New Life Insurance Savings Policy Contracts Increase by 18% in One Year

Even with Raised Public Interest Rates, Banks Can't Keep Up... Ahead of IFRS17

[Asia Economy Reporter Oh Hyung-gil] As banks rapidly raise savings and deposit interest rates following the base rate hike, there are concerns that the windfall profits insurance companies enjoyed through bancassurance sales at bank branches will disappear. Coupled with the upcoming implementation of the new International Financial Reporting Standard (IFRS17) next year, sales of savings-type insurance are expected to shrink significantly.

According to the insurance industry on the 20th, life insurers recorded bancassurance first-year premiums of 4.4753 trillion KRW from January to October last year. Although this is a 16.6% decrease compared to the previous year, it still exceeds the figures of 2018 and 2019 by about 1 trillion KRW.

The bancassurance channel for life insurers has enjoyed a boom since 2020 due to low interest rates and the impact of incomplete sales scandals involving private equity funds. At the center of this is savings-type insurance. Bancassurance channels mainly sell savings-type insurance tailored to customers who prefer stable investments.

Insurance companies have also been actively promoting savings-type insurance sales over the past one to two years. Looking at new contract amounts for life insurers' savings-type insurance, last year reached 32.9956 trillion KRW, an 18.0% increase from 27.9413 trillion KRW the previous year. After recording 31.091 trillion KRW in 2018 and bottoming out at 26.691 trillion KRW in 2019, it has shown a rapid upward trend.

Last year, major life insurers such as Samsung Life Insurance and Hanwha Life Insurance even held events where customers who signed up for savings insurance and maintained it for two months were given Naver Pay points that could be used like cash, demonstrating intense competition.

However, recently, as banks have raised savings and deposit interest rates and absorbed market funds, the likelihood of customers moving to banks has increased. The five major commercial banks raised savings and deposit interest rates by up to 0.4 percentage points following the Bank of Korea’s base rate hike last week.

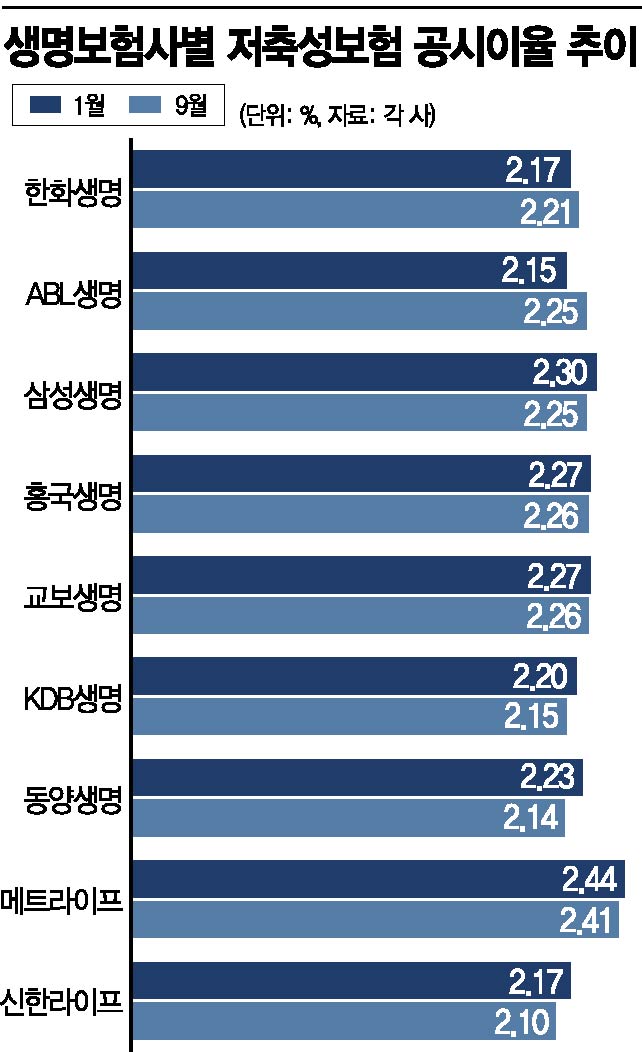

Insurance companies have also responded by raising the declared interest rates on savings-type insurance this year, but it is pointed out that it is impossible to keep pace with the speed of savings and deposit interest rate hikes. For example, Samsung Life Insurance raised the declared interest rate on savings insurance from 2.25% to 2.31% this month, a 0.06 percentage point increase, which is the first since March last year.

An insurance industry official said, "With the introduction of IFRS17 approaching, there is a burden in actively promoting savings-type insurance sales," and predicted, "The savings-type insurance market will not grow significantly this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.