‘Startup Trend Report 2021’ Released

65.2% of Founders "Experience Hiring Difficulties"

Key Hiring Factors: "Monetary Compensation," "Recognition," etc.

"Investment and Fundraising Challenges" Top Concern for Founders

(From left) Lee Gidae, Director of Startup Alliance; Yang Sanghwan, Leader of Naver D2SF; Kwon Dokyun, CEO of Primer; and Lee Bokgi, CEO of Wanted Lab, are having a discussion on startup ecosystem trends at Startup Alliance in Samseong-dong, Seoul on the 7th.

(From left) Lee Gidae, Director of Startup Alliance; Yang Sanghwan, Leader of Naver D2SF; Kwon Dokyun, CEO of Primer; and Lee Bokgi, CEO of Wanted Lab, are having a discussion on startup ecosystem trends at Startup Alliance in Samseong-dong, Seoul on the 7th.

"As large companies competitively raise salaries, it is becoming more difficult for startups. Many talented developers are also leaving for overseas jobs."

"The number of startups itself has increased, and it seems that talent's salary expectations have risen significantly. Investors will also need to increase their investment amounts accordingly."

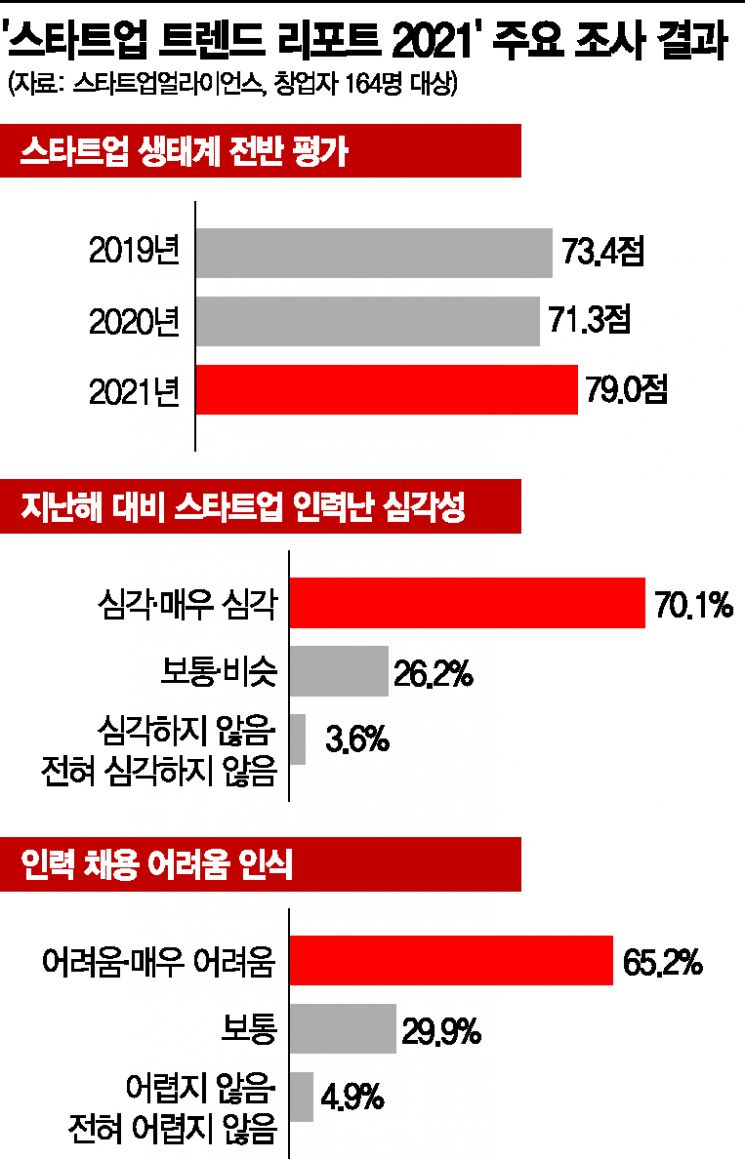

Seven out of ten startup founders felt that the manpower shortage worsened compared to last year. Although the startup ecosystem, which had slowed down due to COVID-19 last year, has shifted to a somewhat positive atmosphere, manpower shortages and investment attraction remain challenges to be resolved.

