Accelerated Digital Innovation Post-COVID

Domestic Server Market Expansion

Revenue to Reach 2.6 Trillion KRW by 2025

IDC Emerges as Key Infrastructure

KT, SKB, LG Uplus Compete to Expand Centers

[Asia Economy Reporter Cha Min-young] Along with the growth of cloud, a distributed data storage system, 'data storage' Internet Data Centers (IDCs) are gaining attention as core infrastructure. Mobile carriers are expanding ultra-large IDC facilities mainly in the metropolitan area to foster the IDC sector, a profitable business showing an annual growth rate close to 10%.

Market to Grow to 2.6 Trillion KRW by 2025

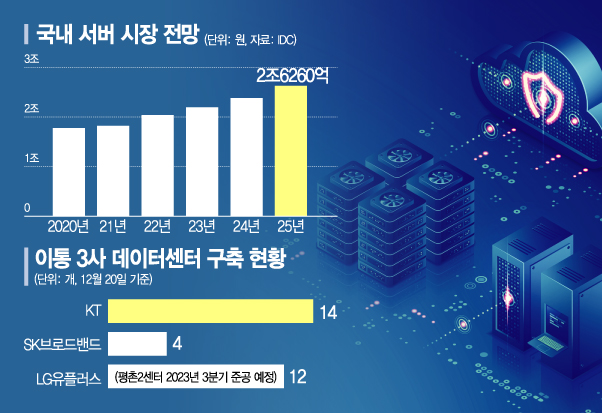

According to industry sources on the 20th, market analysis consulting firm Korea IDC forecasted in its '2021 Domestic Server Market Outlook Report' that the domestic server market will record an average annual growth rate of 8.1% over the next five years, growing into a market worth 2.62 trillion KRW by 2025. Korea IDC analyzed in the report, "Amid the COVID-19 pandemic crisis, companies are actively seeking to adopt servers to expand digital innovation for survival and ensure stable business operations."

Data centers, which in the past served merely as 'warehouses,' are now growing into core infrastructure supporting the cloud industry by taking charge of data collection, processing, and handling. As digital industries such as Artificial Intelligence (AI) and Internet of Things (IoT) accelerate, the demand for data centers to store the exponentially increasing data is also rising. From public sector demand confirmed during the 'vaccine reservation chaos' to general companies and even the five major tertiary hospitals including Seoul National University Hospital, outsourcing of IT operations through IDCs is underway.

Moon Hyung-don, Director of the Institute for Information & Communications Technology Planning & Evaluation (IITP), stated, "The best way to handle the surging data such as vaccine reservations is the cloud," adding, "Already, 94% of global data traffic is processed in the cloud, making the digital transformation (DT) of companies an unstoppable trend."

Competition among the three major mobile carriers in the IDC industry is fierce. KT, SK Broadband (SK Telecom), and LG Uplus currently operate 21 domestic data centers. KT has the most with 14, SK Broadband has 4, and LG Uplus currently has 12, with plans to complete the Pyeongchon 2 Center by the third quarter of 2023.

Mobile Carriers Rush to Invest

Perspective view of LG Uplus IDC Pyeongchon 2 Center scheduled for completion in the third quarter of 2023

Perspective view of LG Uplus IDC Pyeongchon 2 Center scheduled for completion in the third quarter of 2023

KT, the market leader with a 41% share in the domestic IDC market, is estimated to have recorded sales of 290 billion KRW last year. Daishin Securities expects KT's sales to reach 340 billion KRW this year. KT, which is leading affiliate separations, is also expected to actively pursue the spin-off of its cloud and IDC business division next year.

KT, currently operating 14 domestic IDCs, plans to expand overseas as well. Building on domestic success, KT formed a strategic partnership last September with JTS, an IDC business affiliate of Thailand's telecommunications company Jasmine Group. In August last year, KT also signed an MOU with the Korea Overseas Infrastructure & Urban Development Corporation (KIND) to construct overseas IDCs. Kim Hoe-jae, a researcher at Daishin Securities, said, "KT is receiving love calls from global cloud providers due to its excellent location conditions and superior operational capabilities."

LG Uplus has also shown an average annual growth rate of 10% in the IDC sector over the past five years. Last year's sales were 227.8 billion KRW, and this year is expected to record even higher figures. LG Uplus owns 12 IDCs in total, six in the metropolitan area and six in other regions, and is currently constructing the Pyeongchon 2 Center in Anyang, Gyeonggi Province, aiming for completion in the third quarter of 2023. The scale is equivalent to six soccer fields, matching the Pyeongchon Mega Center in size, making it a hyperscale facility.

SK Broadband, which owns four domestic IDCs, has been operating the largest data center in Seoul, located in Gasan-dong, since the second half of this year. At a CEO seminar, SK Broadband announced, "We will expand the scale from 92 megawatts (MW) this year to over 300 MW in the future." With the acquisition of the Gasan data center, processing capacity has increased 2.6 times compared to last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.