Payment of Taxes with Cultural Assets and Artworks Instead of Cash

Ministry of Culture to Propose Bill for Establishing In-Kind Tax Payment Review Committee This Month

Art Community: "Established the Basic Framework for a Cultural Power"

Expectations for Market Appraisal Activation and Related Industry Development

Regret Over Stricter Conditions Compared to UK and France

Concerns Over Authenticity Verification and National Treasury Loss

Transparent Disclosure of Price and Purchase Background Remains a Task

[Asia Economy Reporters Donghyun Choi and Mideum Seo] The long-awaited 'Art Tax Payment System' in the art world, which has been a wish for over a decade, recently passed the National Assembly plenary session and will be officially implemented starting in 2023. This system allows taxes to be paid with cultural assets and artworks (hereafter referred to as artworks) instead of cash, introduced to expand the public's cultural enjoyment rights. While the art community generally welcomes this, some concerns have been raised about potential side effects such as tax evasion.

Follow-up Measures after Introducing the ‘Art Tax Payment System’... Establishing the ‘Tax Payment Review Committee’

The core of the newly introduced ‘Art Tax Payment System’ is that payment with artworks is only possible for tax amounts arising from inheritance of artworks. However, the inheritance tax amount must exceed 20 million KRW, and it is only allowed upon request by the Minister of Culture, Sports and Tourism. Since it applies to inheritance cases starting from January 1, 2023, the Samsung family, who inherited the ‘Lee Kun-hee Collection’ following the death of Chairman Lee Kun-hee in October last year, is excluded.

The Ministry of Culture, Sports and Tourism (MCST) immediately began follow-up procedures. They plan to propose an amendment to the ‘Museum and Art Gallery Promotion Act’ within this month to establish a ‘Tax Payment Review Committee’ that will evaluate and review artworks submitted for tax payment. An MCST official stated, "Our goal is to establish a review body with the authority and expertise equivalent to the Cultural Heritage Committee by the first half of next year," adding, "The committee will be composed of museum and art gallery appraisers, tax law experts, and will include subcommittees according to artwork types such as calligraphy, ceramics, and earthenware."

Going forward, art tax payments will be conducted through verification by the Tax Payment Review Committee and tax authorities. First, if a taxpayer expresses their intention to pay inheritance tax with artworks at the local tax office, the tax office will apply to the MCST for tax payment with artworks. Then, if the Tax Payment Review Committee recognizes the artwork’s historical, academic, or artistic value, it will be approved by the Minister of Culture, Sports and Tourism and handed over to the local tax office. The tax authorities will grant final approval for the taxpayer’s tax payment if they determine there is no risk of loss to the national treasury.

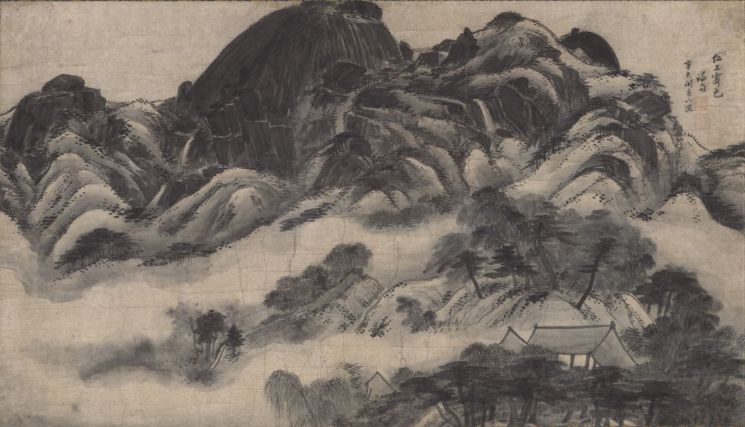

'White Ox' by Lee Jung-seop from the 1950s, donated to the nation as part of the 'Lee Kun-hee Collection.' It is currently held by the National Museum of Modern and Contemporary Art.

'White Ox' by Lee Jung-seop from the 1950s, donated to the nation as part of the 'Lee Kun-hee Collection.' It is currently held by the National Museum of Modern and Contemporary Art.

