Electric Arc Furnace, Greenhouse Gas Emissions at 25% of Blast Furnace Level

POSCO Increases Scrap Purchase Volume to 18-19%

Nippon Steel Aims to Operate 300t Large Electric Arc Furnace by 2030

China Expands Electric Arc Furnace Production Share from 13% to 20%

[Asia Economy Reporters Choi Dae-yeol and Hwang Yoon-joo] The sharp rise in scrap metal prices since the second half of this year is largely due to the surge in demand driven by carbon neutrality policies.

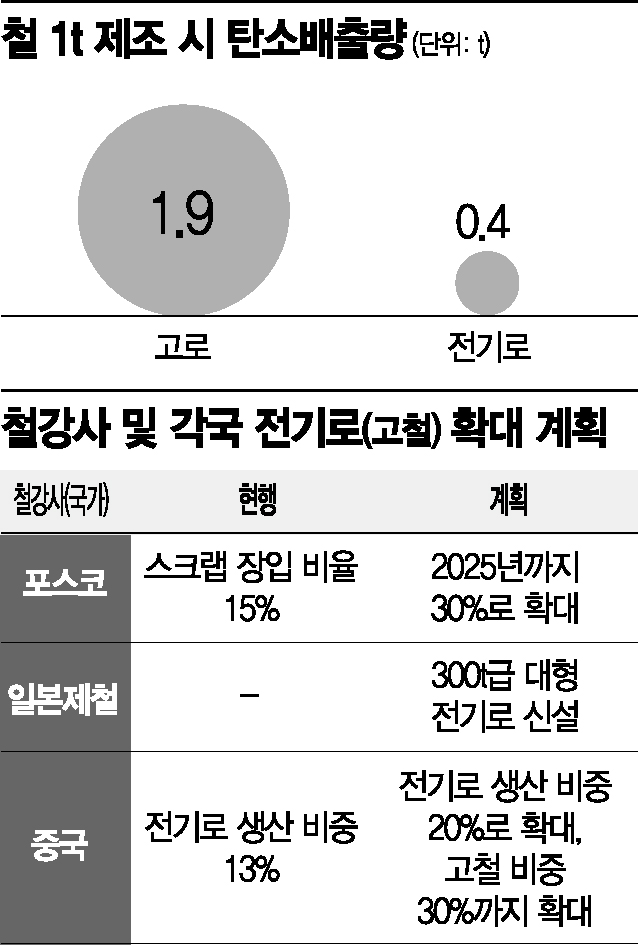

Since the steel industry is considered a major source of carbon emissions, the industry is in a situation where it must reduce emissions, and the realistic option available is to expand the use of electric arc furnaces (EAF). Although fundamental solutions such as hydrogen reduction steelmaking are being prepared, increasing the share of EAFs is the immediate way to reduce carbon emissions. A blast furnace emits about 2 tons of carbon when producing 1 ton of molten iron. In contrast, carbon emissions from EAFs are about 25% of those from blast furnaces, and about 60% of these emissions are indirect.

POSCO's scrap purchases were around 90,000 to 100,000 tons until April but increased to 180,000 to 200,000 tons from May. From June, the scrap usage ratio reportedly rose from 15% to 18-19%. At the company's Q2 earnings conference, it stated, "We will expand the scrap charging ratio from the current 15% to 30% by 2025." Hyundai Steel, although slowed by strikes and maintenance at its Dangjin Steelworks, is also increasing scrap purchases again. In the Q3 conference call, it said, "Demand for steel scrap has increased in relation to carbon neutrality," and "Prices of raw materials for EAF production are expected to rise."

Overseas steelmakers are also increasing the share of EAFs. In July, China's National Development and Reform Commission decided to increase scrap usage from 260 million tons to 320 million tons. China began full-scale scrap imports this year. In February, the Chinese government announced plans to increase the EAF production ratio from 13% to 20% and raise scrap usage to 30%. Nippon Steel also plans to build a large 300-ton class EAF by 2030, and JFE Steel is gradually increasing its scrap purchases. As a result, scrap prices this year are showing patterns similar to those in 2008, when the financial crisis caused the real economy to falter and scrap prices soared to 670,000 KRW per ton before falling to 160,000 KRW within six months.

Rebar, a product mainly made in EAFs, is widely used in construction and structural works. Although raw material prices have surged, it is difficult to raise steel product prices immediately. Rebar products are traded through steelmakers and individual construction companies or major distributors and dealerships. Despite the sharp rise in raw material costs, raising steel prices immediately is challenging. Prices are decided through negotiations between the Construction Material Purchasing Council, composed of purchasing managers from major construction companies, and steelmakers, held quarterly. Since rebar prices have already risen significantly this year, there is a sentiment that further increases are difficult.

According to the industry, as of Q2 this year, the average purchase price of rebar for large construction companies is around 800,000 KRW per ton, up 15% to nearly 25% compared to last year. A steel industry official said, "We are requesting separate negotiations for raw material cost increases, but it is not easy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)