Seoul Average Winning Bid Rate 111.2%... 119.9% in October

Gyeonggi·Incheon at 110.8%·109.9%, Driving the Capital Area

Widening Gap Between Appraised and Market Prices Raises Winning Bid Rate and Success Rate

Withdrawals Increase, Auction Items Decrease, Competition Intensifies Due to Concentrated Demand

[Asia Economy Reporter Ryu Tae-min] This year, due to an unprecedented surge in housing prices, the winning bid rate for apartments at court auctions also recorded an all-time high. Despite the government's successive real estate regulations, apartment prices soared, drawing the attention of both actual homebuyers and investors to the court auction market.

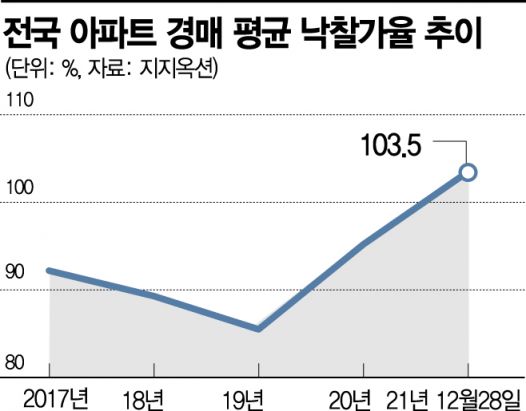

According to Gigi Auction, a court auction specialist company, as of the 28th, the winning bid rate for apartments auctioned nationwide this year was tentatively calculated at 103.5%. This is the highest figure since the company began analyzing related statistics in 2001. The winning bid rate is the ratio of the winning bid price to the appraised value, and a figure exceeding 100 means the property was sold for more than the appraised price. The nationwide apartment winning bid rate fell for two consecutive years from 92.3% in 2017 to 89.3% in 2018 and 85.5% in 2019, but rebounded to 95.2% last year and reached an all-time high this year.

The hottest area is Seoul, the epicenter of the housing price surge. The average winning bid rate reached 111.2%. Following 112.0% in March, it rose to 113.8% in April, 115.9% in May, and 119.0% in June, setting new records for four consecutive months. Due to the COVID-19 impact, courts were mostly closed, causing a temporary dip to 107% in July, but the winning bid rate soared again, reaching 119.9% in October. However, as the transaction slump became more pronounced in November and December, the rates eased somewhat to 107.9% and 104.7%, respectively.

In the same metropolitan area, Gyeonggi and Incheon also recorded high average winning bid rates of 110.8% and 109.9%, respectively. In particular, Incheon surpassed 100% in February with 101.9% and steadily rose to 123.9% in August, exceeding Seoul's peak. Gyeonggi also maintained a record above 100% every month this year, setting a new high of 115.8% in August.

With Increasing Withdrawals, Fewer Properties... Actual Demand and Investment Intensify Competition

The rise in apartment auction winning bid rates this year is attributed to the ripple effects of the sales market. Typically, the appraisal price of auction properties is evaluated several months before the auction starts, so the gap between the appraisal price and market price widened, causing the winning bid rate to soar, according to Gigi Auction.

Additionally, as housing prices surged, more homeowners sought to resolve debts through sales, sharply reducing the number of apartment auction properties. Since court auction appraisals are generally set lower than market prices, when market buying demand is strong, auction withdrawals increase, explained Gigi Auction.

In fact, the number of apartment auctions conducted in Seoul this year was 412, a 37.5% decrease compared to 660 cases last year. Compared to 1,064 cases in 2019, the volume decreased by 61.2% over two years. The number of auction withdrawals for Seoul apartments this year reached 200 cases.

As auction withdrawals reduced the number of bidding properties in the metropolitan area, competition intensified, raising the winning bid rate, which indicates the proportion of properties sold at auction. Seoul's apartment winning bid rate was 73.3%, significantly exceeding the national average of 54.7%. Similarly, Gyeonggi (72.8%) and Incheon (70.5%) also surpassed 70%.

However, due to the government's comprehensive tightening of loan regulations, the metropolitan apartment auction market has shown signs of contraction since the end of the year. Lee Joo-hyun, a senior researcher at Gigi Auction, stated, “Because loan regulations apply equally to auction properties, buyers seem to feel burdened in securing funds,” adding, “With the Debt Service Ratio (DSR) regulation also being applied from the first half of next year, a wait-and-see stance is expected to continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)