[Asia Economy Reporter Minji Lee] Affirm Holdings is expected to see its stock price rise, based on the high growth potential of the BNPL (Buy Now, Pay Later) market.

Looking at Affirm Holdings' stock price trend on the 21st, it rose about 31% from 81.99 to 107.70 over the past six months. This increase is analyzed to be positively reflected in the stock price due to a significant rise in total transaction volume benefiting from the reopening and the effects of partnerships with major companies.

Affirm Holdings is a fintech company operating an alternative installment payment service (BNPL) that went public in January this year. Consumers can choose monthly installment payments over 3, 6, or 12 months mainly through Affirm at affiliated stores. From the customer's perspective, there are no typical late fees, early repayment fees, or annual fees, and the interest and fees to be ultimately paid over the installment period are transparently disclosed in advance.

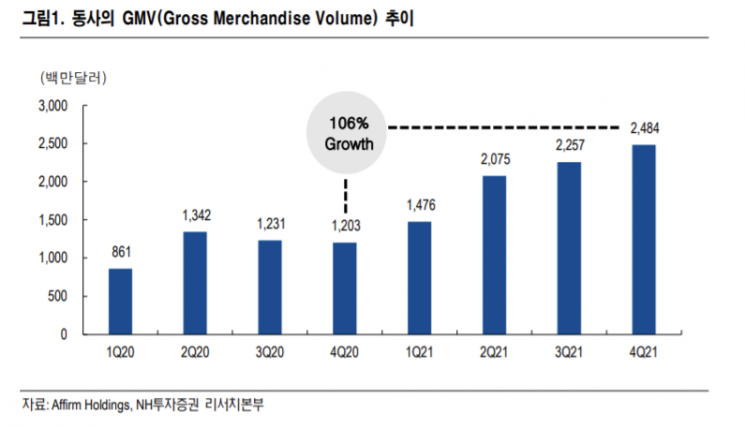

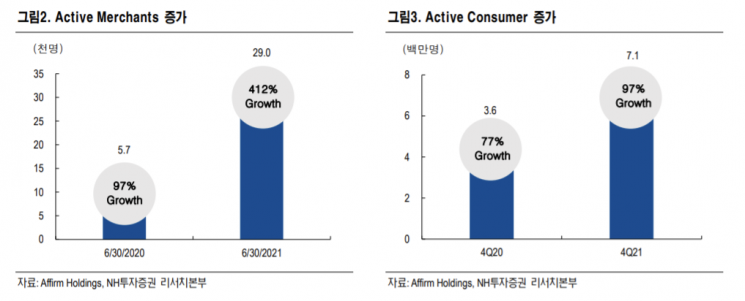

According to the recently announced company’s Q4 revenue, it reached $260 million, a 71% increase compared to the same period last year, exceeding market expectations. EPS was -$0.48, falling short of market estimates, and the total transaction volume (GMV) was $2.48 billion, up 106% year-over-year. The number of active consumers increased by 97% to 7.1 million. Active merchants also grew by 412%, which is analyzed to reflect the partnership effect with Spotify.

According to the guidance provided by the company, the GMV for fiscal year 2022 is expected to be between $12.45 billion and $12.75 billion. Revenue guidance is set at $1.16 billion to $1.19 billion. These figures do not reflect the revenue increases expected from the Amazon partnership and new products, suggesting additional growth potential.

Recently, the BNPL market has seen rapid mergers and acquisitions. Square acquired Afterpay, Australia's largest BNPL company, and PayPal acquired Paidy, a Japanese BNPL company. Additionally, Klarna, the leading BNPL company, is preparing for a large-scale fundraising, and Apple is planning to enter the BNPL market in partnership with Goldman Sachs. Affirm is also striving to secure a leading position in the rapidly growing BNPL market by acquiring return specialist service provider Returnly and Canadian BNPL company Paybright, as well as forming a partnership with Amazon.

Ji-yong Lim, a researcher at NH Investment & Securities, said, “The BNPL market is rapidly growing even within the fintech industry,” adding, “The company's competitive edge lies in its diverse payment options and flexibility without time constraints, differentiating it from competitors.” He further stated, “The company is expected to continue its stock price rise along with additional upward revisions of earnings guidance, and the acquisition effects of Returnly and Paybright will further expand the merchant network.”

Hyesung Kang, a researcher at Mirae Asset Securities, explained, “The value of mergers and acquisitions among high-growth BNPL fintech companies will be highlighted,” but also noted concerns such as “liquidity and funding risks, intensified competition and downward pressure on merchant fees, and the potential introduction of regulations.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)