[Asia Economy Reporter Lee Seon-ae] An investment opinion has been raised that the trend of the KOSPI is currently downward.

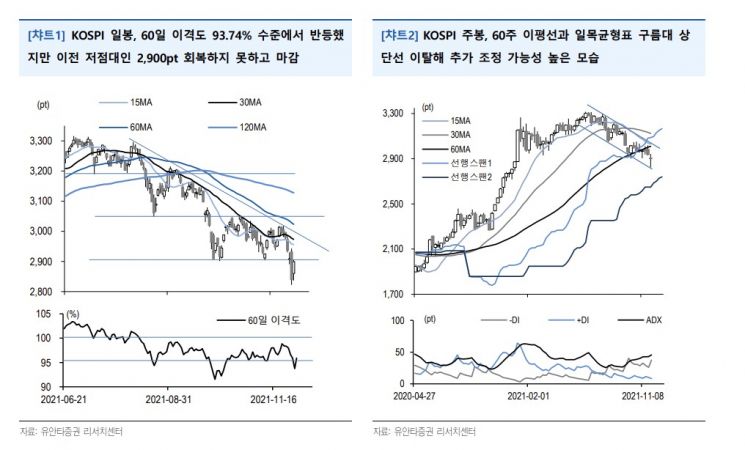

According to Yuanta Securities on the 2nd, the KOSPI reached an oversold level, falling to about 93.67% of the 60-day moving average gap on the 30th of last month, but then successfully rebounded strongly the following day. However, since it failed to break through the previous box range lower boundary of 2900, there is still a possibility of further decline. Researcher Jung In-ji of Yuanta Securities emphasized, "The KOSPI trend is downward, and even if it succeeds in rebounding, there is strong resistance around the 2950 to 3000 level."

On the 30th of last month, the index broke below 2900, which had acted as support for about two months, and further extended its decline, making it highly likely that the index level itself would be downgraded. During this process, the gap from the 60-day moving average fell to 93.74%, and the trading volume on the Korea Exchange approached 20 trillion won, marking the highest level since August 17. The ratio of put option trading volume to call option trading volume was 278.34%, the highest since March 19 of last year. This indicates an extreme oversold condition. Researcher Jung pointed out, "The rebound on the previous day was merely a reaction to that."

If the resistance at 2900 is not broken and the index falls again, it can be seen as confirmation of settling below 2900, increasing the possibility of further decline. Conversely, if 2900 is recovered, the drop on November 30 would be considered a temporary breach of the previous low, and the rebound phase is likely to continue further.

Researcher Jung stated, "Still, the medium- to long-term moving averages on the daily chart remain in a bearish alignment and are declining, and on the weekly chart, the break below the 60-week moving average has already been confirmed. The weekly DMI is signaling a strengthening downtrend (with ADX turning upward). Even if the rebound continues, resistance around 2950 to 3000 will be strong, so the upside potential is limited even if today’s rebound succeeds."

He added, "The proportion of individual investors’ trading has fallen to the past average level, and the relative strength of the Korean stock market has also dropped to average levels, so it is judged that the solo weakness of the Korean stock market is likely to be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)