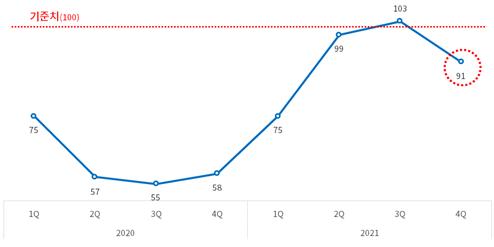

Survey of 2,300 Nationwide Manufacturers

Q4 Economic Outlook Index at 91, Down 12P

[Asia Economy Reporter Choi Dae-yeol] The economic recovery expectations, which had been steadily improving since the third quarter of last year, have been dampened. Many foresee that the rise in raw material prices and the resurgence of COVID-19 will put a damper on the recovery trend.

According to the fourth-quarter Business Survey Index (BSI) announced on the 28th by the Korea Chamber of Commerce and Industry, which surveyed over 2,300 manufacturing companies nationwide, the index dropped 12 points to 91 compared to the previous two quarters (103). After hitting a low of 55 in the third quarter of last year, the BSI had steadily risen and even exceeded 100 ahead of the third quarter this year. However, after rising for four consecutive quarters, it fell again below 100. The BSI uses 100 as a baseline, with values above indicating more positive outlooks and below indicating more negative ones.

A Chamber of Commerce official analyzed, "The resurgence of COVID-19 has put a brake on domestic demand recovery. Although the sharply contracted global demand for raw materials is reviving, supply has not been smooth due to logistics disruptions and reduced production, causing raw material prices to continue rising, which has become a significant burden."

The export companies’ fourth-quarter outlook index fell 18 points to 94. The domestic sector dropped 11 points to 90. By industry, refining and petrochemicals (82), shipbuilding and parts (87), and automotive and parts (90) were low, while medical precision (110) and cosmetics (103) were high. Regionally, Gwangju recorded the highest at 109, while Gangwon (79) and Busan (80) were on the lower side.

Regarding this year’s growth rate forecast, 43% of respondents said below 3.5%, the largest share, while 41.1% expected between 3.5% and 4.0%. Although the Bank of Korea and the government projected growth in the 4% range, more than eight out of ten companies responding to this survey believed achieving 4% growth would be difficult.

As risk factors affecting corporate management, domestic demand recession was the highest at 69%, followed by exchange rate and raw material price volatility (67%), interest rate hike trends (27%), and worsening financing conditions (14%). Kim Hyun-soo, head of the Korea Chamber of Commerce and Industry’s Economic Policy Team, said, "The resurgence of COVID-19 has stalled the economic recovery within just one quarter. It is time to focus policy efforts on proactive support for the vulnerable domestic sector, promoting corporate investment, and resolving difficulties in raw material supply and exports."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)