Last December, 30 out of 53 local apartment complexes fell short

Over 530 contract cancellations at 'Songdo Xi The Dusty' in Incheon, 수도권

Stricter weekly DSR this year makes securing interim payments even harder

Warning signals are sounding in the apartment sales market. In various local areas, cases of subscription shortfalls are occurring one after another, and even in the metropolitan area, which used to record average competition rates of several hundred to one, there are continuous instances of uncontracted units. In particular, concerns are growing that the unsold apartment crisis will spread as loan regulations have been significantly tightened, including the application of the Debt Service Ratio (DSR) to sales payments starting this year.

◇ One in two local apartments remain unsold = According to the Korea Real Estate Board's Subscription Home on the 5th, among a total of 53 private apartment complexes in local areas that conducted subscriptions in December last year, 30 experienced subscription shortfalls. This means that more than one out of every two complexes failed to find prospective residents. In Daegu, 4 out of 5 complexes were undersubscribed, and the number of undersubscribed complexes is increasing in various local areas such as Gyeongnam, Gyeongbuk, Jeonnam, and Jeonbuk.

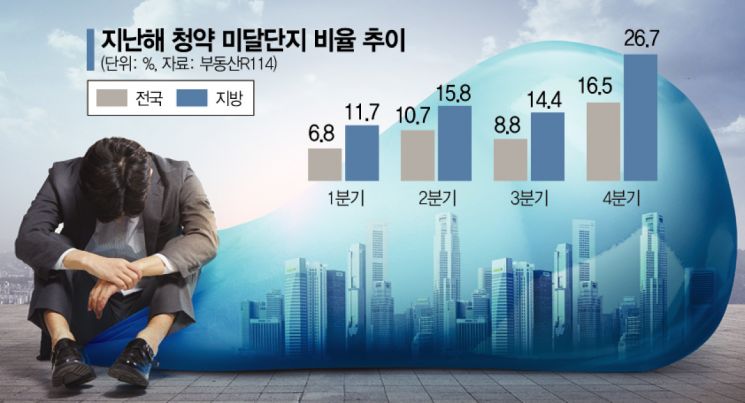

According to a survey by Real Estate R114, among 707 housing types supplied nationwide in the fourth quarter of last year, 117 housing types experienced subscription shortfalls, accounting for 16.5% of the total. This is about twice the proportion compared to the previous quarter, when only 50 out of 569 housing types (8.8%) were undersubscribed. Earlier, the rates were 6.8% and 10.7% in the first and second quarters of last year, respectively.

Especially in local areas, 117 out of 439 housing types supplied in the fourth quarter were undersubscribed, accounting for 26.7%. Compared to 11.7%, 15.8%, and 14.4% in the first, second, and third quarters, respectively, the sales market atmosphere sharply deteriorated in the fourth quarter.

◇ Metropolitan area also sees rising cancellations, an ‘abnormal signal’ = On the surface, conditions in the metropolitan area’s sales market are better. There were no subscription shortfalls among the 268 housing types supplied in the fourth quarter last year. For the entire year, only six housing types were undersubscribed in the second quarter, with none in the first and third quarters.

However, the reality in the metropolitan area is different. Despite recording subscription competition rates of dozens to one, there are many apartments with uncontracted units. For example, ‘Songdo Xi The Star’ in Songdo-dong, Incheon, supplied by GS Construction in November last year, attracted 20,156 applicants for 1,533 units in the first priority subscription, recording an average competition rate of 13 to 1. However, during the contract process, more than 30%, about 530 people, canceled their contracts. Similarly, ‘Songdo Central Park River Rich,’ supplied in the same area in October last year, recorded an average competition rate of 57.51 to 1, but 38 out of 96 units remained uncontracted and were opened for non-priority subscription.

◇ Loan regulations now apply to sales payments... Will the subscription bubble burst? = The market expects that polarization in subscription rates by region and complex may accelerate this year. This is due to the early implementation of the second and third stages of the borrower-level Debt Service Ratio (DSR) as part of strengthened household debt management measures, making it harder to secure funding. From the second half of this year, the DSR application threshold per borrower will be tightened from total loans of 200 million KRW or more to 100 million KRW or more. In this case, contract holders with existing loans may face difficulties in preparing intermediate and final payments, leading to subscription or contract cancellations.

Ye Kyung-hee, senior researcher at Real Estate R114, said, "As housing transactions have recently plummeted and prices have started to decline in some areas, the upward trend has been broken, and subscription sentiment is also faltering depending on the region," adding, "This year, popular areas will attract subscriptions, while unpopular areas or complexes with high prices will be distinctly avoided, highlighting a clear selection process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.