Some Cryptocurrency Moves as Momentum Fades... Likely to Continue Ahead of Base Rate Hike

[Asia Economy Reporter Kwangho Lee] Amid rising interest rates, banks are consecutively launching high-interest savings and installment savings products. Recently, as cryptocurrencies and the stock market have slowed down, it is expected that abundant market funds will partially shift to safe assets.

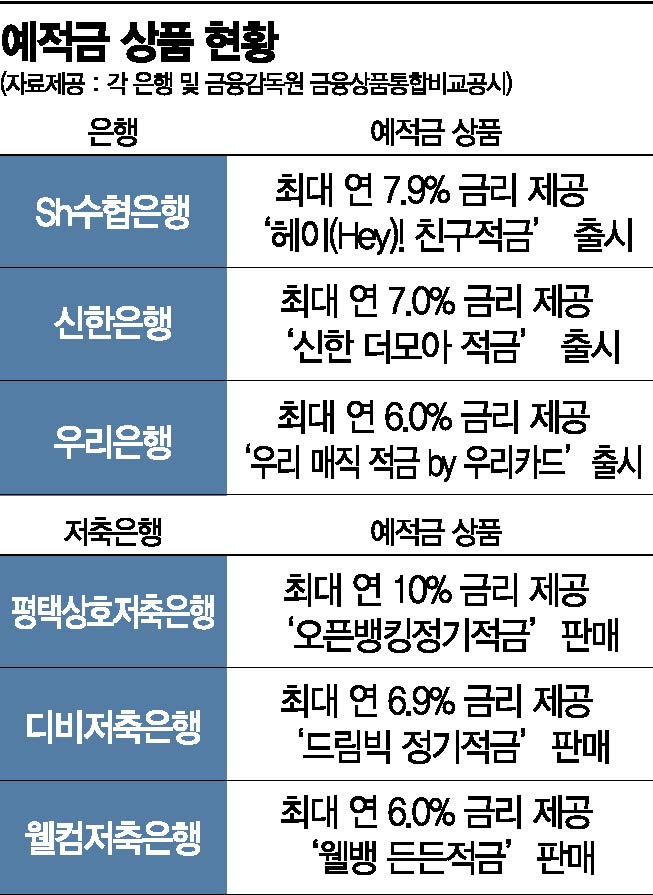

On the 24th, according to banks and the Financial Supervisory Service's integrated financial product comparison disclosure, Pyeongtaek Mutual Savings Bank is selling the ‘Open Banking Installment Savings’ offering up to 10% annual interest. This product provides a base interest rate of 2.0% plus a preferential rate of 8.0%. Conditions include subscribing to SB TokTok Plus Open Banking, applying for a Lotte Card, and using at least 300,000 KRW monthly for three months.

DB Savings Bank also introduced the ‘Dream Big Installment Savings’ offering an annual interest rate of 6.9%, combining a base rate of 3.1% and a preferential rate of 3.8%. To receive the preferential rate, customers must subscribe to DB Insurance Direct Internet Auto Insurance online after opening the installment savings and maintain it until 30 days before maturity.

Welcome Savings Bank launched the ‘WellBank Dundeun Installment Savings’ with a base interest rate of 2.0% and a preferential rate of 4.0%. This product is advantageous for low-credit customers. Depending on credit scores, preferential rates of 3.0 percentage points for scores between 1 and under 350, 2.0 percentage points for scores between 350 and under 650, and 1.0 percentage point for scores between 650 and 850 are provided. Additionally, if the account is opened within 30 days of the bank’s highest installment savings product opening date, an extra 1.0 percentage point preferential rate is granted.

Major banks are also competitively offering installment savings with interest rates reaching up to 8% annually.

Shinhan Suhyup Bank partnered with Shinhan Card and SK Planet to launch the ‘Hey! Friend Installment Savings’ offering up to 7.9% annual interest. Customers who apply for the event by October 31, subscribe to this product via the Suhyup Bank Hey Bank application, and use a Shinhan Card for at least 200,000 KRW within three months will receive the maximum interest rate. The base interest rate is 1.0%, with up to 0.9 percentage points preferential rate for marketing consent and automatic transfer conditions. Meeting the Shinhan Card usage condition grants an additional 6.0 percentage points special reward.

Shinhan Bank is selling the ‘Shinhan The More Installment Savings’ with a 7.0% annual interest rate, limited to 100,000 accounts. This product is a 6-month flexible installment savings allowing deposits from 1,000 KRW to 300,000 KRW monthly. It offers a base interest rate of 1.0% plus a preferential rate of 6.0%, totaling up to 7.0% annually. The preferential rate includes 5.0 percentage points if customers without Shinhan Card usage in the past six months issue the Shinhan The More Card and spend over 600,000 KRW during the savings period, and 1.0 percentage point for agreeing to Shinhan Card marketing and credit limit increase.

Woori Bank also introduced the ‘Woori Magic Installment Savings by Woori Card’ offering up to 6.0% annual interest when meeting Woori Bank transaction and Woori Card usage requirements. The subscription period is one year with a monthly deposit limit of up to 500,000 KRW. The interest rate consists of a base rate of 1.0%, a preferential rate of 1.0%, and a special preferential rate of 4.0%, totaling up to 6.0% annually.

A representative from a major bank stated, "The increase in deposit interest rates is largely influenced by the market interest rates rising preemptively as the base rate hike approaches," and added, "This trend is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.