[Asia Economy Reporter Ji-hwan Park] As the importance of 'customer experience' grows due to changes in consumer behavior caused by COVID-19, it has been found that the top 50 global companies with excellent customer experience evaluations have sales 54% higher than the bottom 50 companies.

Samjong KPMG stated in its report published on the 7th, titled "Everything Customers Want, Customer Experience: Focusing on the Financial Industry," that creating customer experience has emerged as a key task for sustainable business in the rapidly changing financial environment.

Customer Experience (CX) refers to the experience customers have interacting with a company throughout the entire process of purchasing services through customer touchpoints provided by the company, including both face-to-face and non-face-to-face interactions.

Among 1,400 global financial and non-financial companies surveyed by KPMG Global, the top 50 companies with excellent customer experience evaluations had approximately 54% higher sales and about 202% higher earnings before interest, taxes, depreciation, and amortization (EBITDA) than the bottom 50 companies with poor evaluations.

The report analyzed, "The result of all interactions customers have with a company affects their emotions and preferences toward the company's brand and services," adding, "The fresher, more interesting, and smoother the process or experience of using the services provided by the company, the more positive interactions customers have with the company, which ultimately leads to brand loyalty."

In particular, the influence of traditional factors such as corporate brand and market share, which were important considerations when purchasing financial services, has relatively decreased. On the other hand, excellent customer experience has become one of the key factors that most influence financial consumers' purchasing decisions.

Samjong KPMG cited the reasons for the need to strengthen customer experience as the heightened expectations and changed consumption behaviors of consumers, threats from the rise of big tech and fintech companies, and intensified competition in customer touchpoints triggered by new innovative businesses.

Movements to strengthen customer experience are also increasing within the domestic financial industry. In the payment and settlement sector, evolution is occurring toward diversifying payment authentication methods, expanding service areas, and simplifying payment procedures.

In the case of currency exchange and overseas remittance, which were pointed out as inconvenient due to restrictions on time and place for service use, physical constraints of transactions are being overcome through services such as currency exchange via airlines and currency exchange and overseas remittance services using unmanned exchange machines.

In addition, efforts to enhance customer convenience continue, such as simplifying insurance procedures and launching new types of insurance products that meet user needs. In loans and credit information, asymmetry of information between suppliers and demanders is minimized, and users' service accessibility is expanded.

In the investment and asset management sector, services that allow investment with small amounts have recently been launched, broadening consumers' investment opportunities by lowering entry barriers.

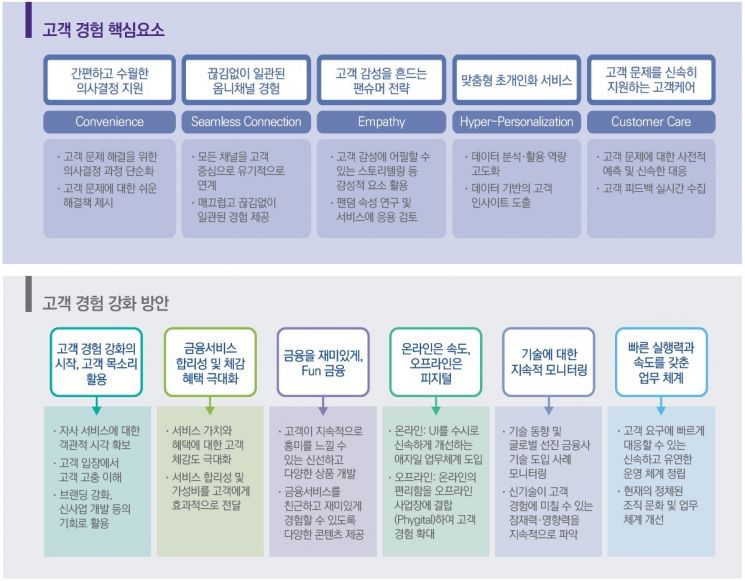

Lee Hee-jung, Executive Director of Samjong KPMG Digital Headquarters, said, "To strengthen customer experience, which has emerged as an essential task for corporate survival, companies must support customers' decision-making to be simple and easy, focus on consistent omnichannel experiences across all channels, financial fansumer strategies, hyper-personalized services, and customer care."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.