[Asia Economy Reporter Park Byung-hee] There are forecasts that the Chinese stock market, which underperformed this year, could rebound significantly next year.

Due to major countries' large-scale fiscal expansion policies in response to COVID-19, most asset prices such as stocks, commodities, real estate, and cryptocurrencies surged sharply this year. In contrast, China strengthened regulations on information technology (IT) companies citing national security and took measures to deflate the real estate bubble, showing a countertrend to the policies of major countries worldwide. As a result, the relative underperformance of the Chinese stock market this year was severe, and there are expectations that its low price appeal could be highlighted next year.

JPMorgan Chase predicted in a report last week that the MSCI China Index could surge nearly 40% next year.

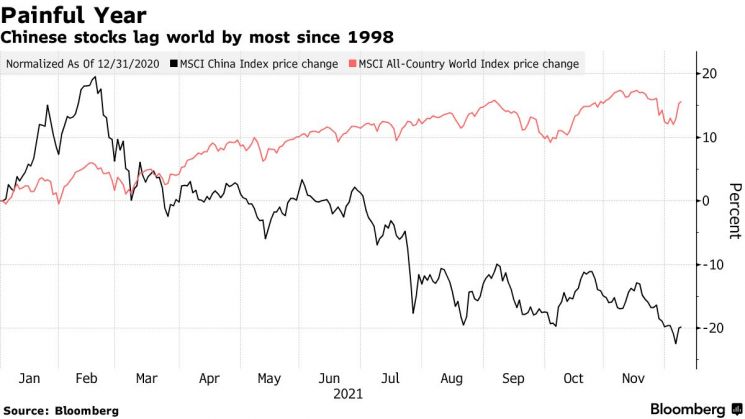

As of the 15th, the return gap between the MSCI China Index and the global index this year reached 37 percentage points, the largest gap since 1998. The yield on China’s dollar-denominated non-investment grade (junk) bonds is also about 25 percentage points lower than that of global junk bonds, showing the largest yield gap in over a decade. While housing prices in major countries such as the U.S. and the U.K. are still rising, China’s housing prices have fallen for four consecutive months recently due to liquidity issues at Evergrande Group.

Wendy Liu, JPMorgan’s chief China economist, explained, "The price-to-earnings ratio (PER) of the MSCI China Index is only 12.2 times," adding, "Compared to the S&P 500 PER, this is the largest gap since 2005." Liu said, "The Chinese market is bottoming out, and since policy shifts are just beginning, it is easy to gain profits from this low base."

China announced a reserve requirement ratio (RRR) cut on the 6th, and the lowered RRR by 0.5 percentage points has been applied since the 15th. This is the second RRR cut this year, following a cut in July after 15 months.

There are also forecasts that China will soon lower the Loan Prime Rate (LPR), which effectively serves as the benchmark interest rate. The LPR has been frozen since April last year.

Not only JPMorgan but also Goldman Sachs, BlackRock, UBS, and HSBC have all advised increasing exposure to Chinese stocks in the past two months. According to Goldman Sachs, the allocation of Chinese stocks in active funds has dropped to the lowest level in 10 years.

On the other hand, Morgan Stanley and Citigroup have expressed opposing views. Morgan Stanley advised caution regarding Chinese stock investments in mid-last month. After Morgan Stanley’s cautious stance, the MSCI China Index fell about 10%. Citigroup also stated last week that it is not yet the time to buy Chinese stocks.

The banks with negative views cite U.S.-China relations as a variable. The U.S. declared a "diplomatic boycott" of the Beijing Winter Olympics in February next year and added over 40 Chinese companies to the blacklist on the 16th through the Departments of Commerce and Treasury.

The appreciation of the Chinese yuan is also a factor. Despite strong regulations by the Chinese government, China’s weight in the bond market has steadily increased since its inclusion in the world’s top three bond indices. The yuan’s value against the dollar has risen about 2% compared to the beginning of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.