Art Community: "A First Step Toward Becoming an Advanced Art Nation"

The art community has warmly welcomed the introduction of the tax payment system. Junmo Jeong, former curator at the National Museum of Modern and Contemporary Art, said, "Having consistently advocated for the need for this system since 2013, I feel deeply moved," and added, "Korea now has the basic framework to become a cultural powerhouse in the 21st century." Misook Choi, Planning and Support Director at the Korean Museum Association, said, "As the first generation of museums, galleries, and art institutions transition to the second generation, inheritance and gift taxes have become problematic," and noted, "With the timely introduction of this tax payment system, important cultural assets held by private museums can become public assets."

There are also expectations that market price appraisals of artworks will become more active and related industries will develop. Recently, as the MZ generation (Millennials + Generation Z) has entered the art market, demands for transparency and reliability in artwork pricing based on data and statistics are higher than ever. Yongcheol Yoon, Appraisal Director at the Korea Gallery Association, explained, "Due to institutional shortcomings, Korea’s market price appraisals have been inferior compared to other countries," adding, "Artwork prices vary greatly depending on purposes such as inheritance, liquidation, and insurance, but even tax authorities often fail to properly understand this." He continued, "With the introduction of this tax payment system, as data accumulates and experts are nurtured, the level of market price appraisal will improve," and expressed hope that "just as the Korea Appraisal Board was reborn as the Korea Real Estate Board last year, the art world will also have an organization with such expertise."

However, some opinions point out that the conditions for tax payment with artworks are stricter compared to countries like the UK, France, and the Netherlands, which have long operated similar systems. France, which introduced the system in 1968, allows payment of inheritance tax, gift tax, and property tax with artworks. The UK, which first introduced the system in 1896, allows inheritance tax to be paid with artworks without any special conditions. Curator Jeong emphasized, "Since Korea limits art tax payment only to inheritance tax arising from artwork inheritance, it is indeed distant compared to other countries," and stressed, "The scope should gradually expand after the system stabilizes."

The Kansong Art Museum, which experienced financial difficulties, exhibited the 'Gilt-Bronze Standing Buddha' (Treasure No. 284) and the 'Gilt-Bronze Standing Bodhisattva' (No. 285) (from left) at K Auction in May last year.

The Kansong Art Museum, which experienced financial difficulties, exhibited the 'Gilt-Bronze Standing Buddha' (Treasure No. 284) and the 'Gilt-Bronze Standing Bodhisattva' (No. 285) (from left) at K Auction in May last year.

Side Effects Such as National Treasury Loss and Tax Evasion

Concerns have also been raised that the art tax payment system could cause various side effects.

There is a possibility of national treasury loss due to the unique characteristics of artworks. In fact, among tax payment assets recognized under current law, the amount of real estate and stocks submitted to the state but not yet sold reached 1.4395 trillion KRW as of February. Over the past five years (2016?2020), the sale amount compared to the securities’ tax payment value resulted in a deficit of 22.5 billion KRW, as the sale price was lower than the price set at the time of tax payment. A tax industry official said, "As confirmed in the forgery controversies involving artists Cheon Kyung-ja and Lee Ufan, it is questionable whether the authenticity of artworks can be properly verified," and added, "Considering the scale of Korea’s art market and appraisal standards, national treasury loss is likely to occur."

There are also criticisms that the system could become a playground for tax evasion by the top 1% wealthy. Changnam Ahn, professor of taxation at Gangnam University, said, "If the tax payment system had applied to the Lee Kun-hee Collection, it is doubtful whether the tax authorities could have received proper answers regarding the artwork prices and purchase history," and pointed out, "There is a risk of abuse for tax evasion through slush funds or excessively inflated prices."

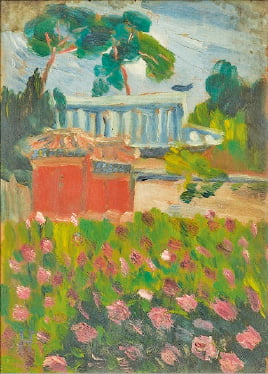

'Hwanyungjeonjak' (1930s) by Na Hye-seok, donated to the National Museum of Modern and Contemporary Art as part of the 'Lee Kun-hee Collection'.

'Hwanyungjeonjak' (1930s) by Na Hye-seok, donated to the National Museum of Modern and Contemporary Art as part of the 'Lee Kun-hee Collection'.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)