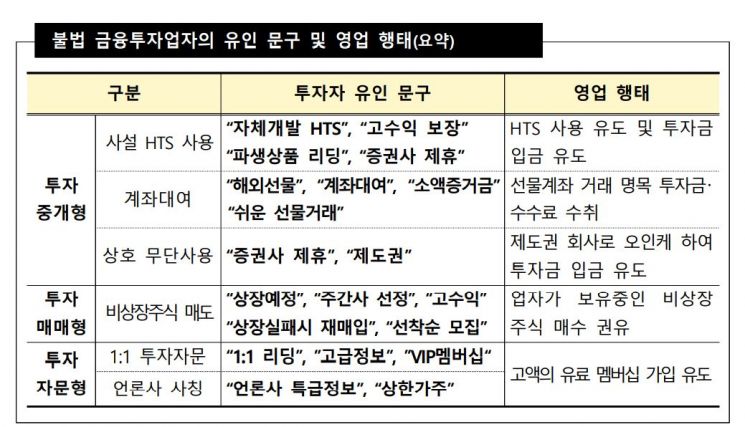

[Asia Economy Reporter Ji Yeon-jin] 'High guaranteed returns,' 'Scheduled for listing,' 'Easy futures trading.' As interest in financial investment has increased recently, illegal financial investment operators who lure investors with such phrases and then embezzle the investment funds are thriving. Financial authorities introduced the false and exaggerated phrases mainly used by illegal operators and provided precautions and response guidelines.

According to the Financial Supervisory Service (FSS) on the 15th, reports related to illegal financial investment operators received through the FSS website's tip-off corner from the beginning of this year until last month totaled 635 cases, an increase of about 62% compared to the same period last year (391 cases).

Most of them deceive consumers with phrases such as 'high guaranteed returns,' 'easy futures trading,' 'stocks scheduled for listing,' and 'premium information,' then embezzle investment funds or cause financial damage through low-quality advisory services.

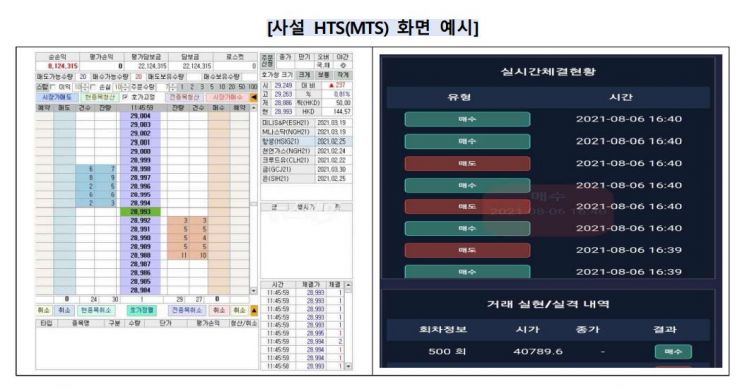

First, they lure investors by claiming that following derivative product leads through messengers guarantees high returns in a short period, then induce them to install self-produced Home Trading Systems (HTS) or Mobile Trading Systems (MTS). After investors deposit funds into designated accounts and trade overseas futures, the operators manipulate the screens to make it appear as if high returns were achieved, reassuring investors. However, when investors request withdrawals, the operators collect additional funds under various pretexts such as fees and then disappear. An FSS official stated, "Investors who see huge profits amounting to several times their investment tend to psychologically comply easily with requests for additional deposits under various pretexts to withdraw their funds."

Illegal operators who rent accounts that allow futures trading with small amounts through YouTube and other platforms also remain active, collecting investment funds and fees. In the case of futures investment through financial companies, individuals must have a basic deposit of 10 million KRW and complete mandatory education, which is cumbersome, so investors rent futures accounts. However, some companies rent virtual futures accounts for simulated trading rather than actual trading accounts or take investment funds and then cut off contact. They also lure investors by falsely claiming to have exclusive contracts with well-known securities firms guaranteeing stable returns.

Riding the IPO public offering investment boom, cases of damage caused by urging the purchase of unlisted stocks through messengers and phone calls have also increased. They mainly use company names such as 'Partners,' 'Holdings,' 'Invest,' and 'Asset,' pretending to be consulting firms, and lure investors with phrases like "scheduled for listing within a few months," "~times guaranteed returns," and "repurchase if listing fails." They reassure investors by pre-stocking shares before the purchase payment is made, then sell them at a higher price than their purchase price to pocket the difference. The FSS explained that although they promote with phrases like 'scheduled for listing' and 'underwriter selected,' exploiting investors' expectations of a 'big hit from listing,' most companies have not confirmed whether they are actually pursuing listing.

Additionally, there were cases where investors were lured into open chat rooms by offering free stock investment consultations via text messages or messengers, providing simple information such as securities market conditions, then invited to 1-on-1 chat rooms with promises of receiving premium information and encouraged to subscribe to paid memberships. Caution is also advised against cases where securities broadcasts on YouTube or AfreecaTV provide free videos related to stock investment to attract viewers and then induce them to subscribe to paid services such as VIP memberships.

The FSS advised not to engage in any financial transactions with companies that guarantee high returns or offer free derivative or stock leads through messengers, and to always verify whether the counterparty is a regulated financial company before any financial transaction. Verification of regulated financial companies can be done through the Regulated Financial Company Inquiry on the Financial Consumer Information Portal. Also, if there are abnormal demands such as account opening fees or taxes during the transaction process or if fraud is suspected, immediately stop the transaction and report to the police or the FSS.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)