[Asia Economy Reporter Park Jihwan] Hana Financial Investment evaluated ChargePoint as having high investment value as the leading electric vehicle (EV) charging operator in North America, emphasizing the need for more charging stations ahead of the mass adoption era of electric vehicles.

ChargePoint is the number one EV charging network operator in North America, holding over 70% market share based on the number of Level 2 charging ports. Its business areas are divided into charging station installation and sales, and services, accounting for 71% and 29% of revenue respectively. By customer segment, the proportions are commercial (69%), fleet (16%), and residential (13%). Currently, the majority of revenue comes from the U.S., but the company is actively pursuing mergers and acquisitions in Europe to expand its software-related business within the region.

Researcher Kim Jaeim of Hana Financial Investment stated, "Synergistic effects from market size growth and market share (MS) acquisition are expected," adding, "With the growth of the EV market, structural co-growth of the charging infrastructure market is anticipated, and the U.S. EV market is projected to grow at an average annual rate of 48% through 2025." However, the current number of public chargers per EV in the U.S. is only 0.06. Investments from the government and companies will focus on supplementing infrastructure in metropolitan areas and revitalizing infrastructure in underserved regions.

ChargePoint is considered the company that will benefit the most from the U.S. infrastructure bill. The U.S. plans to expand EV charging stations to 500,000 by 2030. It is expected that the proportion of Level 2 chargers, which have relatively low installation costs, will be high. Researcher Kim said, "Most EV users charge at home and work, so the Level 2 market has even greater expansion potential."

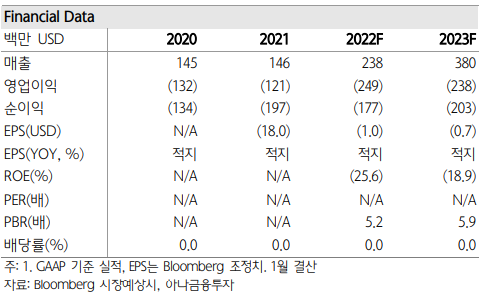

High growth potential is also noteworthy. The expected market revenue for this year and next year is $240 million and $380 million respectively, representing increases of 62% and 59%, respectively. Considering strong demand and policy benefits, it is judged that there is a high possibility of exceeding consensus estimates. Researcher Kim added, "Although it will take more time to turn profitable, it is important to note that this is a strategic investment period to capture powerful growth opportunities and that gross profit margin (GPM) improvements continue." Due to macro issues such as interest rate hikes and tapering, high-value stocks have been hit hard, and ChargePoint's stock price has also experienced significant declines.

Researcher Kim emphasized, "Although cautious sentiment is expected to continue for the time being, the potential for co-growth in the charging infrastructure market driven by EV growth remains unchanged," and "Considering its competitiveness and benefits as the number one operator, its investment attractiveness is judged to be quite high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.