This Week's Science and ICT Committee Bill Subcommittee 2

Reviewing Amendment Including Legal Support Basis for OTT

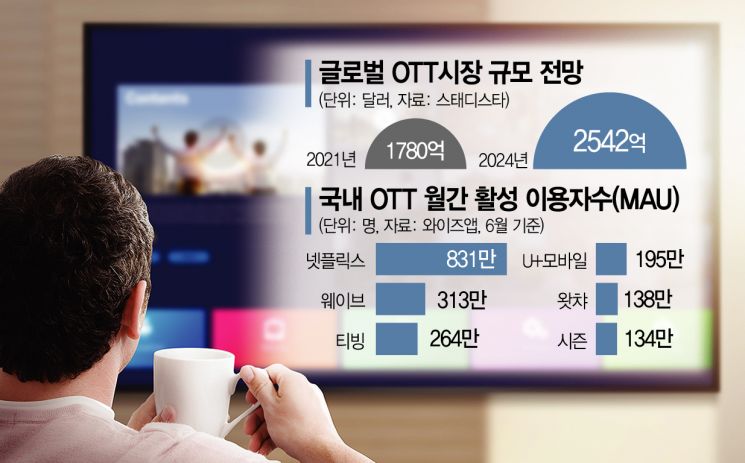

[Asia Economy Reporter Seulgina Cho] The domestic online video service (OTT) promotion policy, introduced to foster a ‘Korean version of Netflix’ through content investment tax credits, has finally taken its first step after a year and a half since its announcement. This is because discussions in the National Assembly regarding the legal basis for OTT support are expected to intensify again starting this week. As global OTT giants targeting the Korean market, such as Netflix and Disney Plus (+), ramp up their offensives, voices inside and outside the industry are growing louder, insisting that support for native OTTs can no longer be delayed.

◇ "Legal Basis First for OTT Promotion"

According to the industry on the 22nd, the National Assembly’s Science, Technology, Information and Broadcasting and Communications Committee plans to hold a Telecommunications and Broadcasting Bill Review Subcommittee (Bill Subcommittee 2) around the 25th to conduct a combined review of the amendment to the Telecommunications Business Act, which includes the legal support basis for OTT.

Park Sung-joong, co-chair of Bill Subcommittee 2 and a member of the People Power Party, said, "Currently, the ruling and opposition party secretariats are discussing the agenda to be submitted to the subcommittee," adding, "We will also carefully examine the bills that will serve as the basis for OTT promotion policies." Another committee official explained, "We will conduct a combined review of the existing government proposal and the recently submitted lawmakers’ bills," and added, "There is a consensus that support policies to strengthen the competitiveness of domestic OTT operators are urgently needed."

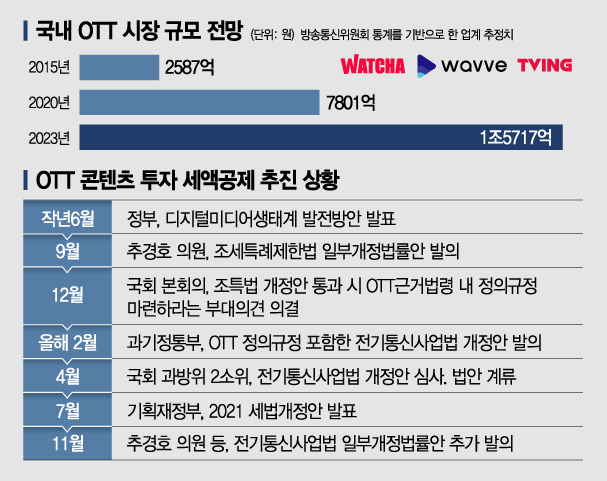

The bills under discussion are very important in that they aim to establish the legal support foundation for various OTT promotion policies to prevent the rapidly growing market from being taken over by overseas OTTs. The government announced a digital media ecosystem development plan last June, expanding content production tax credits to include OTT in addition to existing TV programs and films, and decided to introduce a voluntary rating system. However, due to the lack of a definition of OTT in the Telecommunications Business Act, progress has been stalled.

In particular, the subcommittee will discuss not only the government proposal, which has been pending for nine months, but also a partial amendment bill recently introduced on the 18th by People Power Party lawmaker Choo Kyung-ho. The amendment to the Telecommunications Business Act proposed by the Ministry of Science and ICT in February defined OTT operators as a ‘special type of value-added telecommunications business operator,’ but it was criticized for being insufficiently comprehensive and has remained pending. Choo’s bill newly establishes a definition of OTT as an online video service operator providing video content through information and communication networks among value-added telecommunications service providers.

An industry insider said, "After the amendment to the Telecommunications Business Act, it is possible to amend the Restriction of Special Taxation Act, but because the basic legal support foundation for OTT was not established, follow-up policies have not been promoted for a year and a half," emphasizing, "If this continues, the opportunity for OTT growth will be missed, allowing overseas OTTs like Netflix to dominate domestic platforms and turning Korea into a subcontracting base for K-content. Domestic OTT promotion policies are urgently needed."

The National Assembly passed a supplementary opinion at the plenary session in December last year, instructing that the legal basis for OTT should be established first before expanding production cost tax credits to OTT in the ‘Restriction of Special Taxation Act Amendment.’ The OTT tax credit content was also included in the ‘2021 Tax Reform Bill.’

◇ Shrinking Space for Native OTTs

The industry expects that the OTT content investment tax credit will revitalize the content industry and enable the production of higher-quality content. The credit rates included in the tax reform bill are 3% for large corporations, 7% for medium-sized enterprises, and 10% for small businesses. A representative from Wavve explained, "If a 3% tax credit is applied to an investment of 100 billion KRW, that amounts to 3 billion KRW," adding, "This scale can produce 5 to 6 idol variety shows or 1 to 2 mini-series." There is also a partial amendment bill to the Restriction of Special Taxation Act currently submitted to the National Assembly that proposes raising the credit rate to 6-20%.

Overseas, it has long been recognized that video content production businesses generate high added value, and high tax credit rates are being applied accordingly. For example, Australia applies a 20% tax credit on TV program production costs.

Concerns are also rising that native OTTs are losing ground amid the aggressive advances of OTT giants like Netflix and Disney+, which possess enormous capital. The increasing dependence on global OTTs for content production costs exceeding the domestic market size raises concerns about the global platform dependency of the Korean content industry. The Korea OTT Council, composed of domestic OTT operators such as Wavve, TVING, and Watcha, recently issued a statement saying, "While service competition is up to the operators, basic support policies are urgently needed for Korean OTTs to grow properly and contribute to the domestic content industry," urging acceleration of OTT promotion policies.

There is also heated controversy over unfair treatment compared to overseas OTTs like Netflix, which generate huge revenues in Korea but pay no network usage fees. Netflix, which earned massive profits from the Korean original content ‘Squid Game,’ lost the first trial of a lawsuit claiming it has no obligation to pay network usage fees but has appealed the decision.

In contrast, companies like Naver and Kakao pay network usage fees amounting to about 100 billion KRW annually. Domestic OTT operators, which have lower revenues compared to overseas operators and are still operating at a loss, are in the same situation. As of last year, operating losses were 16.9 billion KRW for Wavve, 6.1 billion KRW for TVING, and 12.6 billion KRW for Watcha.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.