[Asia Economy Reporter Hwang Junho] As funds continue to flow out of the stagnant domestic stock market, the possibility of a tough period for the market has increased with the U.S. pushing for a corporate tax hike.

According to the Korea Financial Investment Association on the 13th, investor deposits, which are considered standby funds for the stock market (excluding deposits for on-exchange derivatives trading), fell to 61 trillion won as of the 9th. Just two trading days ago, it was maintained at around 69 trillion won, and on the 12th of last month, it surged to 74 trillion won, reflecting heightened expectations for the stock market, but the mood reversed in less than a month.

Demand waiting to enter the stock market also decreased. The balance of Comprehensive Asset Management Accounts (CMA), which reached 67 trillion won on the 7th, dropped to 50 trillion won in just two trading days. Money Market Funds (MMF), short-term financial products sought when suitable investment destinations are lacking, also shrank from 162 trillion won to 152 trillion won during the same period.

Since the beginning of this month, the KOSPI has slipped from the 3200 level to the 3100 level, and with the completion of large initial public offerings (IPOs), investment sentiment toward the stock market has weakened, and funds are flowing into safe assets. The KOSPI investor sentiment index fell from 80% on the 6th to 60%.

The outlook is not promising. Corporate earnings burdens due to the U.S. corporate tax hike, rising government bond yields, and increased downward pressure on the stock market are expected. Goldman Sachs stated, "The U.S. 10-year Treasury yield is expected to rise from the current 1.4% to around 1.9% by the end of the year," adding, "The possibility of U.S. interest rate hikes and corporate tax rate increases will increase downward pressure on the U.S. stock market over the next six months."

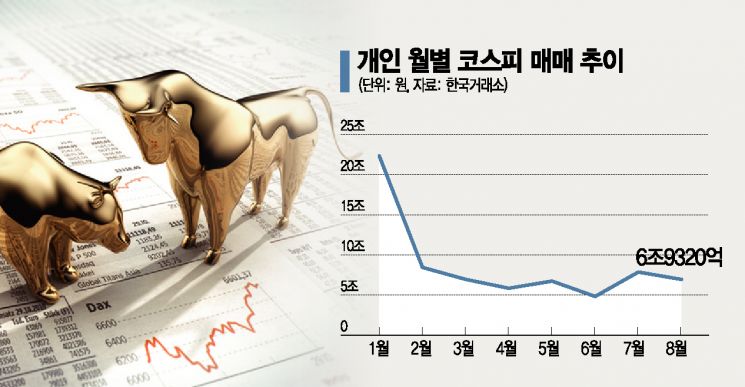

The growing preference for safe assets is likely to accelerate foreign investor outflows from emerging markets, including Korea. According to the Financial Supervisory Service, foreign investors have maintained a net selling position for four consecutive months from May to last month. In just last month, they net sold 7.816 trillion won in the domestic stock market. During the week from the 7th to the 10th, they net sold for four consecutive trading days, totaling about 1.3718 trillion won. As a result, the foreign ownership ratio has already fallen below the post-financial crisis average of 33% (KOSPI), recording 32.60% as of the 10th. The holding balance decreased from 752 trillion won at the end of last month to 737 trillion won.

There is also a possibility of announcing a 'tapering plan' (reduction of asset purchases) starting this month. Regarding this, Samsung Securities researcher Seo Jeong-hoon said, "Market stress related to tapering is expected to increase until the blackout period before the Federal Open Market Committee meeting on the 23rd, during which all Federal Reserve officials' comments on U.S. monetary policy direction are restricted." The European Central Bank has also decided to slightly reduce the pace of bond purchases through its pandemic emergency purchase program.

Concerns about the peak-out of domestic companies' earnings are also increasing downward pressure. Hana Financial Investment researcher Lee Jaeman analyzed, "The current KOSPI (12-month expected) operating profit growth rate (YoY) has stagnated after reaching 56% at the end of July," adding, "It has fallen 7% from the yearly peak to the recent low, currently down 5%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)