Attractive 7% Dividend Yields Amid Bear Market

REITs Stocks Outperform KOSPI Since Early Year

Modetour REITs Up 45%, Koramco Energy Up 44%

Multiple IPOs Scheduled for First Half of Next Year

[Asia Economy Reporter Minji Lee] Investor interest in listed REITs is heating up. While the domestic stock market has been "stagnant" this year due to internal and external adverse factors, it is analyzed that large sums of money have flowed into REITs, which offer attractive high dividends approaching 7%.

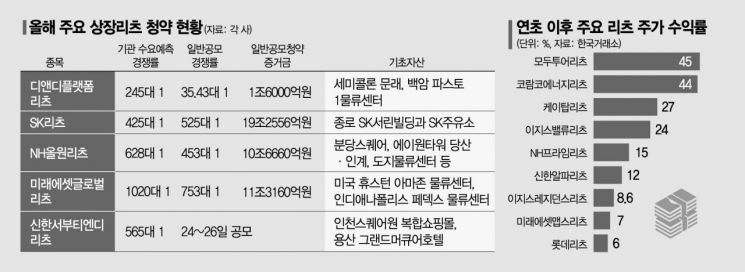

According to the financial investment industry on the 25th, the funds flowing into listed REITs through public subscription for general investors this year have reached 42.582 trillion KRW. The scale of deposits received by listed REITs includes D&D REITs (1.6 trillion KRW), SK REITs (19.2556 trillion KRW), NH All One REITs (10.666 trillion KRW), and Mirae Asset Global REITs (11.316 trillion KRW). Considering that six REITs listed last year (Mirae Asset MAPS REITs - 179.4 billion KRW, ESR Kendall Square REITs - 150 billion KRW, Aegis Residence REITs - 79.9 billion KRW, Aegis Value REITs - 795.8 billion KRW, etc.) recorded subscription shortfalls and the total deposits received from individuals did not even reach 1 trillion KRW, it is analyzed that investment sentiment toward listed REITs has greatly expanded.

Recently, competition to acquire an additional share of REITs has intensified among both individuals and institutions. Mirae Asset Global REITs, which completed its general public subscription yesterday, absorbed the largest amount of funds ever among domestic listed REITs with an institutional demand forecast ratio of 1020 to 1 and a general public subscription ratio of 753 to 1. The previous highest was NH All One REITs, listed earlier this month, with a competition ratio of 628 to 1, and SK REITs, listed in September, set a record of 552 to 1 in the general public subscription.

As the attractiveness of individual stocks has significantly declined due to major countries' monetary policy shifts and global supply chain instability, investors are interpreted to have increased their interest in REITs, which are representative of high-dividend stocks. Listed REITs pursue annual dividends of 5-8%, while the average dividend yield of the KOSPI this year is only in the 2% range. Expected dividend yields by stock include Coramco Energy REITs at 7.1%, JR Global REITs at 7%, NH All One REITs at 7%, and IREIT KOREA at 6.2%.

Funds aiming for capital gains from stock price increases have also flowed in. The 'REIT Infrastructure and Preferred Stock Mixed Index,' composed of listed REITs and preferred stocks, has posted a performance of over 16% since the beginning of the year, while the KOSPI has risen by only about 4%. Looking at the performance of major REITs, Modetour REITs rose 45% since the beginning of the year, Coramco Energy REITs 44%, Aegis Value REITs 24%, and Shinhan Alpha REITs 12%, all outperforming the 'national stock' Samsung Electronics, which recorded a -10% return.

The diversification of included assets, which has increased dividend stability, has also contributed to expanding investor sentiment. Early listed REITs included simple assets such as office buildings or retail shopping malls, but recently, complex REITs incorporating logistics centers, offices, and data centers have been introduced, enhancing dividend stability. An investment banking (IB) industry official explained, "As we saw the collapse of hotel and retail assets after COVID-19, including various assets can mitigate volatility." Shinhan Seobu TND, scheduled to be listed next month, plans to include hotels, logistics centers, retail, and data centers as major assets in the future.

REITs are expected to attract attention as an investment alternative even during future interest rate hikes. Although REITs, which hold large amounts of real estate assets, are inevitably sensitive to interest rate increases, recently REIT operators have been moving away from real estate collateral loans to raising funds based on corporate credit, so there is little difficulty in maintaining the current dividend level. Researcher Kyungja Lee of Samsung Securities explained, "Collateral loan interest rates directly reflect treasury bond rates and are very high," adding, "A decline in funding costs directly leads to a reduction in listed REITs' expenses, enabling them to maintain existing dividend yields sufficiently." Earlier, IREIT KOREA raised 115 billion KRW at a relatively low interest rate through corporate bond issuance in the first half of this year.

As interest in REITs grows, it is predicted that many REITs will go public (IPO) next year. 'Coramco The One,' which has the Hana Financial Investment headquarters building in Yeouido, Seoul as its main asset, and 'Mastern Premier REITs,' which owns the Crystal Park office building in Paris, France, and Amazon logistics centers, are also expected to be listed in the first half of next year.

[Asia Economy Reporter Minji Lee]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)