Lira Defense Likely Injected Up to $17 Billion This Month... Net Foreign Exchange Reserves Expected to Be Negative

[Asia Economy Reporter Park Byung-hee] The Turkish lira, which had been plummeting, sharply rebounded this week, revealing a rapid decline in Turkey's foreign exchange reserves. Analysts suggest that the lira's rebound is due to active intervention by the central bank. Concerns over a Turkish foreign exchange crisis are intensifying.

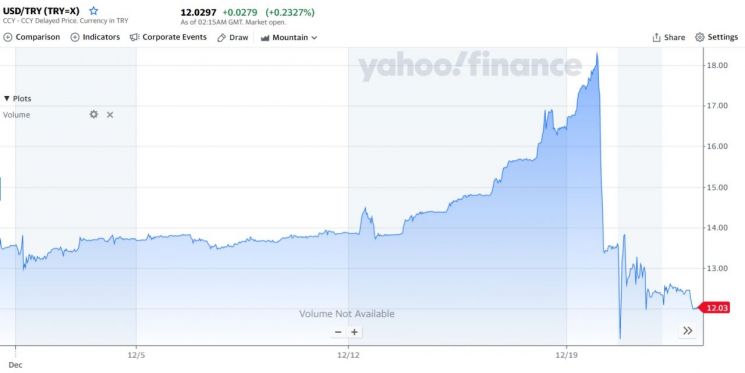

The lira hit an all-time low of 18.4 lira per dollar on the 20th. At that time, the lira had depreciated by as much as 60% against the dollar this year. As the lira continued to plunge, President Recep Tayyip Erdogan announced late that day that measures would be taken to protect lira deposits, after which the lira's value soared. On the 22nd (local time), the lira recovered to the 12 lira per dollar level. On the surface, President Erdogan's statement about protecting lira deposits appears to have led to the lira's sharp rise in value.

However, in reality, it was revealed that the Turkish central bank actively intervened in the market by releasing its dollar holdings to boost the lira.

According to a foreign news report on the day, Turkey's net foreign exchange reserves decreased by $5.9 billion between the 20th and 21st, and the net foreign exchange reserves balance has now shrunk to minus $5.1 billion. Net foreign exchange reserves refer to foreign exchange reserves excluding swap agreements with foreign central banks.

An analyst who requested anonymity estimated that the central bank released about $6.9 billion in dollars between the 20th and 21st. He pointed out, "Turkish banks are working together to highlight President Erdogan's statement on protecting lira deposits." Encouraged by the lira's rebound, President Erdogan said on the 22nd that Turkey is winning the financial war.

President Erdogan said, "We are fighting those who try to suppress us with inflation and interest rates," adding, "Given the current situation, we will achieve the desired outcome."

Market estimates suggest that the central bank's intervention in the foreign exchange market this month alone amounts to $15 billion to $17 billion. Credit rating agency Fitch downgraded Turkey's credit rating outlook to negative earlier this month and warned that if the central bank's interventions to support the lira continue, Turkey's already vulnerable foreign exchange reserves will become even more fragile.

The Bank of Korea signed a $2 billion currency swap agreement with the Turkish central bank in August. The Bank of Korea explained that the impact of the Turkish lira's plunge on the domestic market is not significant. Since Turkey procures won funds through the swap and later repays them in won, it is unrelated to the exchange rate.

Meanwhile, the Turkish central bank has not officially announced any intention to intervene in the foreign exchange market this week. It has also not confirmed whether it released dollars to boost the lira's value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)