Top 3 Onto Industry Companies Secure 267.4 Billion KRW Investment

Global Financial Firms Including Goldman Sachs Show Interest

Substantial Funds Bet on 'Strengthening Competitiveness'

"Expect to Surpass Break-Even Point Next Year"

[Asia Economy Reporter Song Seung-seop] The online investment-linked finance industry (OnTu industry) is attracting investor funds amounting to several hundred billion won. This is interpreted as being influenced by the rapid development of 'innovative finance' technology driven by digitalization and the participation of so-called 'big players' in investments.

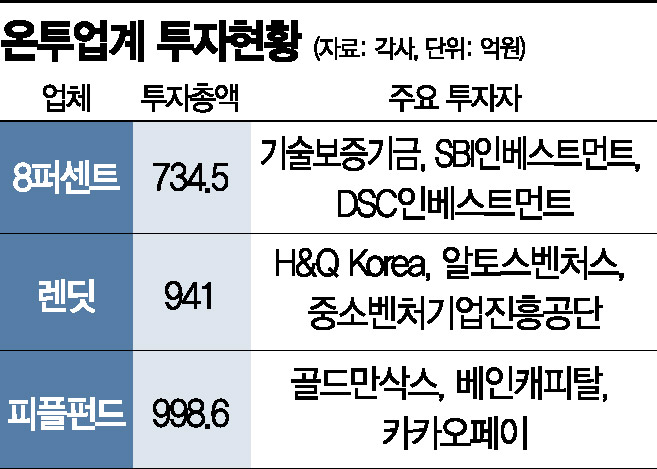

According to the OnTu industry on the 24th, the top three companies by asset size?8 Percent, Rendit, and PeopleFund?have currently attracted investment funds totaling 267.41 billion won. PeopleFund raised the largest amount with 99.86 billion won. Rendit and 8 Percent secured 94.1 billion won and 73.45 billion won, respectively.

The investment amount in the OnTu industry is steadily increasing. The total amount of the most recent investments received by these companies is 174.7 billion won, accounting for about 65.3% of the total. Typically, investments in emerging industries start with seed money and proceed through Series A, B, C rounds depending on the company’s valuation. The seed money for these three companies was only in the range of 1 to 2 billion won each.

The sources of investment are also becoming more diverse. PeopleFund received 75.9 billion won in Series C funding this month from global financial firms such as Bain Capital and Goldman Sachs. 8 Percent secured 45.3 billion won (Series C) from SBI Investment and Glint Partners, while Rendit successfully raised 53.5 billion won (Series E) from H&Q Korea.

OnTu Companies Securing Funds... Betting on Strengthening Competitiveness

Domestic financial companies and related institutions are also showing steady interest in the growth of the OnTu industry. The Small and Medium Business Corporation has invested in Rendit and 8 Percent. Among financial companies, Kakao Pay was listed as an investor with 18.2 billion won (Series B) in PeopleFund in July 2019. As for the government-backed bank IBK Industrial Bank, it invested 10 billion won in Niceabc, which focuses on corporate finance, together with Stonebridge Ventures.

The OnTu industry plans to use the secured funds to refine mid-interest loan models and strengthen competitiveness through workforce acquisition. There are also expectations that full-scale profit realization and rapid growth will be possible starting next year. A PeopleFund representative said, "We have secured the industry's top engineers and credit evaluation experts, and the credit scoring system (CSS) has undergone performance improvements four times," adding, "We expect to surpass the break-even point next year."

Kim Sung-jun, CEO of Rendit, emphasized, "Since the first OnTu industry registration in June, we have laid the foundation for growth through large-scale investment attraction," and added, "We will achieve quantum growth next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)