Sold Out After Unranked Subscription for 'Pangyo SK View Terrace' Directly Implemented

Kyung Sil Ryeon "Who Designed the Scheme to Funnel Thousands of Billions to Specific Individuals?"

Shim Jong-jin, co-CEO of Hwacheon Daeyu, is receiving protests from original residents of Daejang-dong after attending a consultation on compensation for resettlement housing in the Daejang district held at Seongnam City Hall, Gyeonggi Province on the 15th.

Shim Jong-jin, co-CEO of Hwacheon Daeyu, is receiving protests from original residents of Daejang-dong after attending a consultation on compensation for resettlement housing in the Daejang district held at Seongnam City Hall, Gyeonggi Province on the 15th. Hwacheon Daeyu Asset Management, which has been embroiled in controversy over preferential treatment in the development of Daejang-dong in Seongnam, Gyeonggi Province, recently succeeded in selling out all units in the Pangyo Daejang District, securing an additional profit of 150 billion KRW. Including previous sales revenue, Hwacheon Daeyu's total sales revenue reaches 450 billion KRW. Suspicions regarding the project structure, which was designed to allow private developers to reap enormous profits, are expected to intensify.

According to the real estate industry on the 20th, the urban lifestyle housing project 'Pangyo SK View Terrace' implemented by Hwacheon Daeyu completed contracts for all 117 units available for non-priority subscription. The price per 3.3㎡ was set at 34.4 million KRW, similar to the market price of nearby apartments. The total 292 units included 75㎡ units priced between 1 to 1.1 billion KRW, and 84㎡ units priced between 1.1 to 1.3 billion KRW. Considering land acquisition and construction costs at industry-standard levels, the estimated cost of sales for this complex is around 20 million KRW per 3.3㎡. The industry estimates that Hwacheon Daeyu's sales profit from this project will reach 150 billion KRW.

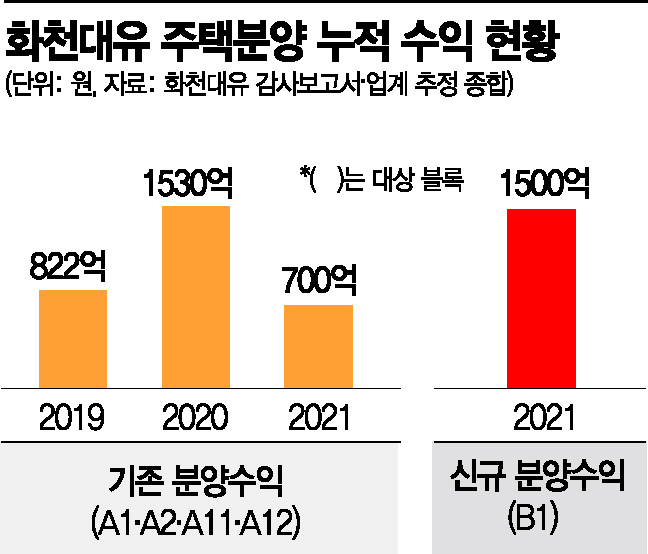

When combining the sales from four other residential land plots where Hwacheon Daeyu directly implemented housing projects, the company's total profit approaches 500 billion KRW. According to Hwacheon Daeyu's audit report, sales profits were 153 billion KRW last year and 82.2 billion KRW in 2019, totaling 235.2 billion KRW. Additional sales profits expected this year from these complexes are estimated at around 70 billion KRW. Adding the SK View Terrace, Hwacheon Daeyu's total sales profit from the five Daejang-dong plots amounts to approximately 450 billion KRW.

A real estate industry insider said, "Hwacheon Daeyu secured five plots in Daejang-dong through private contracts and directly implemented the projects, earning enormous sales profits. Considering they hold only a 1% stake, the profit margin is beyond common sense and inevitably raises suspicions of preferential treatment."

The Citizens' Coalition for Economic Justice (CCEJ), which analyzed the profits from the Daejang-dong development project, stated the day before, "Most of the profits from the Daejang-dong project were taken by private developers, and the public sector recovered only about 10%." They added, "A special prosecutor must investigate who led the project design that funneled thousands of billions of KRW to specific individuals."

Claims have also been raised that Hwacheon Daeyu's 450 billion KRW profit was achieved through a 'closed-door agreement.' Kim Hyung-dong, a member of the National Assembly's Public Administration and Security Committee from the People Power Party, asserted on the 18th, "Hwacheon Daeyu demanded direct implementation of five blocks from the Hana Bank consortium participating in the Daejang-dong development. The consortium specified 'direct use by investors' for all five blocks in the project plan, and the board of 'Seongnam's Deul,' the Daejang-dong project operator, approved this as is." He added, "Despite legal controversies and doubts about Hwacheon Daeyu's qualification to implement the project, this critical decision was made unilaterally at Hwacheon Daeyu's request without any agreement or confirmation."

Meanwhile, Pangyo SK View Terrace attracted attention due to its favorable location and the fact that, as urban lifestyle housing, no subscription savings account was required, and resale was possible after registration. During last month's sale, 92,491 applications were received for 292 units, resulting in an average competition rate of 316.8 to 1. However, amid the spreading Daejang-dong preferential treatment controversy, 117 units remained unsold, accounting for 40% of the total supply (292 units).

The inability to secure interim payment loans is cited as the reason for the unsold units. Since the sale price exceeded 900 million KRW, the Housing and Urban Guarantee Corporation (HUG) did not provide guarantees for interim payment loans. Although Hwacheon Daeyu promised to arrange loans in the recruitment announcement, commercial banks reportedly hesitated to provide interim payment loans due to the Daejang-dong scandal. Subsequently, in the non-priority additional applicant recruitment for the remaining 117 units, which was effectively conducted through cash payments, 40,164 applicants competed, achieving an average competition rate of 343.4 to 1 and successfully selling out all units.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)