Illegal Stock and Coin Auto-Trading Program Ads Rampant on YouTube

Most Considered Similar to Unauthorized Financial Activities

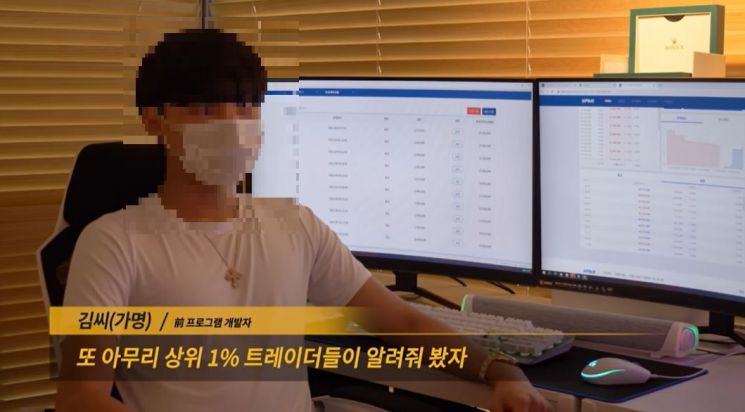

"I made about 20 million won in profit just this week."

A man appears in a YouTube advertisement recommended by an algorithm, showing only cryptocurrency charts without any other actions. The ad claims that by running an automated cryptocurrency futures trading program, one can expect a monthly profit of 80 million won. He explained, "I have input 30 trading strategies into artificial intelligence (AI)" and added, "Because human emotions are not involved, it allows for cold-blooded investing." This video has gained immense popularity, surpassing 2.1 million views. However, experts point out that if a company provides settings for an automated trading program, it is likely to be considered investment discretionary management or investment advisory business, and if it is not under the financial authorities' supervision system, there is a high risk of fraud.

On the 12th, after monitoring YouTube advertisements for stock and cryptocurrency automated trading programs, the reporter identified over 1,000 advertisement videos posted by automated trading program companies. The content mostly claims that if you invest money, AI will automatically make money for you.

Software company, not investment advisory or discretionary management?..."If the company provides investment decisions, it could be considered discretionary management"

One automated trading program sales company actively promoted by uploading 298 advertisement videos on YouTube. Most of the promotions claimed that the stocks found by AI yielded high returns. A participant in one video said, "Selecting stocks is not easy, and every time the return rate turns negative, daily life becomes difficult," adding, "AI, which excludes human emotions, solves these problems."

In the case of stocks, the automated trading program itself is not illegal, but it must meet certain requirements to be sold, according to legal experts. Lawyer Joo Geon-ju (Hannuri Law Firm) explained, "It is difficult to judge, but if the automated trading program company selects stocks or determines the methods of buying and selling, thus providing investment decisions, it could be considered discretionary management."

In fact, financial authorities consider that if investors directly set conditions such as trading stocks, quantities, prices, and timing, it does not fall under investment advisory or discretionary management. However, automated trading program companies appearing in YouTube ads recommend stocks to buy through algorithms or set the timing for buying and selling. Nevertheless, most of these companies are confirmed to be software companies, not investment advisory or discretionary management businesses, according to financial authorities.

Realizing cryptocurrency profits with automated trading programs?..."Most likely to be considered fraudulent solicitation"

A YouTube video advertised an automated trading program for cryptocurrency futures. However, many users have reported losses ranging from as little as 1 million won to several hundred million won. (Source=YouTube)

A YouTube video advertised an automated trading program for cryptocurrency futures. However, many users have reported losses ranging from as little as 1 million won to several hundred million won. (Source=YouTube)

Advertisements claiming to realize profits with automated cryptocurrency trading programs were also found. The main message of the videos is that due to the high volatility of the cryptocurrency market and investors' anxiety influencing investment decisions, automated trading programs are necessary. However, actual users reported that when using these cryptocurrency futures automated trading programs, their investment amounts were often completely lost and liquidated in less than 10 minutes. Ms. Kim (38 years old, female) said, "I invested a total of 4 million won, but it was liquidated instantly," explaining, "Although they claim to mix 30 trading strategies, the Martingale strategy, commonly used in gambling, is mainly applied." The damage amounts ranged significantly, starting from one million won to several hundred million won.

There were also signs of fraudulent activity. When searching the server address of the automated trading program company's website, it was located in the middle of Cheney Reservoir in Kansas, USA. This raises suspicion that the server is overseas to evade regulatory oversight. Additionally, it is known that the company manages public opinion by frequently changing videos or deleting critical comments. Mr. Jung (44 years old, male) explained, "All critical comments are hidden, and only inquiries about the program or comments certifying profits remain," adding, "This behavior was repeated in a video that previously had over 7 million views."

Experts emphasized that it is difficult to trust automated cryptocurrency trading programs themselves. Since cryptocurrencies are not yet included in the regulatory framework, investment advisory and related programs are not legal. Professor Hong Ki-hoon of Hongik University's Department of Business Administration explained, "Currently, there is not a single place in Korea that is officially authorized to provide cryptocurrency investment advice or sell related automated trading programs," adding, "Most are highly likely to be considered fraudulent solicitation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)