Rising Oil Prices and Interest Rates Negatively Impact the Airline Industry

[Asia Economy Reporter Minji Lee] Despite Delta Air Lines recording strong third-quarter earnings, there are opinions that a conservative approach to investment is necessary. This is based on the judgment that cost increases due to rising oil prices may have a greater impact on fourth-quarter earnings than the recovery in demand.

According to the financial investment industry on the 16th, as of the 15th, Delta Air Lines' stock price fell about 6% from $43.54 to $40.99 following its earnings announcement on the 13th. This was due to growing concerns over fourth-quarter earnings amid a sharp rise in international oil prices, despite third-quarter results exceeding market expectations across the board.

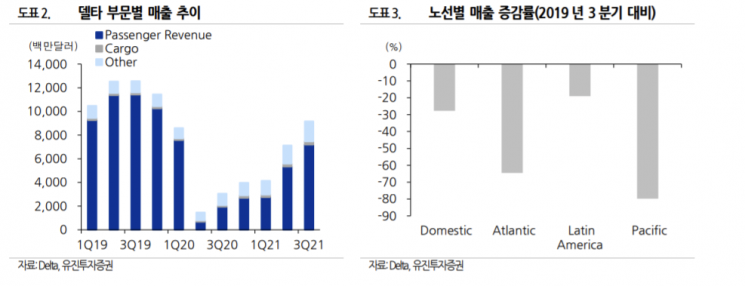

In the third quarter, Delta Air Lines posted revenue of $9.15 billion and adjusted EPS of $0.30, surpassing market expectations by 9% and 76%, respectively. Operating profit excluding government subsidies reached approximately $380 million, marking the first return to profitability since the outbreak of COVID-19. By segment, passenger revenue recovered to 63.1% of the level seen in the third quarter of 2019. Supply recovered to 71.4%, traffic to 64.4%, and load factor also showed a recovery at 71.4%. Domestic demand returned to over 70%, and a gradual recovery in South America routes was analyzed to have had a positive impact. Routes to the UK and Europe are recovering due to border reopenings, but recovery on Pacific routes remained limited. However, corporate customers, who accounted for about half of passenger revenue, remained stagnant at around 40% compared to the third quarter of 2019.

Minjin Bang, a researcher at Eugene Investment & Securities, explained, “The spread of variant viruses hindered the recovery of reservation rates, but a rebound has resumed since September,” adding, “As operations resumed, unit costs were 15% higher than 2019 levels, which is analyzed to reflect costs related to hiring and training staff for service resumption.”

However, the company’s stock price did not positively reflect the strong earnings. The company’s mention of the possibility of returning to losses in the fourth quarter due to rising fuel costs acted as a negative factor. It predicted that the average price of jet fuel could rise by up to 20%, from $1.97 per gallon in the third quarter to between $2.25 and $2.40 in the fourth quarter. The sharp rise in oil prices makes it difficult to pass on costs to air passenger fares, and the market already expects Delta Air Lines to record losses again in the fourth quarter. Researcher Bang said, “The forecast for a return to losses is because passenger demand has not sufficiently recovered to the extent that these costs can be passed on,” adding, “Additional recovery in load factor and revenue per available seat mile is needed.”

Since rising oil prices and interest rates can be burdensome to the airline industry, experts advise a conservative approach. Researcher Choi added, “The U.S. airline industry has already returned to profitability in the second quarter, reflecting reopening momentum, so the focus of investment now is more sensitive to short-term earnings, which means it should be differentiated from Korea.”

Instead, it is predicted that turning attention to domestic airlines could be more positive. The cargo business, which supports the profits of domestic airlines, has a structure that makes it easier to pass on oil price increases to freight charges, so concerns about rising oil prices are less. Researcher Choi said, “Since passenger profitability has not yet turned positive due to the increase in confirmed cases last summer, reopening expectations are more important for domestic airlines,” adding, “We will defend investments centered on Korean Air, which has no short-term earnings worries due to cargo, and use additional corrections in LCCs as buying opportunities in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)