[Asia Economy Reporter Jeong Hyunjin] As the Moon Jae-in administration's wealth tax policies have been continuously implemented over the past five years, opinions have emerged that the tax burden is excessively concentrated on high-income earners, necessitating a shift in tax policy. It has been claimed that the effective tax rate for high-income earners with a taxable income exceeding 500 million won is up to seven times higher than that of other income groups.

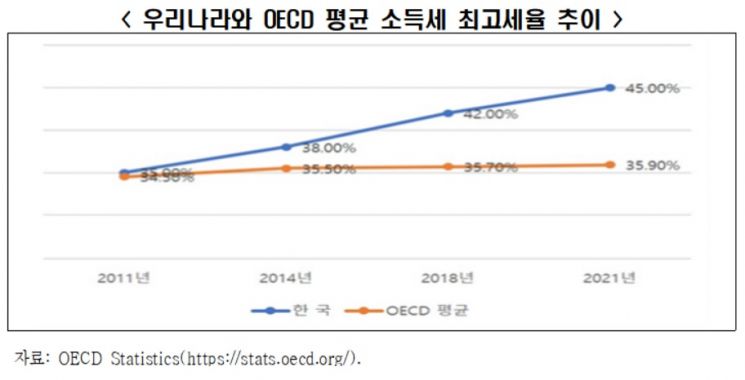

On the 8th, the Korea Economic Research Institute under the Federation of Korean Industries revealed this in a report titled "Review of Progressive Income Tax Burden." The institute pointed out that during the current administration's five years, wealth tax policies have been continuously pursued, and as a result of raising the top income tax rate twice targeting high-income earners who show less tax resistance, the highest domestic tax rate has reached a considerably high level of 45% as of this year. The average top income tax rate among OECD countries is 35.9%.

Im Dong-won, a senior researcher at the Korea Economic Research Institute, stated, "Without adjusting the lower and middle income brackets, only the high-income brackets have been adjusted and tax rates increased, thereby increasing the tax burden solely on high-income earners who exhibit less tax resistance," and argued, "The main income tax policy has become a wealth tax."

The institute analyzed in the report that the effective tax rate for high-income earners with taxable income exceeding 500 million won was 3 to 7 times higher than that of other income earners as of 2019. In particular, the share of income tax paid by high-income earners was 2 to 6 times higher than their share of income, indicating that the tax burden is concentrated on high-income earners.

According to the report, specifically, the effective tax rate for high-income earners with comprehensive income was 33.5%, three times that of other income earners at 11.2%. The effective tax rate for high-income earners with earned income was 34.9%, 6.6 times that of other income earners at 5.3%. Furthermore, high-income earners with comprehensive income accounted for 16.1% of total income but 36.5% of total income tax paid. In the case of earned income, many are exempt from tax, so high-income earners, who make up 1.5% of income, bear a high tax share of 8.8%.

Im emphasized, "High-income earners subject to the top tax rate (45%, for income exceeding 1 billion won) starting this year will face a nominal burden exceeding half of their income (58.23%) when including local income tax (4.5%), national pension contributions (4.5%), health insurance premiums (3.43%), and employment insurance premiums (0.8%), which will further intensify the concentration of tax burden on high-income earners."

Previously, when the top tax rate for high-income earners with taxable income exceeding 500 million won was raised from 40% to 42% in 2018, the Korea Economic Research Institute analyzed that their effective tax rate for income earned in 2018 increased by 1.8 to 3.1 percentage points compared to 2017. The institute added that since 2018, health insurance premiums have increased by 2 to 3% annually, and employment insurance premiums were raised by 0.3 percentage points in 2019, increasing the burden of social security contributions and thus raising the burden rate on high-income earners.

Im stated, "Tax increases concentrated on high-income earners can cause significant economic losses such as human capital outflow rather than increasing tax revenue," and argued, "The income tax burden concentrated on high-income earners should be alleviated by reducing the number of tax brackets and lowering tax rates to ease wealth taxation, and the tax base should be expanded by lowering the proportion of tax-exempt earners through reforming unnecessary tax exemption and reduction systems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)