Hyundai Heavy-Daewoo Shipbuilding M&A Faces 'Disapproval' from Fair Trade Commission

European Regulators Warn "High Market Share Could Harm Shipowners if Merged"

Overlapping Environmental Regulations and Increased Orders Favor Shipyards, Raising Concerns

Daewoo Shipbuilding Struggles with Financial Troubles... KDB Bank Reviews 'Plan B' and Other Options

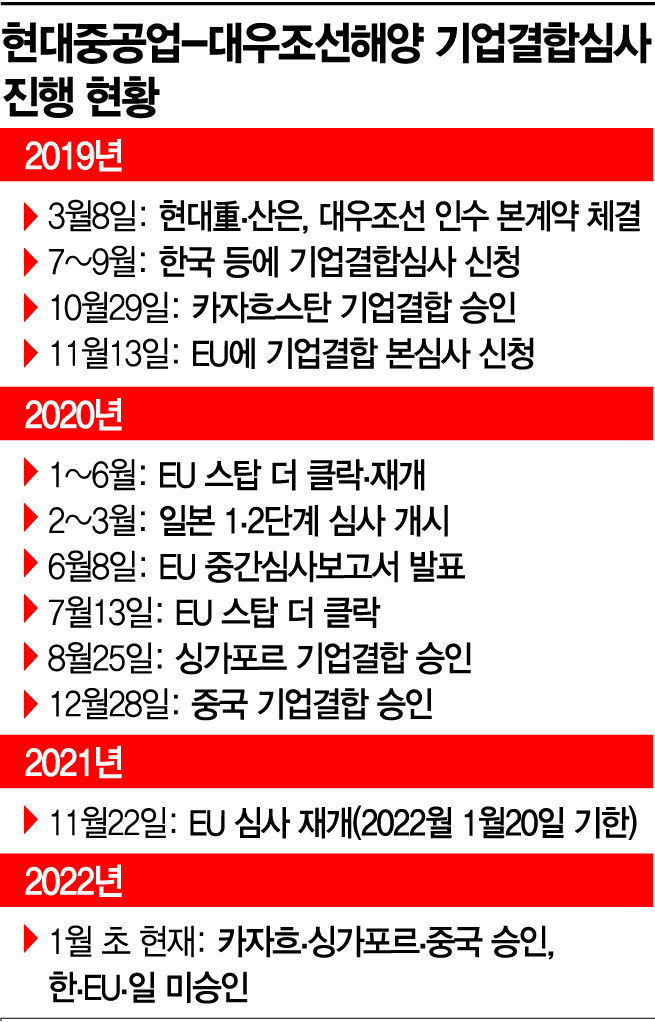

[Asia Economy Reporter Choi Dae-yeol] Europe delayed the corporate merger review between Korea Shipbuilding & Offshore Engineering (formerly Hyundai Heavy Industries) and Daewoo Shipbuilding & Marine Engineering in January 2020, two years ago, because the investigation could not be properly conducted due to the emerging COVID-19 pandemic at the time. Subsequently, the review was suspended twice more (in March and July 2020) with stop-the-clock measures, and the review resumed in November last year after about a year and a half. As the full merger process approaches its third year, Kazakhstan, Singapore, and China have successively approved the merger, while Europe, Japan, and South Korea have yet to reach a conclusion.

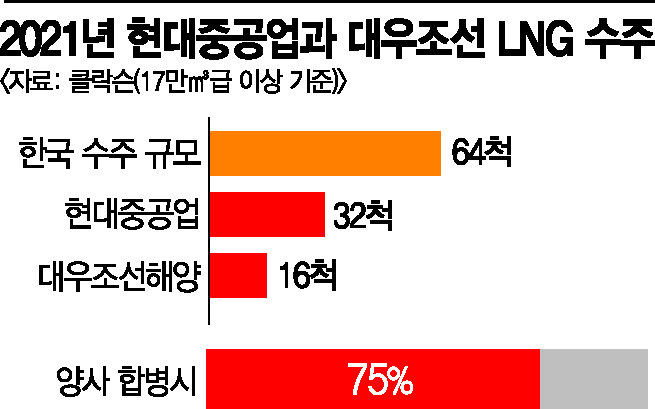

European competition authorities are concerned that the two companies hold a significant market share in certain ship types such as liquefied natural gas (LNG) carriers, and that the merger could harm shipowners based in Europe. According to industry sources on the 5th, Hyundai Heavy Industries Group and Daewoo Shipbuilding's global market share of LNG carriers is estimated to be around 70%. Including Samsung Heavy Industries, nine out of ten LNG carriers worldwide are built at Korean shipyards.

With the global surge in LNG demand to address climate change, the demand for ships to transport LNG is also expected to increase. For other ship types such as container ships, liquefied petroleum gas (LPG) carriers, and tankers, the combined market share of the two companies is around 20-30%, but in certain areas like ultra-large container ships or dual-fuel engine ships with low carbon emissions, Hyundai and Daewoo's technological capabilities are regarded as world-leading.

The surge in ship orders due to overlapping environmental regulations has also become an obstacle to the merger. Until three to four years ago, when the merger was first proposed, the prolonged downturn in the shipbuilding industry gave shipowners a stronger position in negotiating ship prices, but since early last year, the tide has changed as ship orders surged. Large domestic shipyards secured about 140-150% of their initial order targets last year. The backlog of ship orders is estimated to exceed two and a half years. Generally, when such a workload is accumulated, shipowners and shipbuilders are considered to be on equal footing in price negotiations. This has also allowed shipyards to be selective in accepting orders.

Conversely, shipowners, who could previously push down ship prices just a few years ago, now find it difficult. European competition authorities interpret that if the Hyundai-Daewoo merger is approved, the balance of power may tilt toward the shipyards. The European Commission (EC) has repeatedly suspended and resumed the review, demanding remedies to alleviate competition restrictions related to the merger. In response, Hyundai Heavy Industries reportedly proposed technology transfers and partial sales of shipyards. Additional measures were supposed to be submitted by early last month, but Hyundai Heavy Industries did not respond. Around this time, foreign media reported the possibility of the EC rejecting the merger application, citing statements from European competition officials.

As the possibility of the merger's failure increases, KDB Industrial Bank and Daewoo Shipbuilding have become anxious. They initially planned to receive 'KRW 1.5 trillion + α' in capital increases after the merger, but if the merger fails and this support is canceled, resolving financial difficulties will become challenging. As of the end of the third quarter last year, Daewoo Shipbuilding's debt ratio was close to 300%. Its retained earnings, which once exceeded KRW 600 billion, have turned into a deficit of KRW 600 billion.

Even if raw materials like steel plates are purchased in advance and a large workforce is deployed to build ships, considering that a significant portion of payments from clients is concentrated at the time of ship delivery, it is expected to take another two to three years for recent orders to translate into company profits. While the Industrial Bank is making efforts for the merger, it is reportedly considering a 'Plan B' in case the sale fails. The Daewoo Shipbuilding labor union and local communities have consistently opposed the sale, and there is speculation that the issue may be approached politically in connection with the upcoming presidential election.

A representative from Korea Shipbuilding & Offshore Engineering stated, "The shipbuilding market is difficult to evaluate dominance solely by market share, and it is structurally hard for any single company to monopolize. Like the three countries (Kazakhstan, Singapore, and China) that previously gave unconditional approval, we believe it is appropriate for the European Union competition authorities to also make a decision granting unconditional approval."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.