No Performance or Limit Restrictions, Popular

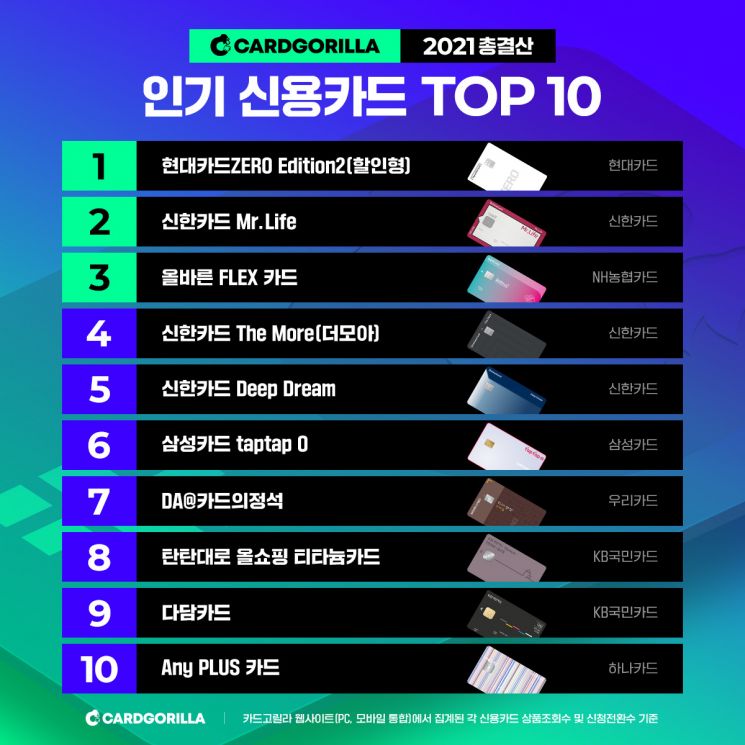

'Hyundai Card Zero Edition 2' Tops Popular Credit Cards

'Naver Pay Woori Card Check' Ranks No.1 in Check Cards

[Asia Economy Reporter Ki Ha-young] The most popular cards sought by consumers this year were 'unconditional cards' that offer discounts and rewards regardless of the previous month's spending. Although card companies competed to launch new Private Label Credit Cards (PLCCs), the advantage of unconditional cards was that they provided benefits without conditions amid a situation where benefits were reduced due to fee cuts.

According to Card Gorilla, the largest credit card platform in Korea, as of the 30th, five out of the top 10 popular credit cards this year were unconditional cards, accounting for half of the list.

The number one card was the representative unconditional card, 'Hyundai Card Zero Edition 2 (Discount Type)'. This card offers a 0.7% statement discount at all merchants and a 1.5% statement discount in daily life categories with an annual fee of 10,000 KRW and no spending conditions. The second place went to the living expense discount card ‘Shinhan Card Mr. Life’, and third place was taken by 'NH Nonghyup All Right Flex Card'. 'Shinhan Card The More', which stopped new issuance from the 31st, ranked fourth, and another unconditional card, 'Shinhan Card Deep Dream', ranked fifth.

In the check card category, 'Naver Pay Woori Card Check', which offers up to 20,000 Naver Pay points monthly without previous month spending conditions and an annual fee of 5,000 KRW, ranked first. Following it were 'Woori Card’s Standard Cookie Check' (2nd), 'Woori 010PAY Check Card' (3rd), 'Shinhan Card Deep Dream Check' (4th), and 'Woori #Oha Check (One Day Check)' (5th).

Although card companies released many PLCCs this year, the cards ultimately chosen by consumers were unconditional cards that provide benefits at all merchants without spending conditions. It is interpreted that those with low spending or who do not frequently use specific merchants chose unconditional cards because the benefits of PLCCs, which focus on specific perks, were not significantly different. The discontinuation of so-called 'value cards' due to continued merchant fee reductions is also considered to have influenced this trend.

As of the 15th, the number of new credit cards issued by eight full-service card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana, BC) reached 199 types, and check cards 33 types, the highest in the past five years. However, only three new cards ranked within the top 20 this year: 'Hyundai Card Z Family' (11th), 'BC Sibal Card' (16th), and 'Hyundai Card M Boost' (18th).

Go Seung-hoon, CEO of Card Gorilla, said, "Due to the prolonged COVID-19 pandemic, unconditional cards will become steady sellers along with living expense (fixed cost) discount cards. Unconditional cards with untact discounts or specialized benefits beyond basic discounts and rewards in specific areas will continue to rank high in the charts next year."

Meanwhile, this survey was based on the number of views and application conversions for each credit and check card product on the Card Gorilla website from January 1 to June 19 of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)