Holding Meetings Every 1 to 2 Weeks

[Asia Economy Reporter Park Sun-mi] A task force (TF) for household debt management has been launched to ensure the smooth implementation of the household debt management strengthening measures announced on the 26th of last month. The TF will monitor the steady supply of jeonse and balance loans and continue discussions with financial authorities and experts on additional management needs related to household debt.

On the 1st, the Financial Services Commission and the Financial Supervisory Service held the first household debt management TF meeting. Attendees included not only financial authorities but also executives from various financial sector associations, guarantee institutions, and the Credit Information Center. This meeting was held as a follow-up measure to the household debt management strengthening plan announced on October 26.

The household debt management TF plans to meticulously check the implementation status of detailed tasks under close cooperation among related organizations such as financial authorities, associations, and the Credit Information Center to ensure the stabilization of the household debt management strengthening plan. In particular, since the borrower-level total debt service ratio (DSR) application target will be expanded from the ‘item-based application’ method for mortgage and credit loans to the ‘total loan amount’ method starting January next year, the TF will address various interpretative cases to prevent difficulties for financial companies and borrowers before the full implementation of the changed regulations.

Additionally, while monitoring household debt trends, efforts will be made to manage next year’s debt growth rate at a stable level of ‘4-5%’, and through strengthening the loan management systems of financial companies, the TF will closely manage to avoid inconveniences to actual borrowers such as loan suspensions.

The TF will also check the smooth supply of jeonse loans and balance loans.

On the 14th of last month, the financial authorities announced the ‘Jeonse and Balance Loan Protection Guidelines’ to minimize funding difficulties for actual borrowers during the household debt management strengthening process. Accordingly, the household debt management TF will monitor, centered on associations, whether the jeonse loan-related guidelines are disseminated to each branch and whether jeonse loans are being supplied smoothly, and continuously check and resolve related difficulties. However, to prevent excessive handling of unnecessary jeonse loans, the financial sector will also continue to devise thorough loan screening measures on its own.

Furthermore, the monitoring scope of balance loan handling for 110 housing projects in the fourth quarter will be expanded to the entire financial sector for precise weekly inspections,

and a hotline will be established for balance loan officers at financial companies to continuously check and minimize temporary mismatches between housing projects and financial companies. To mitigate risks related to household debt, experts from the Korea Institute of Finance, research institutes of commercial banks, and others will investigate related overseas cases and domestic conditions, and prepare measures to improve Korean household loan practices to the level of global advanced countries.

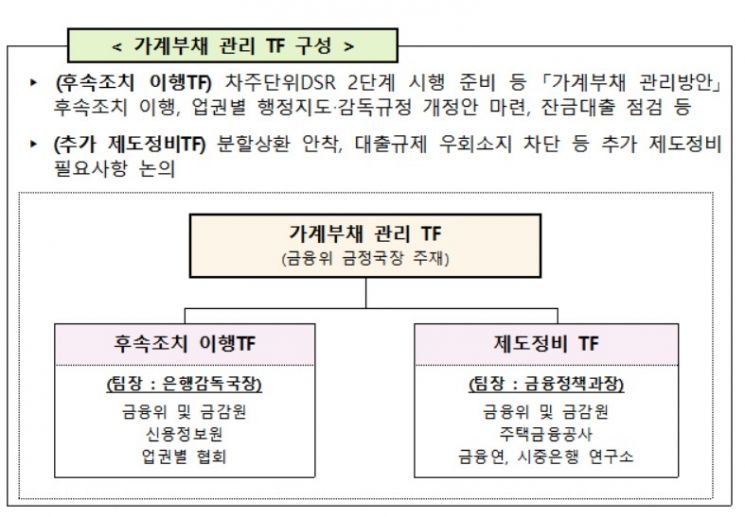

A financial authority official stated, "The household debt management TF will be held every 1 to 2 weeks," adding, "Sub-TFs such as ‘Additional System Improvement TF’ and ‘Follow-up Implementation TF’ will also be formed to discuss and check detailed matters, and meetings will be held as needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)