Oil Prices Plunge Amid Omicron Spread

Gas Prices Surge as Russia Cuts Gas Supply to Europe

[Asia Economy Reporter Hyunwoo Lee] As countries have begun reinstating lockdown measures amid the spread of the COVID-19 Omicron variant, international oil prices, caught in concerns over demand contraction, have fallen back below the $70 mark. In contrast, natural gas, intertwined with geopolitical crises such as the Ukraine situation, surged sharply following news of Russia adjusting its gas supply to Europe. With major energy prices showing instability, concerns are emerging that the overall price stability of the commodity market will be shaken for some time.

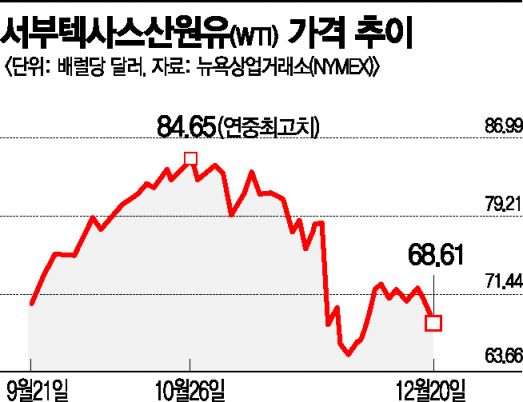

On the 20th (local time) at the New York Mercantile Exchange (NYMEX), West Texas Intermediate (WTI) crude oil futures prices fell 2.98% from the previous session to $68.61 per barrel. Brent crude oil on the London ICE Futures Exchange also closed down 2.72% at $71.52 per barrel compared to the previous day.

On this day, international oil prices collectively declined amid concerns over potential demand contraction due to governments' moves to reinstate lockdown measures. Earlier, the UK government stated that it does not rule out lockdowns before Christmas, while the Netherlands announced it would resume lockdown measures by closing restaurants and non-essential retail stores until mid-January next year.

Accordingly, concerns have arisen that OPEC Plus (OPEC+), the consortium of major oil-producing countries, may adjust oil production. According to major foreign media, Russia plans to reduce its oil exports and transportation volume from 58.3 million tons in Q4 this year to 56.05 million tons in Q1 next year. The compliance rate of oil production cuts by key OPEC+ member countries also exceeded the target, recording 117% last month. It is interpreted that major oil-producing countries are preemptively reducing supply due to concerns over the Omicron variant's impact.

On the other hand, natural gas, affected by the Ukraine situation, showed a sharp rise. At NYMEX, natural gas futures prices surged 3.9% from the previous day to $3.83 per MMBtu (one million British thermal units). The Dutch TTF exchange, a European natural gas price benchmark, saw natural gas futures prices soar 7.7% to 147.5 euros compared to the previous session.

Despite concerns over demand contraction due to the spread of the Omicron variant, it was Russia that pushed natural gas prices higher. According to foreign media such as CNBC, Germany's energy transportation company Gas Connect reported that since the 17th, Russia has reduced the supply volume of the Yamal-Europe pipeline gas line, which connects to Germany via Belarus and Poland.

As tensions between Russia and the North Atlantic Treaty Organization (NATO) over the Ukraine border dispute have intensified, concerns that Russia might weaponize natural gas have significantly driven up natural gas prices.

Experts predict that if abnormal winter weather occurs in the future, major energy prices will become even more unstable. Brian Steinkamp, a commodity analyst at energy consulting firm Schneider Electric, told MarketWatch, "According to the latest forecast from the U.S. National Oceanic and Atmospheric Administration (NOAA), there is a possibility of below-average temperatures across the U.S. over the next two weeks," adding, "Under previous expectations that this winter would be warm, U.S. energy prices, which had not risen as sharply compared to Europe, could see significant increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.