TSMC Issues $1 Billion Corporate Bonds... Aggressive External Fundraising

Confidence in Business Growth and Fundraising Amid Foundry Market Boom

Samsung Electronics with Ample Cash Weighs US Investment Locations

Intel Plans Up to $150 Billion Investment

[Asia Economy Reporter Su-yeon Woo] TSMC, the world's No.1 global foundry company, has begun large-scale investments by raising funds in the financial market. With Samsung Electronics weighing the final candidates for expanding its foundry plant in the U.S. and Intel, which declared its re-entry into the foundry business this year, unveiling plans to expand its production bases in Europe, the 'money war' in the global foundry market is expected to intensify further.

According to industry sources on the 14th, TSMC held a board meeting on the 10th and approved the issuance of $1 billion worth of unsecured dollar-denominated corporate bonds. The issuance terms are a 30-year maturity and an annual interest rate of 3.1%. The funds raised through this bond issuance will be used for plant expansion and facility investment.

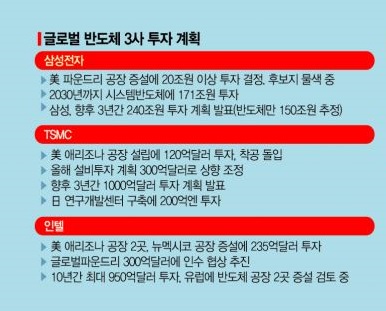

◆ TSMC Rushes to Secure Ammunition= TSMC, which announced a massive investment plan of $30 billion this year alone and $100 billion in the future, has been aggressively raising external funds recently. Previously, it issued corporate bonds worth TWD 60 billion (about KRW 2.5 trillion) in three rounds in the Taiwanese financial market, and this issuance is already the fourth this year. In August, TSMC's board also approved providing guarantees for unsecured corporate bonds worth up to $8 billion for its subsidiary, TSMC Arizona.

TSMC's ammunition securing policy is aimed at raising investment funds for large-scale projects such as the U.S. Arizona plant and Japan research and development (R&D) center establishment, as well as the expansion of the Kaohsiung plant in Taiwan. As the global semiconductor supply shortage, which intensified last year, is expected to continue until 2023, the foundry market is also likely to experience demand exceeding supply for some time.

The market situation also reflects the background for TSMC's unprecedented large-scale investment plan of $100 billion over the next three years. This can be seen as an expression of confidence in business growth and fundraising due to the favorable foundry market conditions. Expansion investment is essential to increase supply, and the profitability conditions, which are prerequisites for investment, are gradually improving. Recently, TSMC notified its customers of foundry price increases of up to 20%.

Price hikes by TSMC, the industry leader, signify a boom in the global foundry market. The global foundry industry's quarterly sales have been hitting record highs for eight consecutive quarters since Q3 2019. TrendForce stated, "Although all production lines are currently running at full capacity, demand still outpaces supply, so global foundry sales are expected to set record highs even after Q3 this year."

◆ Samsung with Ample 'Cash Vault' Nears Final Decision on U.S. Plant Expansion= As TSMC aggressively pursues cash acquisition to continue its investments, the industry is paying attention to Samsung Electronics, which holds relatively abundant cash reserves. As of the end of the first half of this year, Samsung Electronics' cash equivalents (cash + cash equivalents + short-term financial instruments) amount to KRW 108 trillion. This is significantly higher compared to TSMC (KRW 31 trillion) and Intel (KRW 9 trillion).

Recently, Samsung Electronics has been deliberating until the last moment over the final candidate sites for a KRW 20 trillion-scale U.S. foundry plant expansion. Candidate sites such as Texas, Arizona, and New York State are fiercely competing by offering exceptional incentives. The industry expects Samsung to unveil substantial investment plans starting with the selection of the final candidate site.

Samsung Electronics has repeatedly expressed its intention to carry out meaningful mergers and acquisitions (M&A) in new business fields within the next three years, and at least KRW 150 trillion of the recently announced KRW 240 trillion investment plan is expected to be invested in semiconductors.

Another competitor, Intel, is planning a massive investment project worth as much as $150 billion. In March, Intel declared its re-entry into the foundry business and announced a $23.5 billion investment in expanding two plants in Arizona and one in New Mexico. In July, news emerged that Intel was considering acquiring GlobalFoundries, the fourth-largest foundry company, for $30 billion. Recently, Intel also revealed a concrete plan to invest $95 billion over the next 10 years to build two semiconductor production facilities in Europe.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)