Startup Alliance and Open Survey announced the 'Startup Trend Report 2021' with these findings on the 7th. Since 2014, the two organizations have conducted annual surveys to analyze trends in the startup industry. This year, from August 5 to 19, 164 founders, 250 employees of large companies, 250 startup employees, and 200 job seekers participated in the survey.

◆ Seven out of ten founders say "manpower shortage worsened compared to last year" = This survey asked about the hottest issue in the startup ecosystem, the 'manpower shortage.' As a result, 65.2% of founders reported difficulties in hiring, and 70.1% said the manpower shortage had become more severe than last year.

Founders perceived monetary compensation such as salary, stock options, and shining bonuses (40.9%) as the most important factor affecting recruitment. Next were founder/company recognition (26.2%), the vision pursued by the company/founder's philosophy (23.2%), and a horizontal organizational culture (5.5%).

Employees at large companies overwhelmingly responded (58.8%) that they would consider monetary compensation when moving to a startup. This was followed by the company's vision and founder's philosophy (13.6%) and welfare (11.2%). Among respondents who had changed jobs within the last five years, 65.6% of startup employees considered monetary compensation, and 52.1% considered a horizontal organizational culture. When preparing to change jobs, the greatest difficulty was understanding the company's organizational culture and internal information (47.9%).

Lee Bok-gi, CEO of WantedLab, who attended as a panelist, advised, "Startups need to clearly define their recruitment characteristics, not only offering high salaries but also guaranteeing work-life balance and a horizontal organizational culture," adding, "Because each person has different values and ways of being motivated."

◆ Improvement in social perception of startups... Investment attraction remains a challenge = Founders rated the overall atmosphere of the startup ecosystem this year at 79 out of 100 points. This is a significant increase from 71.3 points last year, which was sluggish due to COVID-19, with the largest increase seen in companies less than one year old.

79.9% of founders expected the startup ecosystem atmosphere to improve next year compared to this year. The positive outlook increased by 22.1 percentage points from the previous year, indicating heightened expectations for the future ecosystem. This is analyzed to be influenced by social changes in perceptions of startups and an increase in successful startup cases.

Despite the annual increase in venture investment amounts, attracting investment remains a challenge for the startup ecosystem. Founders identified 'securing base funds/invigorating investment (38.4%)' as the most urgent issue to improve for the development of the startup ecosystem. Difficulties in funding and attracting investment have been the top concern for founders for three consecutive years since 2019. This was followed by deregulation (34.8%) and securing excellent talent (33.5%). Founders responded that the most difficult aspect when attracting investment was company valuation and recognition (41.5%).

CEO Lee said, "A 'rich get richer, poor get poorer' phenomenon has occurred throughout the startup ecosystem," adding, "Due to reliance on online information during COVID-19, manpower and investment have concentrated on famous or already established companies." Kwon Do-gyun, CEO of Primer, emphasized, "Although the investment pie has grown, it has concentrated only on founders with good backgrounds or popular industries," adding, "Since successful companies sometimes emerge outside mainstream businesses, diversity in investment should be considered."

The most preferred accelerator and VC (venture capital) by founders were Primer (18.9%) and Altos Ventures (20.7%), respectively. Domestic companies actively supporting startup activities included Naver (31.7%) and Kakao (15.9%), while public institutions included the Korea Institute of Startup & Entrepreneurship Development (32.3%) and Seoul Business Agency (14.0%).

When asked about the fastest-growing startup in Korea, Danggeun Market received the highest response rate at 23.8%. This was followed by Viva Republica, operator of Toss (12.8%), Woowa Brothers (4.9%), and Market Kurly (4.9%).

Choi Hang-jip, head of Startup Alliance, said, "Although challenges such as manpower shortages and investment concentration remain, the startup ecosystem, which was stagnant due to COVID-19, is gradually reviving this year." He added, "It is encouraging that a virtuous cycle structure among the government, large companies, investors, and startups is taking root, and that social perception is positively changing as successful startup cases like Toss and Danggeun Market increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)