Apple TV+ and Disney+ Officially Launch in Korea on November 4 and 12

Domestic OTTs like TVING and Wavve Face Tough Competition

[Asia Economy Reporter Eunmo Koo] Global over-the-top (OTT) streaming services Apple TV Plus (Apple TV+) and Disney Plus (Disney+) are launching one after another to target the Korean market. With Netflix dominating the market, the entry of Apple and Disney is deepening concerns within the domestic OTT industry. Given the clear size difference with overseas OTTs, voices are emerging that instead of engaging in an all-out battle with the same strategy, survival strategies should be sought through content specialization strategies.

Apple TV+ and Disney+ Arrive in Korea One After Another

According to industry sources on the 3rd, Apple will officially launch its OTT service Apple TV+ in Korea on the 4th.

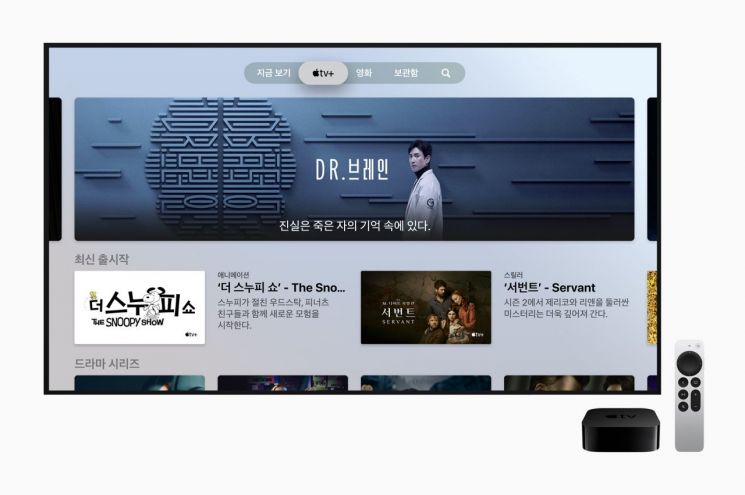

Apple TV+ is the industry's first content subscription service offering only original content and can be accessed through the streaming device Apple TV 4K, which is also launched on the same day, as well as iPhone, iPad, MacBook, and some Samsung and LG smart TVs.

Apple TV+ offers a relatively affordable subscription fee of 6,500 KRW per month and allows sharing one account with up to six users. Since September 17, those who have newly purchased Apple devices such as iPhones are provided with a three-month free trial of Apple TV+.

To coincide with the launch in Korea, the first Korean original series, "Dr. Brain," directed by director Kim Ji-woon and starring actor Lee Sun-kyun, will be introduced. Additionally, overseas Apple TV+ original works such as the comedy series "Ted Lasso" starring Jason Sudeikis and "The Morning Show" starring Jennifer Aniston and Reese Witherspoon, which have not been officially introduced in Korea, will also be released.

Following Apple, Disney+ will launch on the 12th. Disney+ offers a variety of content from Disney-affiliated companies such as Disney, Pixar, Marvel, Star Wars, National Geographic, and Star. The subscription fee is set at 9,900 KRW per month or 99,000 KRW annually. It supports simultaneous access on up to four devices and downloads on up to ten mobile devices.

Disney+ has more than 16,000 episodes of content and plans to actively invest in K-content, which is gaining global popularity, and continuously provide Korean original content. Starting with the variety show "Running Man: The Player Above the Runner," and the superhero series "Moving," based on Kang Full's webtoon, are in preparation.

"Strengthen Competitiveness Through Content Specialization Rather Than Head-to-Head Battles"

Domestic OTTs are also becoming active. With the launch of Apple TV+ and Disney+ imminent, and Amazon Prime, which recently started a partnership service through SK Telecom's subsidiary 11st, and well-made dramas like "Game of Thrones" and "Chernobyl" from HBO Max also expected to enter the market soon, the competition is intensifying.

Earlier, CJ ENM announced plans to invest 5 trillion KRW over the next five years in content production, including its OTT service TVING. Wavve, operated by SK Telecom and the three terrestrial broadcasters, plans to invest 1 trillion KRW by 2025, and KT plans to invest 400 billion KRW in its OTT service Seezn by 2023. Kakao TV is also investing 300 billion KRW in original content by 2023.

While domestic OTTs are actively investing to face direct competition with overseas OTTs, experts point out that to establish themselves as competitive players beyond mere survival, they should strengthen competitiveness through content specialization strategies rather than head-to-head battles. It is necessary to view the OTT market not as a single unified market but segmented.

Kim Yong-hee, an Open Route specialist and professor at Soongsil University, said, "Rather than producing and offering all kinds of content like a department store, it is necessary to split various genres and adopt a strategy to attract subscribers like YouTube channels. Recently, TVING's focus on variety shows such as 'Transit Love' and 'Street Woman Fighter,' which they excel at producing, is a representative example." Given the relatively limited capital compared to global OTT giants, it is better to focus on content that requires relatively low costs but has solid demand rather than competing with blockbuster content.

Along with genre differentiation of content, voices are calling for diversification of content supply routes to increase exclusive content and expand choices for users. Many domestic operators sold distribution rights of their content overseas before starting OTT businesses, resulting in a lack of exclusive content. In the short term, securing exclusive content comparable to foreign competitors is not easy. Cheon Hye-seon, head of the Media Management Center at the Media Future Research Institute, noted, "Netflix also had difficulty securing exclusive rights to content in its early days. Considering the domestic content production workforce and facilities, relying solely on domestic content supply will pose challenges in the competition for content acquisition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.