Increase in Mid-Term Withdrawals and Decline in Subscribers Despite Return of Lump-Sum Payments and Re-Enrollment Restrictions

Recent Proposal to Raise Housing Price Eligibility from 900 Million to 1.5 Billion KRW

Urgent Need for Measures to Revitalize the System, Including Pension Increase Rate Reflecting Market Price Fluctuations

View of apartments in Yongsan-gu and Seocho-gu, Seoul, as seen from Namsan, Seoul. [Source=Yonhap News]

View of apartments in Yongsan-gu and Seocho-gu, Seoul, as seen from Namsan, Seoul. [Source=Yonhap News]

[Asia Economy Reporter Kwangho Lee] Jin-hyung Kim (71, male), who lives in Songdo-dong, Yeonsu-gu, Incheon, is considering giving up his housing pension early due to the significant increase in his house price. He joined the housing pension program last May with an apartment valued at 550 million KRW as collateral and received a monthly pension of 1.5 million KRW. However, the house price has more than doubled within a year, now trading in the 1 billion KRW range.

Young-gyu Choi (69, male), residing in Heukseok-dong, Dongjak-gu, Seoul, recently terminated his housing pension. Choi had been receiving a monthly pension of 2.1 million KRW based on an apartment valued at 800 million KRW in early 2017. But now, the house price is in the high 2 billion KRW range. Choi lamented, "If I cancel midway, I have to return the pension I received and face restrictions on rejoining, but with house prices soaring and pension increases not reflected, I had no choice."

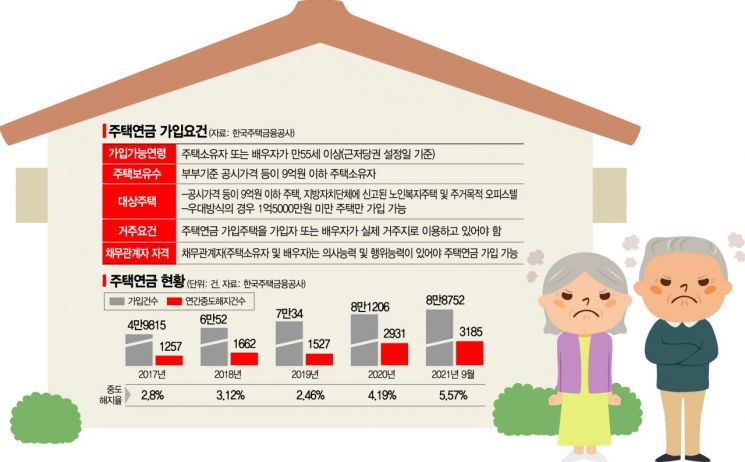

The number of elderly people canceling their housing pensions, known as a "retirement safety net," is rapidly increasing. This indicates that many subscribers prefer to sell their houses, which have skyrocketed in price, to secure funds for their retirement rather than receiving a pension for the rest of their lives. The subscription rate has also significantly slowed down, influenced by the higher entry barriers due to the sharp rise in house prices. Although politicians are pushing to raise the subscription criteria from a market price cap of 900 million KRW to allow apartments up to 1.5 billion KRW, there are concerns that this could conflict with the government's real estate policies, so a cautious approach is advised.

◆ Proposal to Raise Official Price from 900 Million KRW to 1.5 Billion KRW = According to the National Assembly and related industries on the 24th, 12 members of the People Power Party, including Representative Taeyoung Ho, proposed an amendment to the Housing Finance Corporation Act on the 22nd to raise the housing pension subscription criteria from an official price of 900 million KRW to 1.5 billion KRW.

The housing pension is a product where seniors aged 55 or older pledge their owned homes as collateral and receive monthly retirement funds as a pension for life or a fixed period.

The amendment includes raising the official price limit for collateral homes to 1.5 billion KRW and setting the appraisal price cap at 1.5 billion KRW.

Representative Tae said, "With the recent surge in house prices, cases where people cannot join the housing pension are increasing, raising calls to expand eligibility. Considering that real estate accounts for a large portion of the average household head's assets in Korea, amending the Housing Finance Corporation Act is necessary to ensure the stability of seniors' retirement life and the soundness of the housing pension."

According to KB Real Estate statistics, as of last October, the average apartment sale price in Seoul was 1.21639 billion KRW, reaching the official price cap of 900 million KRW for housing pension subscription.

Democratic Party lawmaker Kwan-seok Yoon also pointed out during this year's national audit, "The current housing pension determines the pension amount based on the house price at the time of subscription, so even if house prices rise, the pension increase rate is not reflected. Urgent measures are needed to revitalize the system."

Because pension increases are not reflected despite rising house prices, early cancellations are rapidly increasing. Generally, housing pension subscriptions increase when the likelihood of house price rises is low. The higher the house price, the relatively lower the monthly pension amount received.

According to the Housing Finance Corporation, the early cancellation rate of housing pensions was 5.5% as of last September. It rose from 2-3% during 2017-2019 to 4.19% last year and reached an all-time high this year. The number of early cancellations also more than doubled from 1,527 in 2019 to 3,185 as of September this year.

The number of subscriptions has also slowed. After recording about 50,000 cases in 2017 with an annual increase of over 10,000 cases, the number of subscriptions as of last September was 88,752, similar to the end of the previous year.

◆ Need for Careful Consideration of Law Amendments and Early Cancellations = The Housing Finance Corporation states that if a housing pension is canceled, the subscriber must repay the total amount received plus compound interest, and rejoining is difficult, so decisions should be made carefully.

A Housing Finance Corporation official said, "It is a natural economic decision for subscribers to secure necessary retirement funds by selling their homes, but if early cancellation is made simply because house prices have risen, it is necessary to fully consider the possible situations that may arise afterward."

In fact, upon early cancellation, the subscriber must repay the entire outstanding housing pension loan balance, including the pension amount received so far and interest and other financial costs. The initial guarantee fee is non-refundable, and additional financial costs may occur to secure repayment funds. Rejoining with the same house is restricted for three years, and a separate initial guarantee fee must be paid upon rejoining.

A Housing Finance Corporation official advised, "Since the housing pension fundamentally has the characteristics of a loan, financial costs such as interest and guarantee fees occur relative to the pension amount received. Receiving a higher monthly payment is not necessarily advantageous."

Some raise concerns that raising the housing pension price cap to 1.5 billion KRW could conflict with the government's real estate policies. In December 2019, the government announced a ban on loans for apartments exceeding 1.5 billion KRW to curb house prices. That is, mortgage loans are not available for apartments over 1.5 billion KRW. However, if the housing pension price cap is raised to 1.5 billion KRW, depending on the setting method (such as lifetime mixed method, fixed period mixed method, loan repayment method, preferential mixed method, etc.), up to 50% can be withdrawn at once, potentially circumventing loan regulations. For example, receiving 200 to 300 million KRW in advance and then repaying it.

A financial authority official said, "We are reviewing various difficulties related to housing pension subscriptions," but declined to elaborate further.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)