Korea Institute of Finance's 'Bank Business Diversification Strategy Directions'

[Asia Economy Reporter Park Sun-mi] Although the profitability of domestic banks significantly improved in the first half of this year, there is a growing call for the need to diversify revenue sources as non-interest income remains minimal compared to interest income. It has been advised that revenue diversification can be achieved through Banking as a Service (BaaS), which is gaining attention as a new business model in the banking sector, as well as through virtual asset custody services.

On the 28th, Lee Soon-ho, a research fellow at the Korea Institute of Finance, stated, "While non-interest income accounts for 30-50% of total profits in global banks such as those in the U.S., Canada, and Australia, the proportion of non-interest income in domestic banks is only 10-15%, despite efforts to discover high-yield non-interest income sources such as trading, asset custody, trusts, and private banking (PB)."

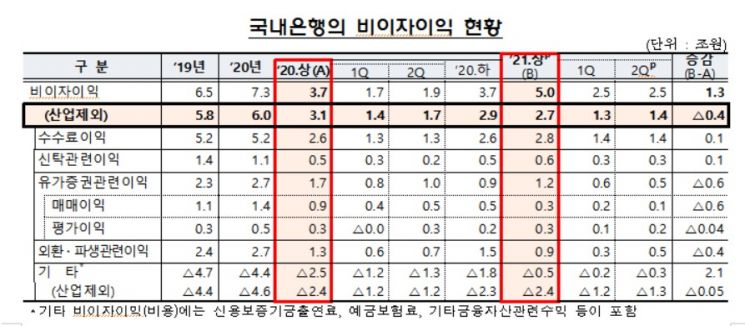

In the domestic banking sector, non-interest income performance is minimal compared to interest income, resulting in a concentration of bank revenues. According to the Financial Supervisory Service, non-interest income of domestic banks reached 5 trillion won in the first half of this year, an increase of 1.3 trillion won from 3.7 trillion won in the same period last year. However, excluding the Korea Development Bank, non-interest income for 18 banks decreased by 400 billion won to 2.7 trillion won. When excluding the Korea Development Bank’s non-recurring income, it actually declined compared to last year, indicating that the concentration of bank revenues has yet to be resolved.

Research fellow Lee explained, "To resolve the revenue concentration issue, it is necessary to pursue revenue diversification. In particular, BaaS is expected to play an important role in the future banking industry. BaaS allows non-financial companies to embed banking services into their own offerings without obtaining licenses to operate the heavily regulated banking business, thereby enabling banks to secure new customer touchpoints."

BaaS operates as a business model where banks open their application programming interfaces (APIs) to external businesses, allowing them to develop and embed banking services into their own services and provide them to end consumers. BaaS can be accessed not only by fintech companies but also by other online-only banks, which can pay access fees to the host bank. This provides traditional banks with technological strengths a new opportunity for growth.

In addition to BaaS, research fellow Lee advised that virtual asset custody services targeting institutional investors investing in virtual assets are emerging as a business sector attracting significant interest not only from major overseas banks but also from newly entering banks.

Lee added, "Domestic banks have already shown interest in BaaS and virtual asset custody as new business areas. Financial authorities need to thoroughly discuss and organize related systems and infrastructure. Although the legal foundations such as the Financial Innovation Support Act, Electronic Financial Transactions Act, and Credit Information Act have advanced significantly for innovative financial services, there are still no clear regulatory laws regarding virtual asset custody and transactions. Therefore, it is necessary to promptly establish relevant laws to enhance the reliability and transparency of the virtual asset market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)