KT Earnings Surprise, Dividend Yield Expected Above 5%

[Asia Economy Reporter Lee Seon-ae] As red flags are raised in the financial market due to the spread of the COVID-19 virus and interest rate hikes, investors' interest in stable dividend stocks is increasing. Experts also advise increasing the proportion of investments in relatively stable dividend stocks during volatile markets. Amid growing attention on telecommunications stocks, which are considered traditional dividend stocks, many securities firms are focusing on KT.

According to the financial investment industry on the 27th, KT is regarded as a representative dividend stock with the highest dividend payout ratio among the three major telecom companies. Last year, KT announced that it would maintain a policy of paying 50% of its adjusted net income on a separate basis as dividends until 2022, and paid a year-end dividend of 1,350 KRW per share in 2020, up 22.7% from 1,100 KRW the previous year. The average dividend payout ratio of KOSPI-listed companies last year, as announced by the Korea Exchange, was 39.55%, making KT's dividend payout ratio more than 10% higher than the average.

The dividend outlook for 2021 is also bright. KT announced a surprise performance in the first half of this year that exceeded market expectations, and securities firms predicted that KT would continue its strong performance improvement in the second half. Accordingly, the day after the Q2 earnings announcement, several securities firms including Hyundai Motor Securities, Samsung Securities, and Mirae Asset Securities raised their target prices in succession. If profit improvement continues in the second half, it is expected to directly lead to an expansion of shareholder returns, creating a virtuous cycle that results in both dividend increases and stock price appreciation.

Jangwon Kim, a researcher at IBK Investment & Securities, stated, “KT, which increased dividends last year due to improved performance and a higher dividend payout ratio, is expected to raise dividends again this year, with a dividend yield expectation of 5% alongside stock price appreciation.”

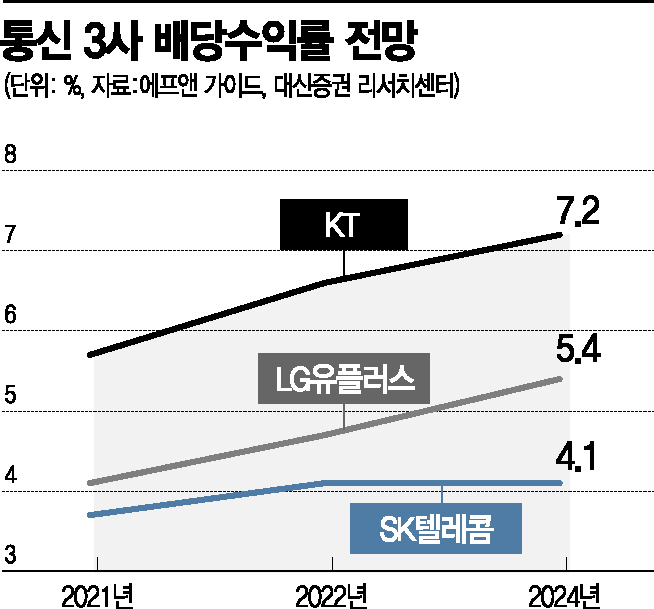

Ho-jae Kim, a researcher at Daishin Securities, also analyzed, “The telecommunications sector is showing its best performance in 10 years, and although there are differences among the three companies, all are linking performance improvements to higher dividends, making the telecom industry more attractive for investment than ever.” Among them, KT was cited as the most preferred. KT’s expected dividend yield is estimated to be around 5-6%, based on the trend of profit growth linked to dividends.

Hongsik Kim, a researcher at Hana Financial Investment, said, “As the dividend season approaches, buying interest is expected to continue flowing into telecom stocks with high dividend growth rates and dividend yields. However, compared to SK Telecom, which has concerns about long-term dividend decreases, KT is recommended for its expectation of sustained high dividend growth, and LG Uplus is expected to enter a phase of undervaluation correction.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)