Last Year's Q3 Financial Group Integrated Disclosure

Samsung's Capital Adequacy Ratio Falls Below 300%

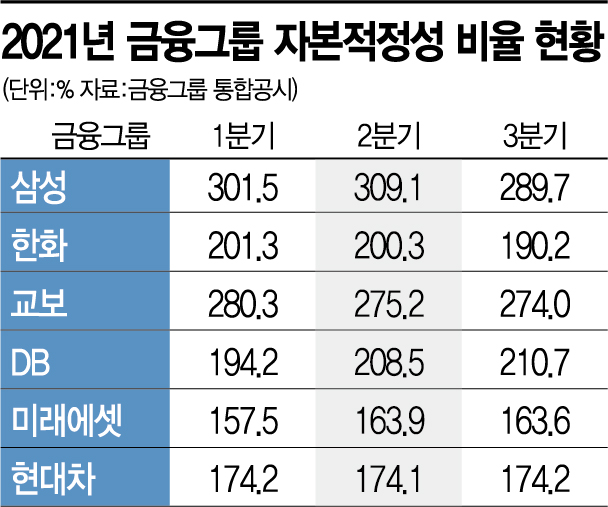

[Asia Economy Reporter Oh Hyung-gil] The capital adequacy ratios, which indicate the loss absorption capacity of financial conglomerates such as Samsung, Hyundai Motor, Hanwha, Kyobo, Mirae Asset, and DB, have been steadily declining.

According to the integrated disclosures of each financial group on the 5th, Samsung Financial Group (with Samsung Life Insurance as the representative financial company) recorded a capital adequacy ratio of 289.7% in the third quarter of last year, down 19.4 percentage points from the previous quarter. Since Samsung began integrated financial group disclosures in the first quarter of 2020 (294.5%), its capital adequacy ratio had consistently exceeded the 300% level.

The decline was largely due to a decrease in equity capital (loss absorption capacity) excluding overlapping capital, which fell from KRW 72.6788 trillion in the previous quarter to KRW 69.1511 trillion, a reduction of about KRW 3.5 trillion. As a result, surplus capital also decreased from KRW 49.1686 trillion in the second quarter to KRW 45.2858 trillion.

Hanwha Asset Management's Capital Adequacy Drops 10 Percentage Points After Acquiring Hanwha Investment & Securities

Hanwha (Hanwha Life Insurance) also recorded 190.2%, down 10.1 percentage points from the previous quarter, entering the 100% range for the first time. This is a significant drop of 71.1 percentage points compared to the same period last year.

In August last year, Hanwha Asset Management acquired 56,761,908 shares of Hanwha Investment & Securities held by Hanwha Global Asset, Hanwha Hotels & Resorts, and Hanwha Galleria Timeworld, increasing risks such as risk transfer among financial affiliates. The surplus capital size was KRW 6.3443 trillion, down KRW 653 billion (9.3%) from the previous quarter.

Kyobo (Kyobo Life Insurance), Hyundai Motor (Hyundai Capital), and Mirae Asset (Mirae Asset Securities) also saw slight decreases in their capital adequacy ratios. Kyobo recorded 274.0%, down 1.2 percentage points from the previous quarter, while Hyundai Motor and Mirae Asset recorded 174.2% and 163.6%, down 1.9 and 0.3 percentage points, respectively.

Surplus capital increased by KRW 183.6 billion to KRW 8.1522 trillion for Kyobo, and Hyundai Motor recorded KRW 8.1164 trillion, up KRW 294.6 billion. Mirae Asset also increased by KRW 170 billion to KRW 4.5059 trillion.

DB (DB Insurance) was the only group among the six whose capital adequacy ratio rose. It increased by 2.2 percentage points from the previous quarter to 210.7% in the third quarter. Surplus capital rose by KRW 162.5 billion to KRW 4.672 trillion.

The Financial Services Commission designated these six groups as financial conglomerates in July last year following the enforcement of the "Act on the Supervision of Financial Conglomerates" in June. According to the Act, groups engaged in two or more financial businesses with total assets exceeding KRW 5 trillion are designated as financial conglomerates.

Accordingly, these six conglomerates must regularly inspect and evaluate their capital adequacy starting from the 14th of this month. They must maintain loss absorption capacity, considering overlapping use of capital and additional risks at the group level, above the minimum capital standards. The Act requires maintaining this at 100% or higher, and if it falls below 100%, the group must submit a management improvement plan to the authorities.

Additionally, any changes in governance, internal controls, risk management, and internal transaction management must be reported and disclosed to the authorities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.