[Asia Economy Reporter Oh Hyung-gil] As domestic savings banks gradually expand their business scale, the number of employees working at savings banks has also significantly increased over the past three years.

According to the Financial Supervisory Service's Financial Statistics Information System on the 26th, as of the end of June this year, the number of employees at 79 savings banks was 9,726, approaching 10,000.

This represents an increase of 1.5% compared to the end of June last year (9,585 employees) and a 7.9% increase compared to the end of June 2018 (9,010 employees).

This contrasts with the number of employees at domestic banks excluding internet-only banks K Bank and Kakao Bank, which decreased by 1.7% from 117,834 at the end of June last year to 115,804 at the end of June this year.

Looking at individual savings banks, SBI Savings Bank, ranked first in asset size, had 601 employees as of the end of June this year, a 15.8% increase from 519 employees three years ago. During the same period, the number of employees at Sangsangin Savings Bank rose 28.4%, from 95 to 122.

Pepper Savings Bank, which acquired the former Neulpureun Savings Bank in 2013 and changed its name, saw an even steeper increase in employees. As of the end of the first half of this year, it had 474 employees, a 50.5% jump from 315 employees three years ago.

The main reason for the increase in the number of savings bank employees was the growth in the amount of money handled by savings banks themselves.

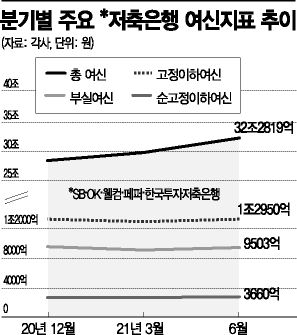

As of the end of June this year, the total assets of domestic operating savings banks reached 102.4384 trillion won, surpassing 100 trillion won for the first time since the Financial Supervisory Service began compiling data in June 1999. Moreover, this represents a 24.2% increase compared to 82.4979 trillion won at the end of June last year.

Additionally, as savings banks expanded their business scope to areas such as non-face-to-face finance and corporate finance, new labor demand emerged. A savings bank official said, "As the asset size of savings banks expands, the demand for corporate finance continues to grow," adding, "Because of this, there is a noticeable trend of job changes and recruitment both inside and outside the industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.