KCCI Hosts the 7th ESG Management Forum... Discussing Latest ESG Issues and Response Strategies Including Social Taxonomy

[Asia Economy Reporter Kim Hyewon] The European Union (EU) is pushing for taxonomy legislation in the social (S) sector following the environmental (E) sector, raising calls for our government and companies to prepare in the areas of climate environment and human rights protection.

The Korea Chamber of Commerce and Industry (KCCI) held the "7th KCCI ESG Management Forum" on the 6th in collaboration with the Ministry of Trade, Industry and Energy and the law firm Jipyung to discuss the latest ESG (environment, social, governance) issues and response measures, including social taxonomy.

Im Seongtaek, lead attorney at Jipyung Law Firm, who presented on the topic "Trends and Challenges of Social Taxonomy," stated, "In July this year, the EU announced a draft of the social taxonomy, which is a principle to determine what constitutes socially sustainable economic activities," adding, "Once the social taxonomy is introduced in the EU, it is expected that investors will use it as an important criterion when issuing social bonds."

Attorney Im emphasized, "As fundraising through social bond issuance is increasing, domestic companies must respect the rights and interests of stakeholders such as employees, consumers, and local communities in their business activities." Previously, the EU established the green taxonomy, a standard to determine eco-friendly activities, in June last year, which is scheduled to be applied from July next year. Regarding the K-Taxonomy, for which the Ministry of Environment is preparing the final draft, Attorney Im advised, "Taxonomy is a guideline for sustainable finance, so standards should be established in a way that aligns with international trends and gains trust from the market and society."

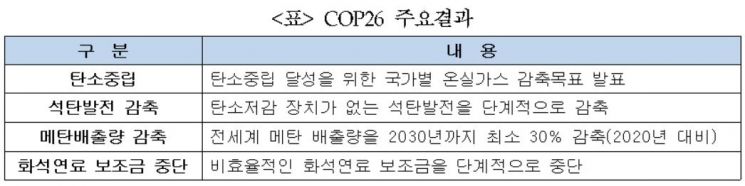

The second presenter, Professor Myung Jaekyu of Korea University of Technology and Education, said, "At COP26 (the 26th UN Climate Change Conference of the Parties), countries submitted plans to reduce greenhouse gas emissions and agreed on the phased reduction of coal power and methane emissions," adding, "Through this conference, companies likely reaffirmed that issues related to climate change, such as energy transition, renewable energy use, and carbon capture, will impact corporate competitiveness."

Professor Myung pointed out, "Climate change issues like greenhouse gas reduction should not be seen only as burdens but as opportunities to strengthen corporate competitiveness," and stressed, "Proactive and strategic corporate responses are necessary." He proposed three strategies for this: ▲ linking core corporate competencies with climate change issues and product competitiveness ▲ strategic ESG disclosure and communication ▲ enhancing management performance through strategic adoption of ESG management.

In the final presentation on the topic "Current Status and Challenges of ESG Investment," Professor Cho Shin of Yonsei University emphasized, "ESG was initiated and is led by investors," adding, "Only when ESG investment is properly conducted will corporate ESG management be activated."

Professor Cho diagnosed, "Global ESG investment reached $35 trillion in 2020, accounting for 36% of total assets under management, and institutional investors are encouraging ESG management through active shareholder engagement," but noted, "In comparison, ESG investment in South Korea is still quantitatively and qualitatively weak." He further stated, "Financial institutions must play a key role as market makers in developing ESG financial products and promoting ESG investment, and institutional investors including the National Pension Service should take the lead in improving ESG issues."

During the subsequent open discussion, participants agreed that the concretization of environmental and social taxonomy should not be viewed solely as a burden but rather as an opportunity to strengthen competitiveness through proactive responses. Woo Taehee, Executive Vice President of KCCI who chaired the meeting, said, "With the strengthening of ESG-related environments such as the increase of greenhouse gas reduction targets and the EU's promotion of social taxonomy, corporate burdens are expected to increase," adding, "If it is an unavoidable trend, it is necessary to use it as an opportunity to become a leader in new markets through a change in perspective."

Choi Namho, Director of Industrial Policy at the Ministry of Trade, Industry and Energy, said, "Although ESG system strengthening domestically and internationally is increasing corporate burdens, depending on the response, it can become an opportunity for domestic companies to sustain growth in the global market," and added, "The government will also make efforts such as tax and financial support to help companies strengthen their ESG competitiveness more actively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)