A favorable wind is blowing in the 5th generation mobile communication (5G) equipment market. 5G equipment companies recorded sluggish performance this year as 5G-related investments by global telecom operators decreased due to COVID-19. However, starting next year, 5G investments are expected to resume in major countries such as the United States, drawing renewed attention to domestic companies supplying related equipment. Asia Economy analyzed KMw, Solid, which are preparing for a resurgence among 5G equipment companies.

[Asia Economy Reporter Park Hyungsoo] KMw secured the core technology of 5G equipment, Massive MIMO (Multiple Input Multiple Output) technology, through continuous research and development (R&D) investment even before the commercialization of 5G. Massive MIMO is a facility that combines multiple antennas to provide a 'beamforming function' that strengthens radio signal intensity. They jointly developed the MMR, a 5G base station equipment applying this technology. Since the first commercialization of 5G in 2019, they have been actively supplying MMR. They are also supplying some products for pilot services overseas through their clients.

In line with changes in the 5G market environment, they are mass-producing ultra-small filters (MBF) developed through independent design and automated mass production technology. They have developed new products while conducting joint development projects for 5G and 4G equipment with multiple clients. Thanks to their outstanding 5G technology, they are attracting attention from leading global telecom equipment and telecom companies.

Since the commercialization of 5th generation mobile communication service (5G) in Korea in 2019, the number of 5G subscribers has steadily increased. As of the end of the first half of this year, the number of domestic 5G subscribers was 16.47 million, accounting for 23.0% of the total mobile communication subscribers. Besides Korea, major countries such as the United States, China, Japan, and the United Kingdom have started 5G services. Other countries have also entered the full commercialization phase of 5G globally by starting 5G pilot services along with 5G frequency auctions and allocations.

Telecom operators providing mobile communication services must install new base stations every time they upgrade their networks. Various equipment constituting base stations across the service area must be replaced. Due to the characteristics of 5G, which can deliver ultra-high-speed and large-capacity data, tens to hundreds of times more filters and antennas are required compared to the previous generation (4G). However, due to the spread of COVID-19 and the resulting global economic downturn, most telecom operators worldwide have reduced or postponed network construction investments (CAPEX). This is why the telecom equipment sector has shown overall poor performance since last year.

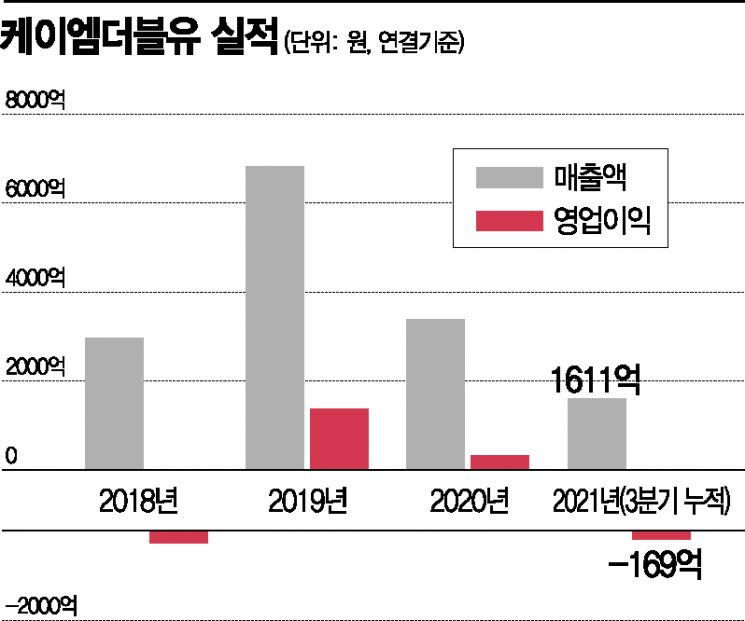

KMw recorded sales of 36.2 billion KRW and an operating loss of 9.2 billion KRW in the third quarter of this year on a consolidated basis. Sales decreased by 51.4% compared to the same period last year, and operating profit turned to a loss. Poor performance has continued through the third quarter this year. System sales, which led growth in 2019, decreased by 86.5% compared to the same period last year. Antenna sales dropped by 65.3% year-on-year. Although filter sales increased by 22.5% compared to the same period last year, the scale was not enough to drive overall sales growth.

Performance has continued to decline as domestic telecom companies and overseas 5G infrastructure investments have been delayed through the third quarter following the first half of this year. Operating profit turned to a loss due to a sharp decrease in sales and the impact of fixed costs. Considering the investment plans presented by the three domestic telecom companies and government regulatory conditions, the investment scale for this year was estimated at 7 trillion KRW, but the investment scale in the first half of this year remained at 2 trillion KRW. Park Jongseon, a researcher at Eugene Investment & Securities, said, "5G investments are being delayed domestically and overseas due to the ongoing COVID-19 situation. However, with active vaccine distribution in major overseas countries, investments are expected to resume by the end of this year and next year."

There is a possibility of a recovery trend starting from the fourth quarter after bottoming out in the third quarter. Eugene Investment & Securities estimated that KMw will record sales of 72.7 billion KRW and an operating profit of 400 million KRW in the fourth quarter of this year. Sales are expected to slightly increase year-on-year, and the break-even point is expected to be surpassed.

KMw is continuously pursuing diversification of domestic and overseas customers based on various products such as systems, antennas, and filters to improve performance. If 5G investments resume, the speed of performance improvement is expected to accelerate.

Kim Hongsik, a researcher at Hana Financial Investment, explained, "Recently, the three domestic telecom companies are expected to resume 5G investments in the fourth quarter of this year. Verizon in the United States has also been actively investing in the 3GHz band since June this year." He added, "The volume is expected to increase after next year. Along with the full-scale 5G investment by Rakuten in Japan next year, network investments by existing Japanese telecom companies such as SoftBank are also expected to increase."

Although delayed due to the impact of COVID-19, the reason for expecting 5G investments is also related to the metaverse. Lee Hakmoo, a researcher at Mirae Asset Securities, emphasized, "The metaverse must be accessible anytime and anywhere, and high-level graphic implementation is essential to secure realism. As virtual reality (VR) technology needs to develop further, 5G's core capabilities of hyper-connectivity, ultra-low latency, and large-scale data transmission are necessary."

Each domestic telecom company supports a maximum LTE transmission speed of 1Gbps, and currently, 5G provides speeds of 1 to 1.3Gbps. The 5G network speed is sufficient to support initial metaverse services, but if VR is fully applied to the metaverse, data capacity limits may be encountered. The researcher said, "In the past, LTE adoption accelerated along with the expansion of the smartphone-centered mobile internet market. Similarly, 5G adoption is expected to accelerate along with the expansion of the metaverse."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)