[Asia Economy Reporter Park Byung-hee] Turkey has signed a $5 billion currency swap agreement with the United Arab Emirates (UAE), major foreign media reported on the 19th (local time). Recently, Turkey has depleted a significant portion of its foreign exchange reserves in an effort to prevent the depreciation of its national currency, the lira, and this move appears to be a kind of safety measure.

On the day, the central banks of the two countries announced that they had signed currency swap agreements worth 64 billion lira and 18 billion dirhams, respectively.

The Governor of the UAE Central Bank explained, "The currency swap reflects the will to expand mutual cooperation in trade and investment sectors between the two countries." The Governor of the Central Bank of Turkey also stated, "We will increase local currency transactions to advance economic and financial trade between the two countries."

Turkey's currency swap can be seen as a kind of safety net in preparation for an economic crisis caused by the decline in foreign exchange reserves, but conversely, it can also be interpreted as indicating the significant sense of crisis within the Central Bank of Turkey.

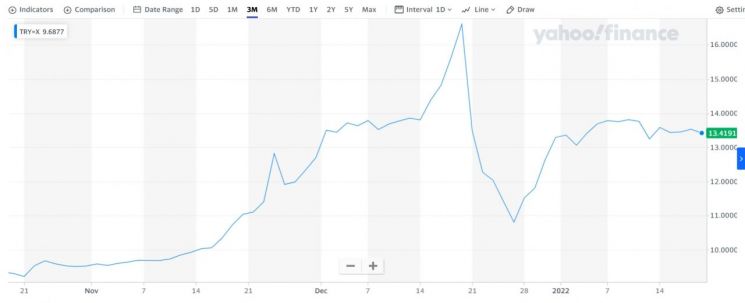

The value of the Turkish lira plummeted by 45% last year. To prevent the depreciation of the lira, Turkey is estimated to have recently used a considerable amount of its foreign exchange reserves. The lira fell to 18 lira per dollar in early last month but rebounded sharply and is currently trading around 13 lira per dollar. There is also analysis suggesting that the Central Bank of Turkey has depleted over $10 billion in foreign exchange reserves during the lira's rebound.

A Turkish government official expressed expectations that this currency swap could serve as an opportunity to attract investment from Middle Eastern countries. However, the market reaction has been lukewarm.

HSBC analyst Ibrahim Aksoy said, "This currency swap will not have a significant impact on the value of the lira," adding, "The market is focusing on foreign exchange reserves excluding the currency swap."

Turkey and the UAE had an uneasy relationship after taking opposing stances during the Arab region's democratization movements in 2011. However, signs of improvement have appeared over the past year. In November last year, Sheikh Mohammed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Air Force, visited Turkey for the first time in about 10 years and met with President Erdogan. At that time, Crown Prince Al Nahyan promised a $10 billion investment in Turkey.

Foreign media analyzed that since U.S. President Joe Biden took office in January last year, Turkey has been seeking to improve relations with Middle Eastern countries, and that Turkey and Middle Eastern countries share aligned interests in developing their economies.

President Erdogan announced that he plans to visit Saudi Arabia next month. If he visits, it will be his first visit to Saudi Arabia since the murder of Saudi journalist Jamal Khashoggi in Turkey in October 2018. The two countries have maintained an uneasy relationship since the Khashoggi murder incident.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.