[Asia Economy Reporter Lee Seon-ae] The earnings per share (EPS) growth rate of the Korean stock market is expected to record a negative figure next year. It is the lowest among major global countries, effectively an 'EPS shock.' The status is falling from 'top-tier' to 'last place.'

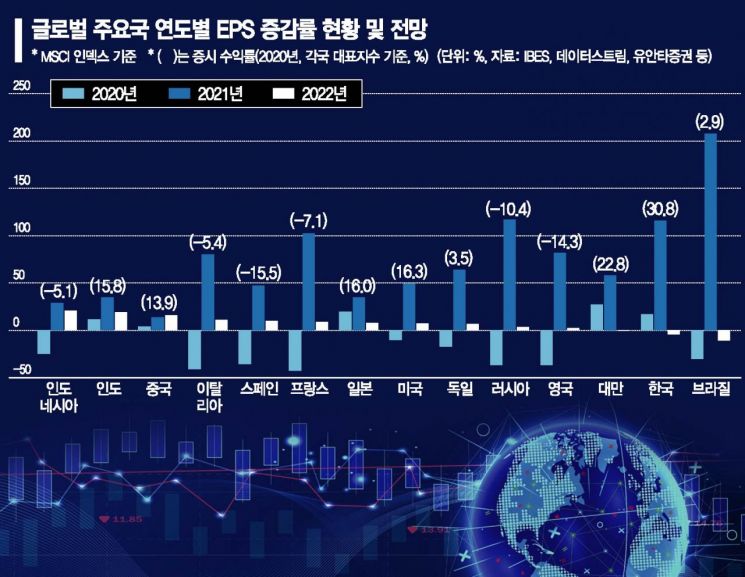

According to IBES (Institutional Brokers Estimate System), a global corporate earnings estimate agency, market research firm Datastream, and Yuanta Securities on the 30th, the EPS growth rate of the Korean stock market based on the MSCI (Morgan Stanley Capital International) index was 17.1% in 2020 and 115.8% in 2021. Among major global countries, Taiwan (27.0%) was the only country with a higher EPS growth rate than Korea in 2020. This year, only Brazil and Russia have higher EPS growth rates than Korea.

However, the situation changes next year. Among major global countries, Brazil, Korea, and Taiwan are expected to record negative EPS growth rates. Taiwan is at -0.4%, Korea at -4.3%, and Brazil at -10.5%. Compared to other emerging Asian countries such as Indonesia (20.8%), India (18.9%), and China (16.0%), the differentiation is expected to be clear. The current 12-month forward EPS growth rate is 0.6%, the lowest level except for Brazil (-4.3%).

Due to this outlook, the financial investment industry views a bearish market for the Korean stock market next year as inevitable. One of the reasons for the rise in the Korean stock market was the high EPS growth rates in 2020 and 2021. As a result, Korea was ranked as the country with the highest stock market return in 2020. Korea's return was 30.8%, the highest among major global countries, followed by Taiwan at 22.8%. Only two countries exceeded 20%.

Kim Kwang-hyun, a researcher at Yuanta Securities, explained, "The ongoing slowdown in the earnings cycle next year and the lack of significant earnings momentum in 2022 indicate relative weakness in the Korean stock market." He particularly raised concerns about the valuation attractiveness of the Korean stock market, saying the numbers are distorted. Researcher Kim said, "Based on the MSCI index, the 12-month forward price-to-earnings ratio (PER) of the Korean stock market is 0.5 times, and the price-to-book ratio (PBR) is about 1.14 times, which is not high, but we need to point out the distortion in the numbers." He emphasized, "The double-counting issue caused by stock splits is a unique problem of the Korean stock market and has been steadily accumulating since 2013 when splits became active." He added, "The poor performance of existing stocks due to new listings has become a problem especially this year. The changes in the index weighting due to record-breaking initial public offerings (IPOs) have led to the poor performance of existing listed stocks, causing an optical illusion where the valuation indicators of the MSCI index composed of existing listed stocks appear lower."

Expectations for earnings should be lowered immediately (4th quarter). In the past 10 years, the 4th quarter earnings have never exceeded estimates. Temporary costs occur every year, bonuses are paid, and provisions accumulate. With the 3rd quarter earnings falling short of estimates this year, the 4th quarter and 2022 forecasts are being revised downward simultaneously. Researcher Kim emphasized, "The earnings cycle downturn in the stock market, which started at its peak in the 1st quarter of 2021, is expected to continue until the 3rd quarter of next year." He added, "The growth rate in the 4th quarter is expected to be lower than the 3rd quarter, with single-digit growth expected in the 1st quarter of next year, and negative growth rates anticipated in the 2nd and 3rd quarters of next year."

Accordingly, since overall earnings growth in the stock market is expected to be rare next year, the price differentiation between companies with earnings growth and those without is expected to be significant. This is because during market corrections, investors tend to focus not on betting on valuation increases but on companies that show actual performance. Hwang Ji-woo, a researcher at Shin Young Securities, said, "Within the KOSPI 200 and KOSDAQ 150, we should look at companies expected to have an increase in gross profit margin (GPM) next year, companies estimated to have sales growth of over 10% next year, and companies whose sales estimates for next year have been revised upward in the last three months." He mentioned Pearl Abyss, Krafton, Cheonbo, KH Vatec, Iljin Materials, EO Technics, Asiana Airlines, IS Dongseo, AfreecaTV, and Classys. He also advised that strategies selected based on the top and bottom EPS growth rates will play a leading role. He cited HMM, Husung, OCI, SK Bioscience, DB HiTek, Lotte Tour Development, LG Innotek, S-Oil, NCSoft, and Hyosung Advanced Materials.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.