Full Implementation from 4 PM on the 5th

[Asia Economy Reporter Park Sun-mi] The secure API-based personal credit information management service (financial MyData) will be fully implemented from 4 PM on the 5th. From the new year, consumers will be able to manage their scattered financial information more safely, quickly, and conveniently.

On the 4th, the Financial Services Commission and the Financial Supervisory Service announced that with the full implementation of MyData at 4 PM on the 5th, scraping will be completely banned, and 33 operators will provide financial MyData services through the API method. These 33 companies have participated sequentially in the MyData service pilot operation since last month, promptly addressing necessary improvements to stabilize systems and traffic, enhance service completeness, and improve consumer convenience.

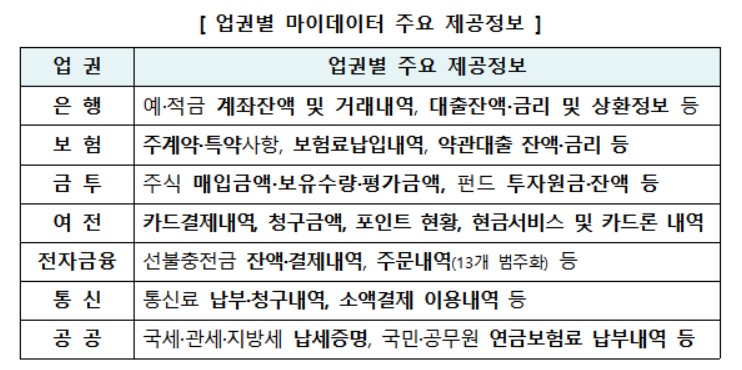

Information from 417 regulated financial companies, excluding some lending companies, will be provided starting on the 5th. Among the total 550 information providers, data from 24 banks, 40 insurance companies, 44 securities firms, 51 credit finance companies, 79 savings banks, 5 mutual finance companies, 34 electronic finance companies, 58 telecommunications companies, and 82 P2P and lending companies will be available. However, for users to actually perform integrated inquiry and use the information, MyData operators need to connect individually with each information provider.

Public information such as national tax, local tax, customs payment details excluding the National Tax Service’s national tax payment certificate available from the 5th, as well as health insurance, civil servant pension, and national pension premium payment details, are under negotiation to be provided within the first half of this year.

With the full implementation of API-based MyData, financial consumers will be able to perform integrated inquiry and management more safely than before, through stricter information protection and security system reviews, prohibition of scraping, functional suitability assessments, and mandatory security vulnerability inspections. Additionally, a safe system will be established to enable faster and more convenient integrated inquiry of more information, allowing effective customized asset and financial management. The integrated inquiry speed via API is about 10 times faster compared to the scraping method.

There are also many advantages for MyData operators. When users request information transmission, information providers are obligated to provide the information, creating an environment where MyData operators can receive necessary information quickly and stably. Under the previous scraping method, if information providers holding customer data applied scraping prevention technologies for information protection reasons, stable provision of MyData services was hindered.

Moreover, compared to the previous scraping method, receiving information from a more diverse and larger number of information providers enables service innovation and the creation of various business models.

A financial authority official stated, "The 21 operators not participating in the API-based MyData service will join within the first half of this year after developing related systems and apps. To enhance consumer convenience, financial sector information and big tech information not yet included will also be continuously and actively opened this year through consultations with related industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.