Impact of Regulations, Interest Rate Hikes, and Holding Tax Burden... Nationwide Spread of Weakened Buying Sentiment

Eight Provinces Also Show Selling Dominance... Seoul Maintains Supply Surplus at 92.8 for 8 Consecutive Weeks

The selling trend in the housing market is spreading further. Not only in the metropolitan area but also in the provincial apartment market since the new year, the number of people wanting to sell has surpassed those wanting to buy. As the areas experiencing house price declines expand, buyer sentiment is freezing even more. The contraction of buyer sentiment, which began in Seoul and the metropolitan area due to comprehensive financial regulations, interest rate hikes, and holding tax burdens, appears to be spreading nationwide.

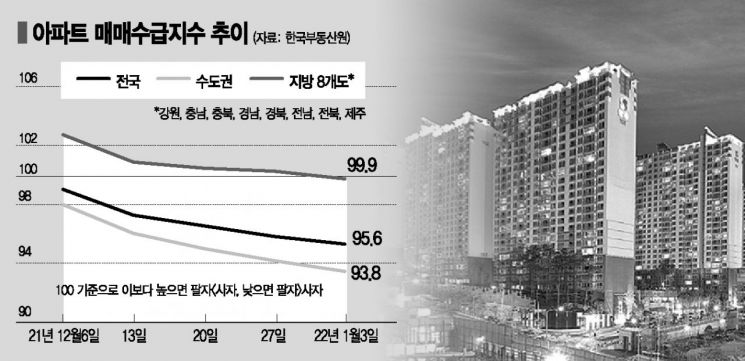

◇Provincial 8 Provinces, ‘Sellers > Buyers’ for the First Time in 14 Months = According to the apartment sales supply-demand index trend announced by the Korea Real Estate Board on the 7th, this week the index for the 8 provinces excluding the metropolitan area and metropolitan cities recorded 99.9, falling below 100. It is the first time in 1 year and 2 months since November 9, 2020 (98.9) that the sales supply-demand index for the 8 provinces dropped below 100. The supply-demand index is quantified from 0 to 200 based on surveys of real estate agencies by the Real Estate Board, reflecting the ratio of demand to supply. If the index falls below the baseline of 100, it means that currently, the number of homeowners wanting to sell their houses exceeds the number of people wanting to buy.

This week, the apartment prices in Jeonnam (91.9), Gyeongbuk (99.4), and Chungbuk (98.3), which turned stable, dropped compared to last week, pulling the average of the 8 provinces below 100. Jeju maintained the same level as last week at 99.0.

Among the 8 provinces, only Gyeongnam (100.4), Chungnam (101.7), Gangwon (102.4), and Jeonbuk (102.8) still had sales supply-demand indices above the baseline. Among these, except for Jeonbuk, the other three provinces all saw their indices decline.

◇Selling Pressure Expands Further in Seoul = Seoul, the barometer of house prices, is showing a trend of expanding selling pressure. This week, the apartment sales supply-demand index dropped to 92.8, marking the lowest in 2 years and 4 months since September 9, 2019, when it was 92.6. The ‘supply surplus’ where sellers outnumber buyers has continued for 8 consecutive weeks. Incheon slightly rose from 99.2 to 99.3, but Gyeonggi fell from 94.0 to 93.2, causing the metropolitan area’s supply-demand index to drop by 0.7 points to 93.8.

The five major provincial metropolitan cities recorded 94.4, down from last week. Accordingly, the nationwide apartment sales supply-demand index also fell by 0.5 points to 95.6, remaining below the baseline for 5 consecutive weeks. Notably, Daejeon, where apartment prices turned downward for the first time in 2 years and 9 months, saw its supply-demand index drop 1.7 points from last week’s 96.1 to 94.4.

◇Jeonse Demand Decreases in Metropolitan Area but Increases in Provinces = In the jeonse (long-term lease) market, demand slightly increased in some regions, leading to a rise in the provincial jeonse supply-demand index. This week, the provincial apartment jeonse supply-demand index rose by 0.4 points from last week’s 100.5 to 100.9, indicating that demand increased relative to supply.

Especially, the four regions of Ulsan (103.9), Jeonbuk (103.3), Chungnam (103.1), and Gangwon (102.0), which had more demand than supply last week, saw their jeonse supply-demand indices rise again this week. Regions below the baseline such as Busan (99.7), Jeonnam (98.0), Daegu (93.6), and Sejong (90.9) also experienced increases in their indices compared to last week. Jeju’s jeonse supply-demand index, which fell below 100 to 98.3 last week, rose back above the baseline to 103.6 this week. Conversely, in the metropolitan area, the jeonse supply-demand indices of Seoul (94.5) and Gyeonggi (95.9) fell further compared to last week, exacerbating the demand decline. However, Incheon slightly increased from 100.1 last week to 100.2 this week.

Kim Hyoseon, Senior Real Estate Advisor at NH Nonghyup Bank, said, "This year’s housing market faces strong downward pressure both policy-wise and psychologically due to interest rate hikes, loan regulations causing liquidity contraction, and the burden of accumulated house price increases." He added, "Especially, the strengthened borrower-specific Debt Service Ratio (DSR) regulations introduced this year are expected to significantly impact the quasi-housing market, such as officetels and residential hotels, which were spotlighted as alternative residences to apartments in the second half of last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.