Revival of Shipbuilding Industry Boosts Insulation Material Orders

Expansion of Supply in Unmanned Aerial Vehicle Sector

Carbon Fiber Composites, Key Materials for Future Industries

Korean shipbuilding industry has emerged from a dark tunnel of a decade-long recession and started to run again. Despite COVID-19, orders from global shipowners have continued, causing an explosive increase in ship orders. Domestic shipbuilders have secured 2 to 3 years’ worth of work, mainly focusing on liquefied natural gas (LNG) vessels. In particular, with the strengthening of environmental regulations, they have shown strengths in securing orders for LNG carriers and LNG-powered ships, which are classified as high value-added vessel types. This has led to an increase in orders for companies producing LNG cryogenic insulation materials. Cryogenic insulation materials are substances made using carbon fiber and other materials to keep the internal temperature of LNG ships low, maintaining and storing LNG in liquid form for extended periods. In Korea, ‘Korea Carbon’ and ‘Dongsung FineTec’ are representative companies. Asia Economy examined the current status of these companies that are rising along with the revival of the Korean shipbuilding industry and analyzed their future growth potential.

[Asia Economy Reporter Lim Jeong-su] Korea Carbon shares the LNG cryogenic insulation material market with Dongsung FineTec. Recently, as domestic shipbuilders’ LNG vessel orders have increased, expectations for performance have grown. Moreover, the carbon fiber composites technology possessed by Korea Carbon is widely used as a core material in future industries such as hydrogen mobility markets and aircraft materials. Beyond LNG vessels, there are many application fields, equipping the company with unlimited growth momentum. It is also evaluated that Korea Carbon has sufficient financial capacity for new business investments and research and development (R&D).

Boom in Cryogenic Insulation Material Orders Following Explosive LNG Ship Orders

Korea Carbon has recently seen rapid growth in orders centered on LNG cryogenic insulation materials. According to Korea Carbon, the order backlog at the end of the third quarter this year was 634 billion KRW, sharply increasing from 372 billion KRW at the end of 2019 and 479 billion KRW at the end of 2020. The order volume up to the third quarter this year reached 367 billion KRW, nearly matching last year’s full-year order volume of 373 billion KRW.

Orders for cryogenic insulation materials are expected to continue increasing next year as well. As major clients Hyundai Heavy Industries and Samsung Heavy Industries continue to secure LNG vessel orders, the likelihood of increased orders for cryogenic insulation materials has grown. An industry insider said, "LNG cryogenic insulation materials are essential core materials for both LNG carriers transporting LNG and LNG-powered vessels (including container ships and bulk carriers). As domestic shipbuilders’ LNG vessel orders increase, orders for LNG cryogenic insulation materials inevitably continue to rise."

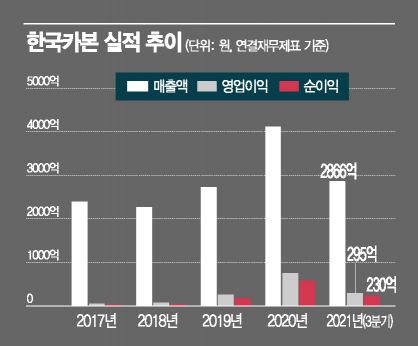

Supported by the increase in orders, performance is also showing an improving trend. Sales, which were in the 200 billion KRW range until 2019, increased to 411.7 billion KRW last year, and are expected to maintain a similar level this year. Operating profit also rose about threefold from 25.3 billion KRW in 2019 to 75.7 billion KRW last year.

Domestic securities firms’ performance forecasts are also rising. Analyst Chwa Kwang-sik of Korea Investment & Securities said, "Based on the LNG vessel order volumes from major suppliers such as Hyundai Heavy Industries and Samsung Heavy Industries, estimating the delivery volume of cryogenic insulation materials, Korea Carbon’s sales will continue to break records with 428.3 billion KRW in 2022 and 446.2 billion KRW in 2023," adding, "Profitability will also rise alongside fixed cost effects."

Securing Future Growth Engines by Arming with New Businesses Such as Unmanned Aircraft

Korea Carbon does not rely solely on LNG vessel cryogenic insulation materials. It has also secured cryogenic insulation material technology for liquefied hydrogen, which is considered a future fuel. Composite materials using carbon fiber are gaining attention as eco-friendly lightweight materials in aerospace and future mobility sectors.

Recently, through its affiliate Korea Composite Materials, it signed a supply contract with Israeli state-owned aerospace defense company IAI for the ‘Gulfstream G280 aircraft tail wing structure.’ In addition, in 2018, Korea Carbon and IAI jointly established a joint venture, Korea Aircraft Technology KAT, participating in the development of military and civilian vertical takeoff and landing unmanned aerial vehicles.

Based on its high technological capabilities, Korea Carbon is expected to expand its supply channels into future industrial fields, including participation in various hydrogen-related projects. An industry insider said, "Korea Carbon’s composite material technology is highly likely to expand its application fields as core materials needed for future mobility such as hydrogen vehicles."

Maintaining a Debt-Free Policy for Over 10 Years... Sufficient Investment Capacity

Financial stability is also maintained at the highest level among shipbuilding equipment companies. Total borrowings are around 250 billion KRW, which is less than the annual EBITDA. This means the company could repay all borrowings with one year’s profit and still have surplus.

Holding over 100 billion KRW in cash equivalents, Korea Carbon has effectively maintained a debt-free policy. Net cash stands at around 70 to 80 billion KRW. An investment banking industry insider said, "The company has maintained a net cash position for over 10 years," and evaluated, "As performance improves, cash equivalents accumulate, which will act as investment capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.