang aymsdream@

At the end of October 2020, civic group representatives including those from People's Solidarity for Participatory Democracy held a picket protest at the National Pension Fund Management Committee meeting. Photo by Jin-Hyung Kang aymsdream@

Professor Choi said, "Justifying management interference in the name of the people while acting as shareholders with national retirement funds is essentially 'pension socialism,'" and added, "The SRC is only a temporary three-year body and does not bear legal responsibility even if a sued director is acquitted," warning, "If the lawsuit becomes public, it could cause international embarrassment for the company and make it a target of foreign hedge funds."

On the other hand, the government argues that the SRC is composed of experts with more than five years of experience in finance, law, and other fields and undergoes strict procedures, so the business community's concerns are somewhat excessive. A Ministry of Health and Welfare official said, "We will listen to various opinions and discuss them at the Fund Management Committee meeting scheduled for the end of February," adding, "Whether to revise the existing amendment will be decided after internal review."

Recently, the NPS sent shareholder letters to about 20 domestic companies, including Samsung Group affiliates and Hyundai Motor Company, inquiring about facts related to shareholder value damage cases. The business community interprets these letters as a preliminary step toward filing lawsuits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.