[Asia Economy Reporter Lee Seon-ae] Individual investors, exhausted by volatile market conditions, are showing signs of withdrawing from ‘direct investment.’ As they increasingly move to discretionary services that manage assets on their behalf, funds are flowing into ‘indirect investment’ products.

According to the financial investment industry on the 3rd, there has been a sharp increase in inflows into TDFs (Target Date Funds) recently. A TDF is a fund where the asset management company manages the money to maximize asset value by the investor’s expected retirement date, known as the ‘target date.’ A representative from an asset management company said, “Although individuals were very active in investing to the extent that it was called a nationwide investment era, they are now struggling in volatile markets and are turning back to professionals.” He added, “Especially, there is a growing perception that it is better to entrust experts with pensions, which are directly linked to life after retirement, leading to an increase in TDF assets under management.”

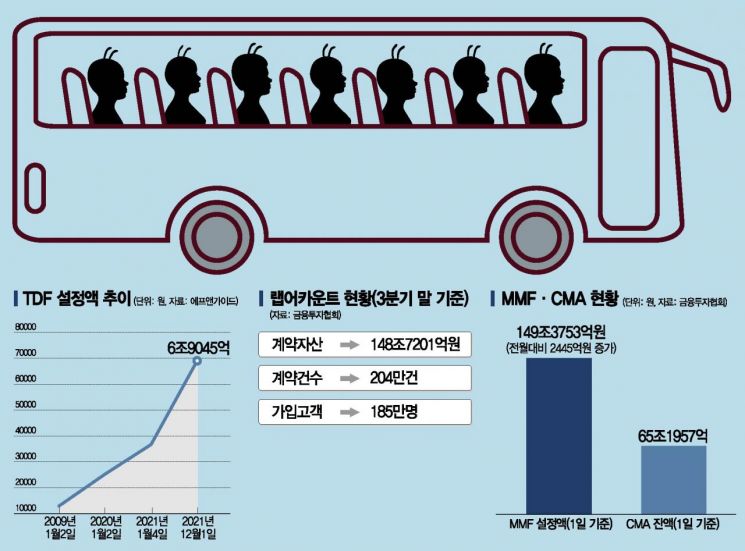

According to FnGuide, the size of domestic TDF assets under management, which was only 647.6 billion KRW on January 2, 2008, increased to 1.2896 trillion KRW on January 2, 2009, 2.5225 trillion KRW on January 2, 2020, and 3.6685 trillion KRW on January 4, 2021. It has continued to grow, surging to 6.9045 trillion KRW as of December 1. This represents an increase of over 3 trillion KRW just this year. Domestic TDF net assets, which were 729.3 billion KRW in 2017, have increased more than tenfold to 9.6684 trillion KRW as of the 1st, and it is widely expected to surpass 10 trillion KRW by the end of the year.

Discretionary asset management service wrap accounts, where securities firms invest clients’ funds in various assets such as domestic and foreign stocks, exchange-traded funds (ETFs), bonds, and equity-linked securities (ELS), have also attracted significant funds. According to the Korea Financial Investment Association, the size of domestic wrap account assets under management was 148.7201 trillion KRW as of the end of September. This represents an increase of 16.1921 trillion KRW through the third quarter, surpassing last year’s annual increase of 15.7313 trillion KRW. The number of subscribers also increased by about 100,000 compared to the end of last year, exceeding 1.85 million. The number of contracts reached 2.04 million, surpassing 2 million for the first time since discretionary wrap account sales began in 2003.

Idle funds are also increasing. This is interpreted as an investment sentiment to keep funds in accounts for the time being while watching market volatility. As of the 1st, the assets under management of money market funds (MMFs) stood at 149.3753 trillion KRW, with an inflow of 244.5 billion KRW in one month. MMFs invest in short-term financial products such as certificates of deposit (CDs), commercial paper (CP), and bonds with maturities under one year. The recent increase in market volatility is believed to have driven short-term funds into MMFs.

The balance of CMA accounts is also maintaining its level. CMA (Cash Management Account) is an asset management account operated by securities firms, where the securities company invests deposited funds in dedicated products to generate returns and pays a certain interest to customers. CMA funds are also considered idle funds in the stock market. When the stock market is booming, investors tend to reduce CMA balances as they trade stocks. The balance fell from about 62.6437 trillion KRW in January to around 45.4 trillion KRW in April, then rose to the 67 trillion KRW level in August and has remained at a similar level since. As of the 1st, it was recorded at 65.1957 trillion KRW.

This money movement is causing abnormal signs in stock market trading volumes. The average daily trading volume in November (KOSPI + KOSDAQ) was 25 trillion KRW, up from 22.7 trillion KRW in October but lower than the 26.2 trillion KRW in the third quarter (July to September). Researcher Jeon Bae-seung of Ebest Investment & Securities said, “Considering that trading volumes typically decrease in December, the fourth quarter trading volume is likely to decline by about 5-10% compared to the 26-27 trillion KRW in the second and third quarters, marking the lowest level of the year.” He analyzed, “In particular, the average daily trading volume of individual investors decreased from 23 trillion KRW in the first half of the year and 19 trillion KRW in the third quarter to 16 trillion KRW in October and 17 trillion KRW in November. The individual trading ratio, which was 78% in the first half, also dropped to 71% in October and November, which is the cause.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)