KCCI, '2022 Corporate Management Outlook Survey' Results

[Asia Economy Reporter Kim Hyewon] Among companies that have established management plans for next year, only about 20% plan to expand investment and hiring. The projected economic growth rate for South Korea next year is an average of 2.7%, which is more conservative compared to the government and major institutions (around 3%). The biggest issue constraining the Korean economy was identified as various regulatory policies that reduce corporate vitality, and many voices expressed expectations for tax reduction policies from the next government.

These findings come from the '2022 Corporate Management Outlook Survey' conducted by the Korea Employers Federation on the 26th, targeting 243 companies nationwide with 30 or more employees (based on responses). Among the responding companies, 64.6% said they had either 'finalized (11.1%)' or 'drafted (53.5%)' their management plans for next year. The remaining companies responded that they had not even drafted a plan.

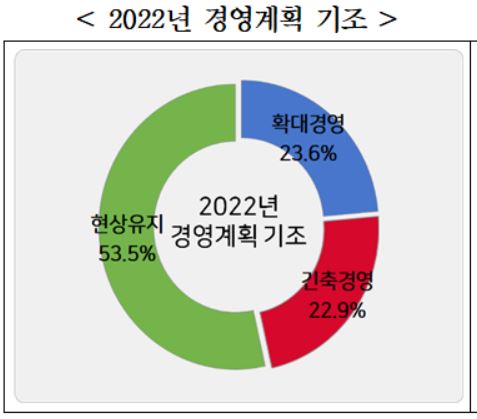

Companies that established management plans for next year mainly responded that their management stance would be to maintain the status quo (53.5%). Expansion management (23.6%) and austerity management (22.9%) showed similar response rates. In particular, among companies choosing austerity management, cost reduction (80.6%) was overwhelmingly the top priority. The Korea Employers Federation interpreted this as most companies considering cost reduction as the top priority for austerity management due to recent issues such as supply chain shocks, soaring raw material prices, and wage increases.

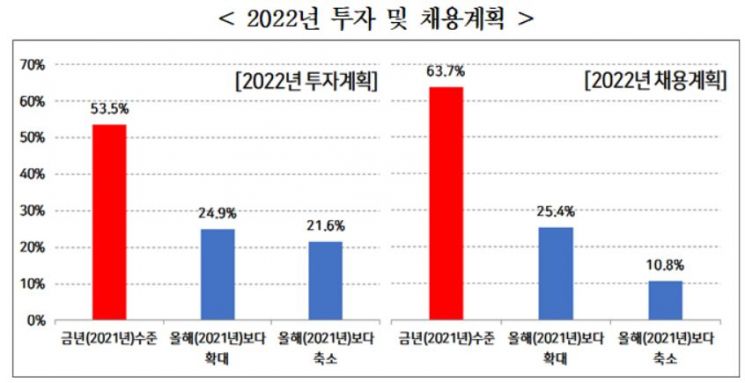

When asked about investment and hiring plans for next year among companies that established management plans, the highest response rates were for maintaining the current year's level: 53.5% for investment and 63.7% for hiring. In contrast, only about a quarter of companies planned to expand investment or hiring compared to this year. Lee Seungyong, head of the Economic Analysis Team at the Korea Employers Federation's Economic Research Headquarters, explained that the high number of companies responding with plans to maintain this year's level is likely because the 4% economic growth this year is seen not as a sign of economic recovery but as a rebound effect from the base caused by the negative growth (-0.9%) in 2020.

Responding companies projected the Korean economy's growth rate next year to be an average of 2.7%. This is somewhat lower than the approximately 3% growth rate forecasted by major domestic and international institutions recently. The Korea Employers Federation interpreted this as reflecting corporate sentiment amid increasing domestic and international uncertainties such as the spread of Omicron, ongoing supply chain instability, and expanded volatility in raw material prices.

Regarding overall changes in workforce demand due to digital transformation (ICT-based unmanned/automation, non-store sales, etc.), 27.8% of responding companies answered that a decrease in workforce demand is expected due to unmanned/automation. Notably, this response was 31.6% among companies with 300 or more employees (26.1% for companies with fewer than 300 employees). Meanwhile, 61.8% of responding companies believed that workforce demand would not change significantly as the factors increasing and decreasing demand would offset each other, and only 10.4% chose that workforce demand would increase due to business area and opportunity expansion from digital transformation.

Regarding improvements in worker (union) wages and treatment next year, responding companies expected demands for high wage increases (39.7%) and securing fairness and rationality in compensation such as improving performance evaluation criteria (38.4%). In particular, the demand for high wage increases was thought to be mainly due to habitual demands from workers (unions) (42.7%) and minimum wage increases (39.6%) rather than improvements in corporate performance (11.5%). Lee explained, "This reflects the reality that although corporate performance should be an important basis for determining wage increase rates, wage increase demands in the field are mainly driven by factors other than performance."

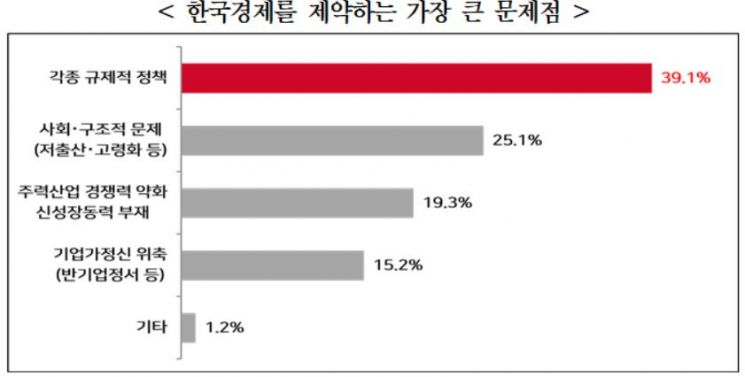

Among responding companies, 39.1% pointed to various regulatory policies that reduce corporate vitality as the biggest problem constraining the Korean economy. This was followed by social and structural issues such as low birthrate and aging population, and deepening polarization (25.1%), weakening competitiveness of key industries and lack of new growth engines (19.3%), and contraction of entrepreneurial spirit due to high tax rates and widespread anti-corporate sentiment (15.2%).

Regarding the tax policy direction of the next government, 54.5% responded that it should be 'tax reduction policies for economic revitalization and reducing the burden on citizens,' expressing concerns about South Korea's high tax burden. Meanwhile, 33.5% said that tax rationalization such as reducing non-taxable and deductible items and adjusting tax exemption thresholds is more urgent than discussions on tax increases or reductions. Only 12.0% chose tax increase policies to secure welfare funding. As policies that the next government should prioritize to promote corporate investment, respondents cited regulatory innovation (49.4%), improvement of corporate tax environment (44.4%), and labor sector reform (41.6%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)