[Asia Economy Reporter Seulgina Cho] "A stronger player is coming." As Disney Plus (+), a global video streaming service (OTT) considered a rival to Netflix, completes preparations to enter the Korean market, a seismic shift is expected in the domestic OTT market, which has been dominated by Netflix as the clear leader.

Recently, Netflix, which has hit consecutive home runs with original Korean series such as the dramas D.P. and Squid Game, has also announced a full-scale "content war" against Disney+, which has built a powerful content lineup. In the IPTV industry led by telecom companies, there are growing expectations that Disney+ will become a trigger to shake up the market.

◇ Disney+ Arrival Ignites ‘Content War’

According to industry sources on the 27th, Disney+ has announced a substantial content lineup along with its domestic service launch scheduled for November 12. Representative titles include "Shang-Chi and the Legend of the Ten Rings," which surpassed 1.5 million viewers in Korea alone despite the COVID-19 pandemic; the original animated short "Olaf Presents" from the Frozen series; and "Home Sweet Home Alone," a reinterpretation of the movie Home Alone. For Korean original content, Disney+ is preparing titles such as Police University, Grid, and Moving.

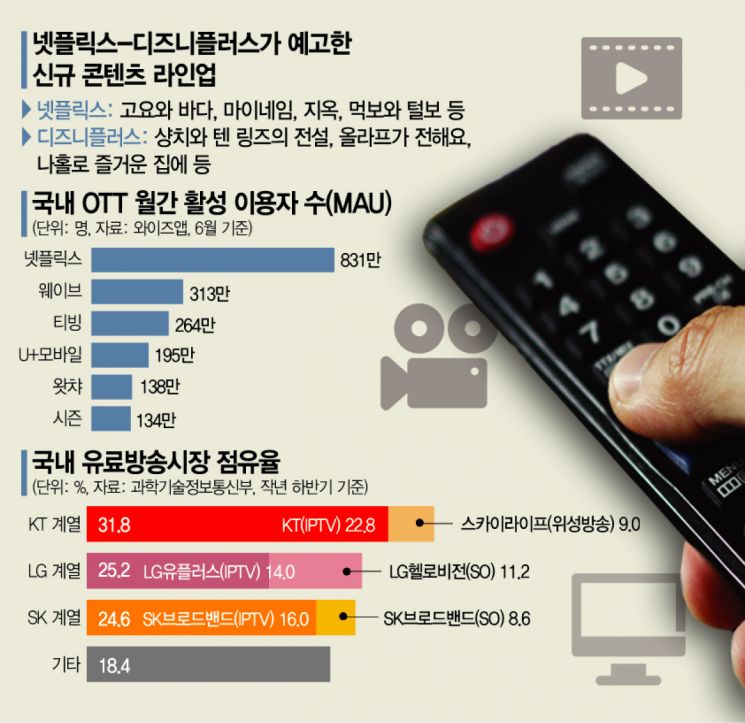

Disney+ is equipped with content appealing to all age groups, from children to the silver generation, including Marvel, Pixar, Star Wars, and National Geographic, and has been regarded as a strong competitor to Netflix, which dominates the domestic market. According to WiseApp, as of June, Netflix’s monthly active users (MAU) in Korea stood at 8.31 million, far exceeding the combined total of the three leading domestic OTT platforms?Wavve (3.13 million), TVING (2.64 million), and Watcha (1.38 million).

Inside and outside the industry, it is expected that the arrival of Disney+ will ignite a full-scale content war in the Korean market. Tae-wan Oh, a researcher at Korea Investment & Securities, said, "Disney+ will expand its investment in Korean originals after its launch," adding, "In the long term, many OTTs such as Apple TV+ and HBO Max will enter the Korean market and secure Korean content."

Netflix is also focusing on Korean content ahead of Disney+’s entry into Korea. The previously sluggish domestic subscriber growth has rebounded recently with the consecutive hits of D.P. and Squid Game. On the 25th, Netflix held the global fan event TUDUM, where it separately introduced upcoming Korean content such as the drama My Name, directed by Kim Min-jin of Human Class; Hellbound, adapted from the webtoon of the same name; and The Silent Sea, an SF series set in the year 2075.

In response, domestic OTTs are also prioritizing securing original content as a survival strategy. Wavve announced plans to invest a total of 1 trillion won by 2025 to produce original content. TVING, partnered with Naver, released the popular webtoon-based original drama Yumi’s Cells and will exclusively release Naegwa Park Won-jang and Drunk City Women in the second half of the year.

◇ Impact Expected on IPTV Market as Well

The arrival of Disney+ in Korea is expected to have ripple effects not only on the domestic OTT market but also on the IPTV market. The day before, LG Uplus announced an exclusive partnership with Disney+ to distribute content through its IPTV service ‘U+tv’ and LG HelloVision’s cable TV service ‘HelloTV.’ Similar to the significant market share gains experienced during Netflix’s entry in 2018, there is analysis that Disney+ could again serve as a trigger for subscriber growth for LG Uplus.

Currently, LG Uplus ranks second in the overall paid broadcasting market, including IPTV and cable TV, following KT. This presents a golden opportunity to widen the gap with third-place SK Broadband and even challenge for first place. According to the Ministry of Science and ICT, as of the second half of last year, the domestic paid broadcasting market shares were 31.8% for KT affiliates (KT and KT Skylife), 25.2% for LG affiliates (LG Uplus and LG HelloVision), and 24.6% for SK affiliates (SK Broadband).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)